In early 2024, investors' eyes remain intently focused on the Federal Reserve's policy path, as decelerating inflation should open the door to Fed rate cuts this year—a pivotal event for financial markets. Historically, risk assets have thrived during rate-cutting cycles if recession is avoided. This year, however, with the "maturity wall" looming, investors may not be as indiscriminate in their support of markets.

A much-flagged risk for this year is that, due to the Fed’s 2022-23 hiking cycle, the wall of maturing debt will face significantly higher refinancing costs, potentially triggering a spike in defaults. Yet, assuming the economy remains fairly robust, a deeper look into the refinancing dynamics shows that, except for the lowest-quality segments of the credit spectrum, the broader credit space should be able to climb the wall relatively unscathed. Fed rate cuts without recession reduces the maturity wall risk.

The Federal Reserve's policies will significantly impact the obstacles corporations may face when refinancing, underscoring the vital need for investors to closely monitor the likelihood of the Fed achieving a smooth landing in 2024.

Rate hikes to finally start impacting corporates

Corporations have not been materially impacted by the Federal Reserve's tightening cycle until now, as pandemic response actions essentially insulated them from the effects of rising policy rates. In 2020, the Fed's decision to make credit cheap and easy to access for all companies, including the most vulnerable, encouraged corporates to take full advantage of low rates by refinancing their debt and issuing new debt in record numbers.

Consequently, there has been relatively little maturing corporate debt requiring refinancing in recent years, and the Federal Reserve's aggressive hiking cycle has simply raised the cost of newly issued debt. Notably, the significant increase in yields during 2022 and 2023 prompted many firms to delay refinancing, hoping that yields will come back down if they wait long enough, providing some funding cost relief. This has contributed to a significant build-up of near-term maturing debt.

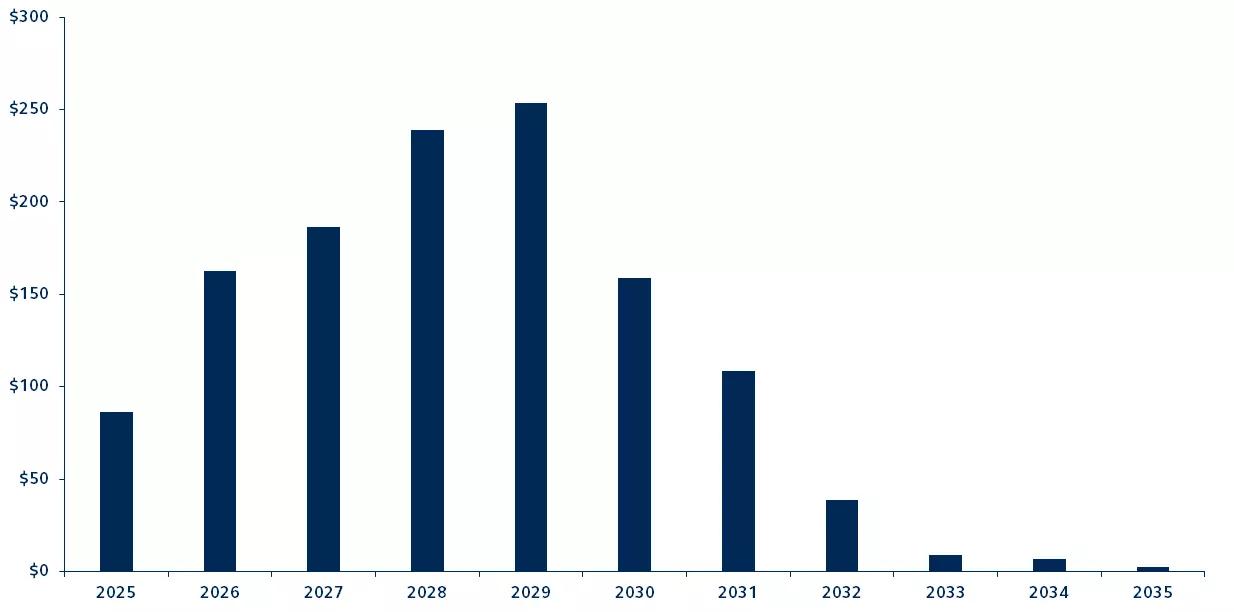

The supportive backdrop for corporates is beginning to fade. Over the next six years, the record levels of bond issuance from the pandemic (which was issued at extremely low rates) will begin to mature. In fact, a quarter of all U.S. high yield debt comes due over the next three years, the most front-loaded maturing wall in recent history, and it will all require refinancing at a higher rate than corporates have enjoyed for the past few years.

