A much-flagged risk for this year is that, due to the Fed’s 2022-23 hiking cycle, the wall of maturing debt will face significantly higher refinancing costs, potentially triggering a spike in defaults. However, assuming the economy remains fairly robust, a deeper look into the refinancing dynamics shows that, except for the lowest-quality segments of the credit spectrum, the broader credit space should be able to climb the wall relatively unscathed.

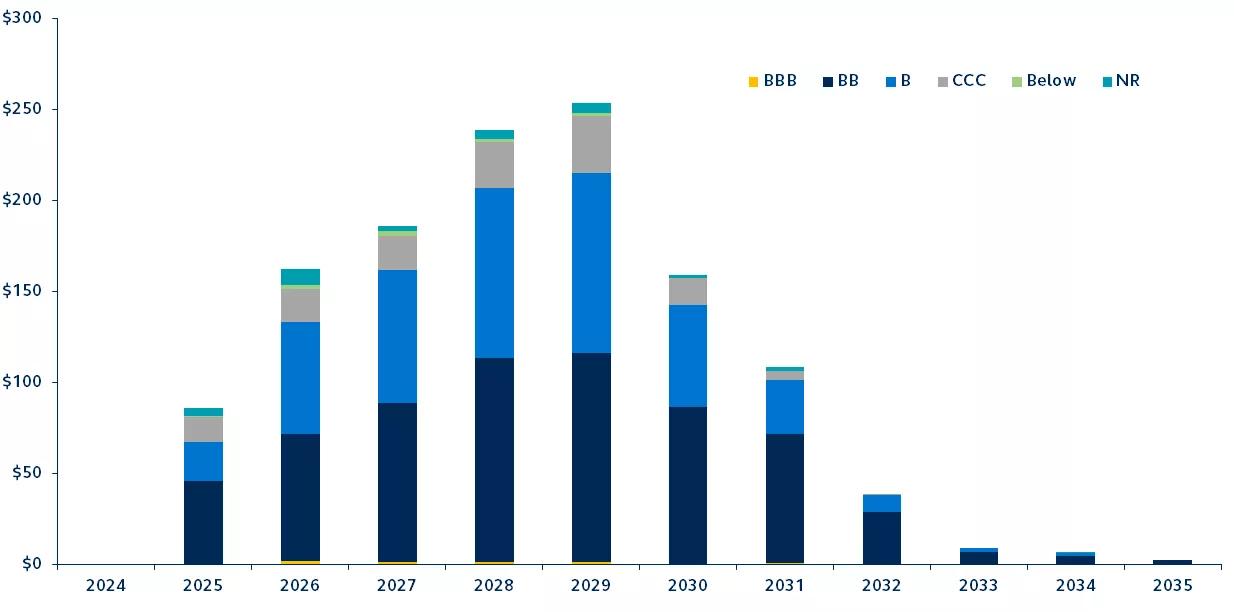

High yield maturity wall by credit quality

$billions of debt scheduled to mature per year

A record number of bonds issued during the pandemic at very low interest rates are set to mature over the next six years. In fact, within the next three years, a quarter of all U.S. high-yield debt will need to be refinanced at rates higher than what corporations have been accustomed to in recent years.

Although the elevated interest rate environment has spooked some investors into fearing that higher refinancing costs will lead to a sharp spike in defaults, a closer look reveals several factors that suggest most companies are in good position to climb the debt maturity wall relatively unscathed:

- A resilient macro backdrop: Despite rising interest rates, high yield credit spreads remain narrow, reflecting strong market fundamentals and optimism that the Fed will steer the economy to a soft landing.

- Recent rally in bonds: Market conditions have improved, reducing refinancing costs compared to five months ago, thanks to a sharp rally in rates toward the end of 2023.

- The maturity wall leans toward higher-quality: The high yield maturity wall is quality-biased, primarily composed of higher-quality BB and B issuers.

While the maturity wall presents initial concerns, upcoming rate cuts and solid corporate balance sheets suggest most companies should be able to digest the higher interest rate costs without too much strain. Still, lower-quality corporates may face tougher challenges, underscoring the importance of active management in the period ahead.

For a deeper dive into the credit maturity wall and its implications for investors, read Where the looming credit maturity wall and the economy collide.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower‐rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3463593