The February jobs report provided a very mixed picture of the U.S. labor market. Job gains beat expectations once again, increasing by 311,000, but were offset by an unexpected increase in the unemployment rate to 3.6% and softer-than-expected average hourly earnings. Earlier this week, Federal Reserve (Fed) Chair Jerome Powell emphasized the importance of today’s jobs report for their forthcoming March policy rate decision. While the mixed nature of the report likely does not clear up their 25 bps vs. 50 bps hike dilemma, the bigger picture is that the U.S. economy still requires further monetary tightening to curb inflation.

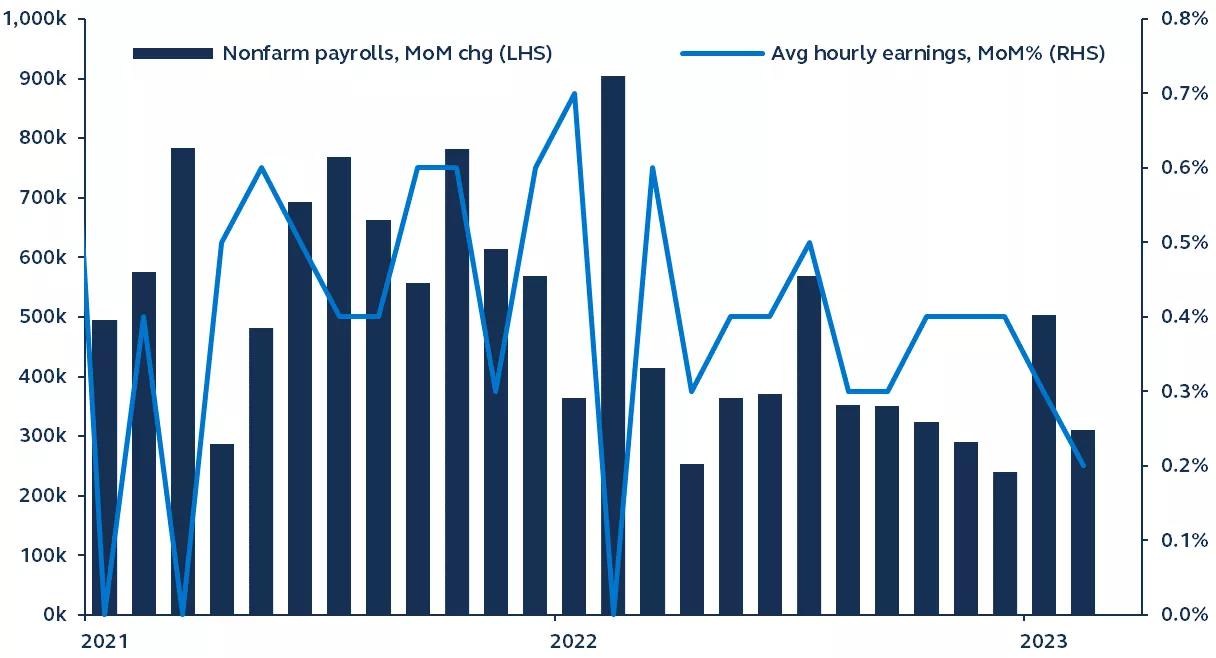

Nonfarm payrolls and wage growth

2021–present

Source: Bureau of Labor Statistics. Principal Asset Management. Data as of March 10, 2023.

Report details:

- Non-farm payrolls increased by 311,000 on the month, higher than the consensus expectation for 225,000. While lower than last month, this is still a very strong number and confirms the signal of strong economic momentum which has been visible in recent data.

- After last month’s blowout report (revised to +504,000), there had been some suspicions that much of the prior gains would be revised away. In fact, the December and January numbers were revised down by a total of just 34,000.

- On its own, the payrolls number was likely strong enough to tilt the Fed’s March rate hike dilemma towards 50 bps. But other details of the jobs report tentatively suggest that the labor market is loosening and wage pressures are softening. The unemployment rate rose from 3.4% to 3.6%, with labor market participation ticking up from 62.4% to 62.5%.

- Average hourly earnings growth rose only 0.2% month-on-month, the lowest monthly rate in a year. The increase in participation has slightly loosened the labor market, and that appears to have taken out some of the steam from wage pressures.

The U.S. jobs report has rarely been in the spotlight quite like February’s report was. After January’s blowout payrolls number, and following Powell’s hawkish testimony earlier this week, investors were hoping that the jobs report would provide some guidance as to whether the Fed will hike by 50 bps in their next meeting (on March 22). While the February payroll number on its own would suggest a 50 bps hike is required, the unexpectedly large rise in the unemployment rate, and softer-than-expected average hourly earnings number, mean that 25 bps is still on the table. Indeed, as much as Powell is injecting his own brand of uncertainty and volatility, today’s economic data itself isn’t helping sharpen the picture. All eyes will be on next Tuesday’s CPI inflation report to hopefully clear up some of the uncertainty.

Ultimately, with the unemployment rate still historically low and a significant number of jobs being added each month, the bigger picture is clear: Further monetary tightening to curb inflation is warranted, and the likelihood of rate cuts later in the year is minimal.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2786586