Striving for positive financial, environmental, social, and governance (ESG) outcomes.

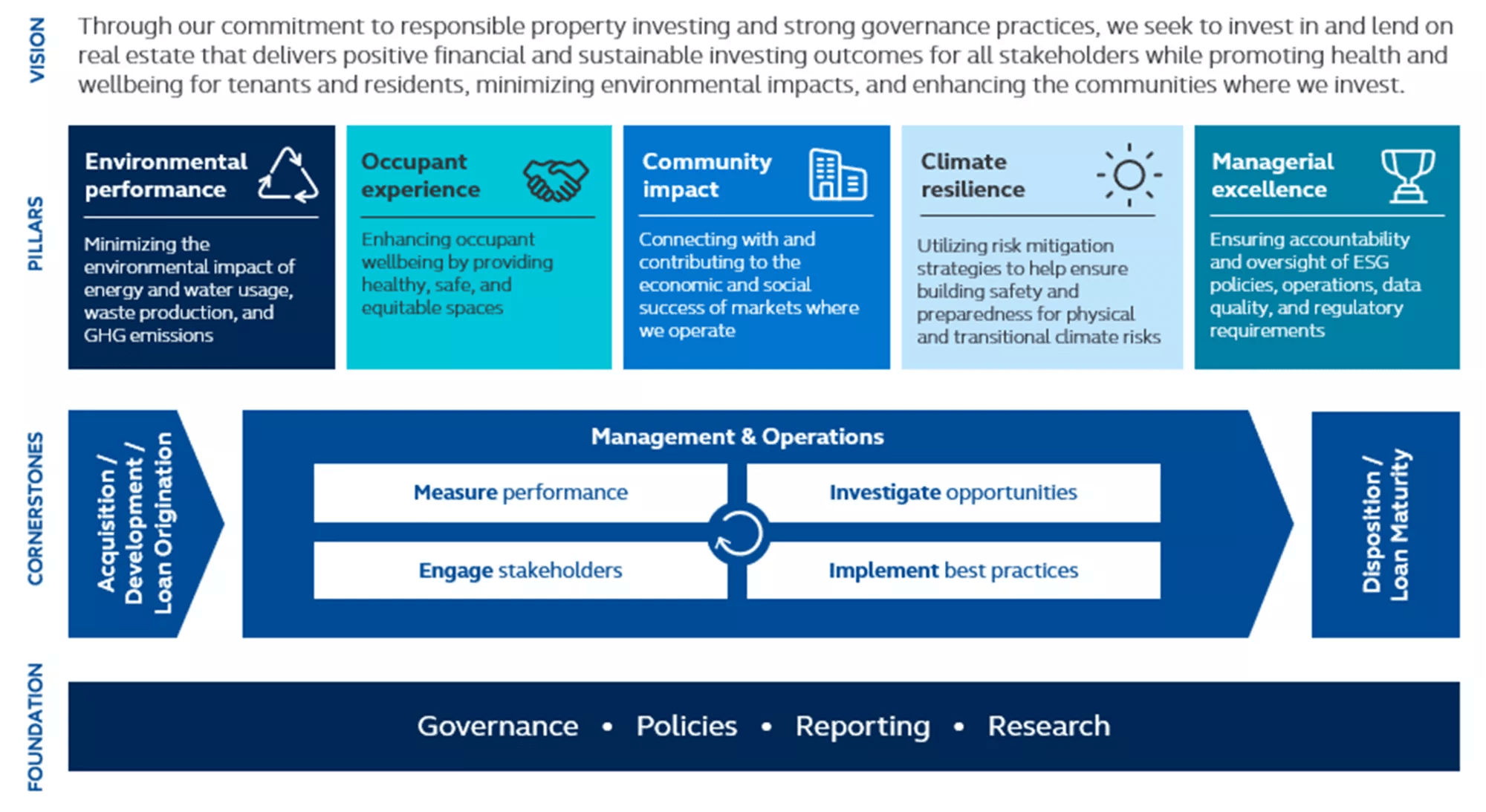

Through our commitment to responsible property investing and strong governance practices, we seek to invest in and lend on real estate that delivers positive financial and ESG outcomes for all stakeholders while promoting health and wellbeing for tenants and residents, minimizing environmental impacts, and enhancing the communities where we invest.

Principal Real Estate is recognized globally as a leader in sustainable investing.

Longstanding commitment to corporate stewardship and responsible property investing.

Holistic approach to ESG integrated throughout the property investment life cycle for private equity and private debt.

Net zero carbon commitment by 2050.

Proprietary ESG scoring for public equity investments and ESG risk underwriting for public debt investments.

Signatory to the Principles for Responsible Investment since 2010.

GRESB 5-Star rating (2025)

The Firm paid GRESB an application fee to be evaluated and use the rating.

ENERGY STAR Partner of the Year, 2016-2024Sustained Excellence, 2018-2024

Gold recognition Three consecutive awards, 2017, 2020, 2023

Our experienced investment teams provide comprehensive, specialized, and sustainable capabilities across all four quadrants of commercial real estate—public equity, private equity, public debt, and private debt—and more recently, infrastructure investing. Whatever real estate strategy or combination of strategies you believe is right for your objectives, we can help.

No information

Footnotes

Past performance does not guarantee future results.

Third party rankings and recognitions are no guarantee of future investment success and do not ensure that a client or prospective client will experience a higher level of performance or results. These ratings should not be construed as an endorsement of the advisor by any client nor are they representative of any one client's evaluation.

ESG criteria may present additional advantages or risks and does not protect against market risks or volatility. You should not make any investment assumptions based solely on the information contained herein. There is no assurance that nay ESG component in our investing strategy will be successful.

ESG integration is considered across all actively managed asset classes, with the approach determined by each investment group’s process. This information is specific to the strategies managed by the individuals providing this content and various investment teams across Principal may have differing views of this approach.

Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.