Historically, rate cutting cycles tend to be long, lasting 26 months with the Effective Fed Funds Rate falling 441 basis points on average.

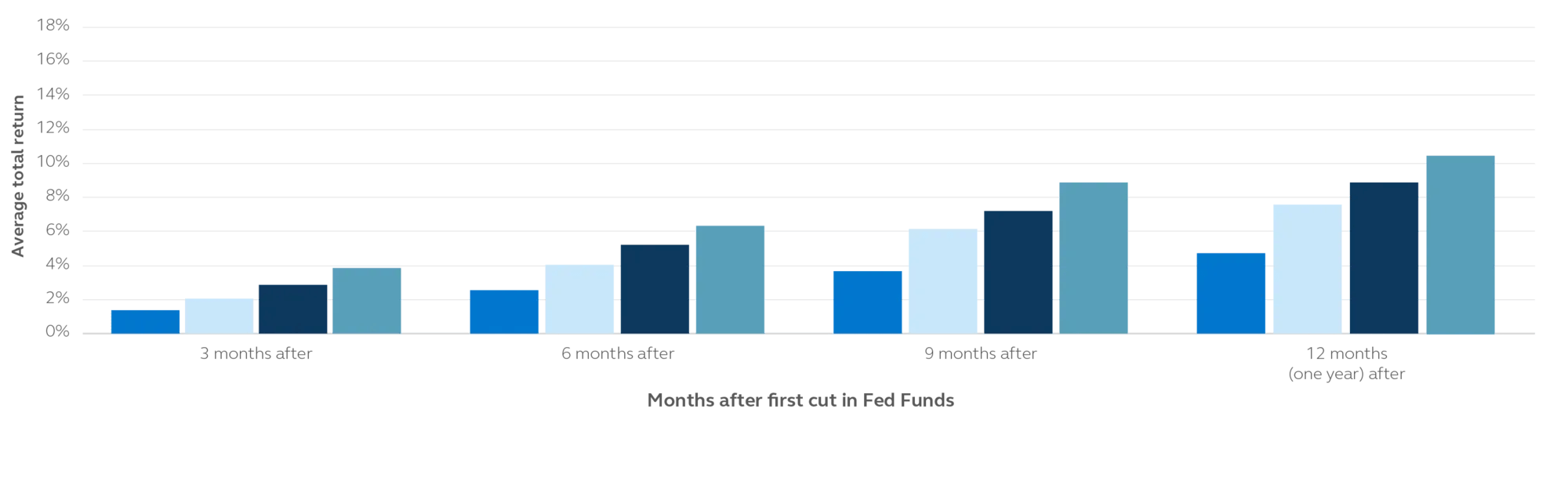

Over a long rate cutting cycle, investors in cash and cash equivalents see income and total return fall relative to longer duration alternatives. As the chart demonstrates, high-quality fixed income outperformed 3-month Treasury bills after the start of rate cuts.

Outperformance of high-quality fixed income continues to increase once cuts start

Returns of 3-month T-bills and high-quality fixed income after Fed starts cutting

- 3-month T-bills

- Municipal Bonds

- U.S. Credit 1-3 Years

- U.S. Aggregate

Source: Principal Global Investors. Reflects the average total return in relation to the six rate cuts over the time period from October 1982 to June 2024. The beginning of the rate cut dates: August 1984, June 1989, July 1995, January 2001, September 2007, August 2019. Data represented by St. Louis Fed 3-month T-bill, Bloomberg U.S. 1-3 Year Index, Bloomberg Municipal Index, and Bloomberg U.S. Aggregate Bond Index.

High-quality fixed income does well with cuts regardless of the type of landing

By the numbers: Since 1982, there were six rate cutting cycles.

Three times the U.S. economy went into a recession within 12 months after the first cut.

Three times the U.S. economy avoided a recession.

In all six instances, high-quality fixed income had positive return.

We believe now's the time to extend duration in high-quality fixed income

Upcoming events

Catch up on past events

Take advantage of our expertise

Access timely insights that uncover opportunities, identify risks, and provide unique perspectives. Our teams of specialized experts offer a clear point of view—allowing you to make decisions with confidence.

Footnotes

Index descriptions:

Bloomberg U.S. Aggregate Bond Index is the most widely followed broad market U.S. bond index. It measures the investment grade, US dollar-denominated, fixed-rate taxable bond market.

Bloomberg U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Treasury bills are excluded by the maturity constraint. STRIPS are excluded from the index because their inclusion would result in double-counting.

Bloomberg Municipal Index covers the USD-denominated Long-Term tax-exempt bond market with four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds.

Bloomberg U.S. 1-3 Year Index measures the performance of investment grade, US dollar-denominated, fixed-rate, taxable corporate and government-related debt with 1 to 2.9999 years to maturity.

Index performance information reflects no deduction for fees, expenses, or taxes. Indices are unmanaged and individuals cannot invest directly in an index.

Risk considerations

Past performance does not guarantee future return. Investing involves risk, including possible loss of principal. Fixed-income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Potential investors should be aware that Investment grade corporate bonds carry credit risks, default risk, liquidity risks, currency risks, operational risks, legal risks, counterparty risk and valuation risks. Lower-rated securities are subject to additional credit and default risks. A portion of the Fund's income may be subject to state and/or local taxes, and it may be subject to federal alternative minimum tax (AMT) for certain investors.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain `forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

Principal Fixed Income is an investment team within Principal Global Investors.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

MM14144 | 09/2024 | 3835696-092026