High yield maturity wall

$billions of debt scheduled to mature per year

Source: Bloomberg, Principal Asset Management. Data represents the U.S. High Yield 2% Issuer Cap index. As this index excludes bonds that mature within the next year, the chart does not include any bonds maturing in 2024.

Under pressure, but defaults may not be as stressed as it seems

The popular narrative has been that the higher interest rate environment has significantly increased the risk of a sharp spike in defaults as growing numbers of companies are confronted with higher refinancing costs. This concern threatens to deter many investors from increasing their credit exposure. Yet several factors suggest that companies will not struggle to refinance their debt. So, the projected rise in defaults this year will likely be considerably smaller than in previous higher interest rate environments, setting 2024 up as another robust year for high yield credit.

1. A resilient macro backdrop

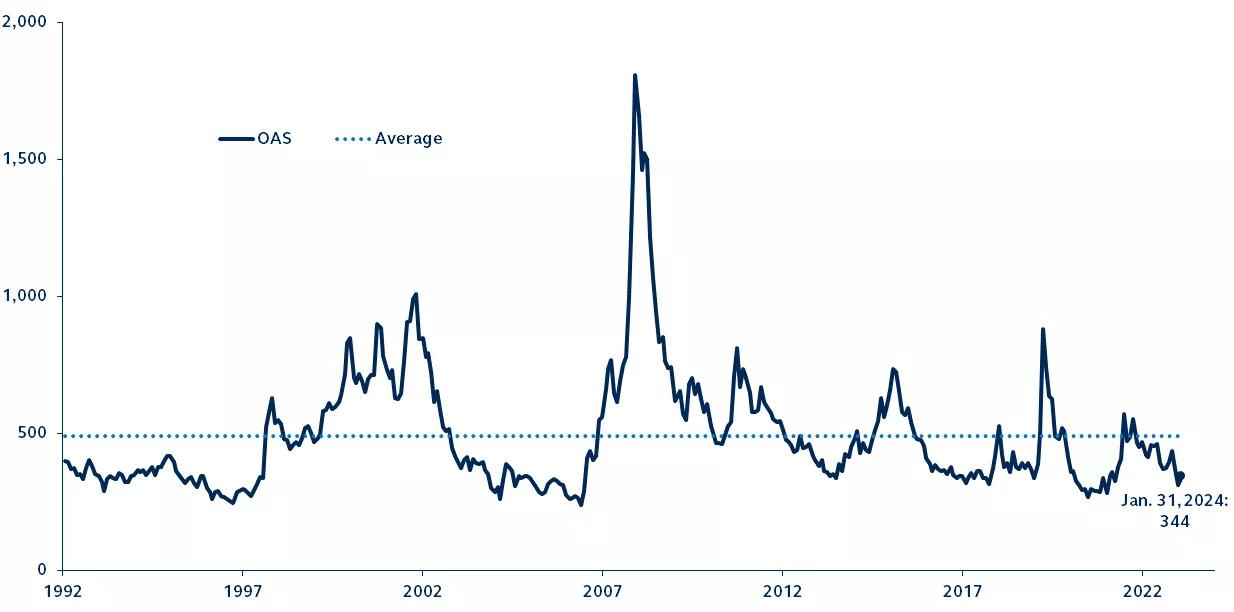

U.S. high yield historic option-adjusted-spread

Basis points, 1992–present

Source: Bloomberg, Principal Asset Management. Data represents the U.S. High Yield 2% Issuer Cap index. Data as of January 31, 2024.

High yield credit spreads are historically narrow. This reflects the fact that, despite the significant run-up in interest rates, the credit market is enjoying renewed strong fundamentals, supported by expectations that the Fed will successfully navigate the economy into a soft landing. Under the hood, household balance sheets remain solid, while companies are carrying a historically high level of cash. As a result, the broad corporate sector is enjoying both balance sheet strength and a robust economic backdrop, reducing the risk that refinancing debt will prove very onerous.

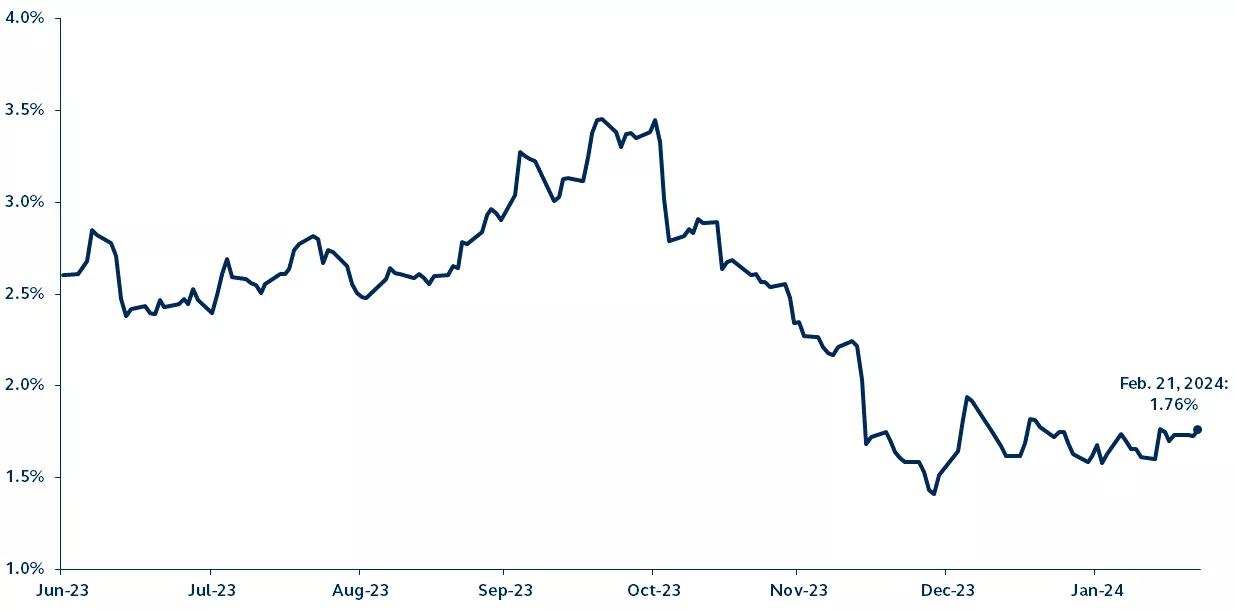

2. Recent rally in bonds

Market conditions have improved significantly in recent months. Just five months ago, refinancing the wall would have involved a meaningful step up in refinancing costs (as measured by the gap between the average coupon and the average yield to maturity). But after very sharp rally in rates towards the end of 2023, refinancing costs have come down meaningfully.

High yield bond yield minus coupon spread

June 30, 2023–present

Source: Bloomberg, Principal Asset Management. Data represents the U.S. High Yield 2% Issuer Cap index. Data as of February 21, 2024.

Many corporate borrowers have taken advantage of this recent period of market strength, with numerous companies coming to market since late 2023 to address their upcoming maturities.

It is also notable that many companies have been utilising call structures which will help them take advantage of lower rates if and when yields drop further, further reducing the potential refinancing burden.

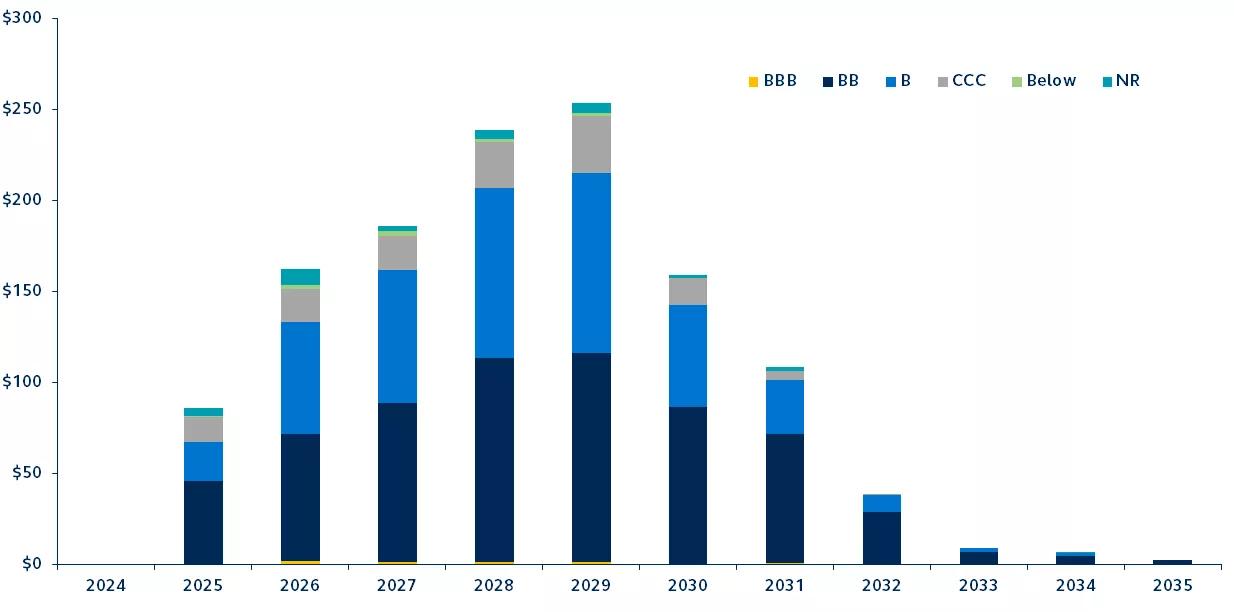

3. The maturity wall leans towards higher quality

High yield maturity wall by credit quality

$billions of debt scheduled to mature per year

Source: Bloomberg, Principal Asset Management. Data represents the U.S. High Yield 2% Issuer Cap index. As this index excludes bonds that mature within the next year, the chart does not include any bonds maturing in 2024.

The jump in refinancing costs is inevitably more significant and burdensome for higher-risk borrowers. While the average high yield refinancing cost has decreased in recent months, the gap between coupon and market yields remains wide for CCC issuers. The good news is that the high yield maturity wall is quality-biased, primarily composed of higher-quality BB and B issuers.

The implication is that while higher refinancing costs may impair the ability of some of the highest- risk borrowers to roll over their debt, and defaults in this space will likely rise, for the broader credit market, the much-feared maturity wall is unlikely to trigger a sharp and meaningful spike in defaults.

What could go wrong?

While the baseline macro scenario sees a modest economic slowdown and gradual rate cuts starting in mid-2024, a soft landing is not an assured outcome. Alternative outcomes of a "hard" landing or "no" landing are still gathering support, and it's worth considering how such economic scenarios could impact the challenges presented by the looming maturity wall.

In an upside scenario (no landing), whereby the U.S. economy accelerates, inflation may not moderate to 2% as the Fed currently anticipates. Reigniting inflation pressures could prompt the Fed to restart monetary tightening.

Naturally, investors may worry that, with higher rates, companies would need to devote a larger share of their revenue to covering higher interest expenses. While true, the economy's underlying strength would presumably be reflected in improving company fundamentals, putting them in a stronger position to deal with the higher costs and offset some of the default risks. Historically, credit events are rare when monetary tightening simply reflects a strong economy, inferring that a no-landing scenario doesn't necessarily have to be bad news for credit.

In a downside scenario (hard landing), the Fed would be expected to cut policy rates more aggressively, potentially in successive 50bps moves, looking to return monetary policy to an "easy" stance quickly. In such an environment, credit spreads would likely widen significantly as economic fundamentals deteriorate and market liquidity dries up, leaving companies with an even more challenging refinancing situation.

So, while a no-landing scenario should not necessarily spell bad news for high yield, by contrast, the hard landing scenario would render the maturity wall even more challenging, leading to higher defaults.

Implications for investors

The headline risk from the maturity wall is, at first sight, very concerning. After enjoying insulation from the Fed’s hiking cycle, growing numbers of corporations will now need to face the reality of the higher rate environment. Yet, the approaching Fed pivot implies that that rise in refinancing costs is unlikely to be as onerous as it looked just five months ago. Additionally, corporate balance sheet strength and the still-solid economic backdrop imply that most companies will be able to digest the higher interest rate costs without too much strain.

However, there will be an important differentiation across the credit quality spectrum, with lower- quality corporates facing a far more challenging road ahead. In this environment, it will be vital for investors to carefully examine company balance sheets and market dynamics, avoiding the most vulnerable corporates. The fundamental analysis required to evaluate corporates’ financial health and identify compelling opportunities in this market means that investors should seek active high yield managers to help them traverse the impending credit maturity wall.

Learn more about our high yield investment strategy.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation strategy will be successful. Lower‐rated securities are subject to additional credit and default risks. Emerging market debt may be subject to heightened default and liquidity risk.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Fixed Income is an investment team within Principal Global Investors.

3439473