Persistent economic concern and volatility continues to plague markets and threaten a second straight year of decline. While many investors may feel best suited to pull their money out of the market in this environment, historical cycles suggest that bear markets are typically short lived and staying invested in a diversified portfolio through the downturns is likely still the best approach.

Stock market bull and bear cycles

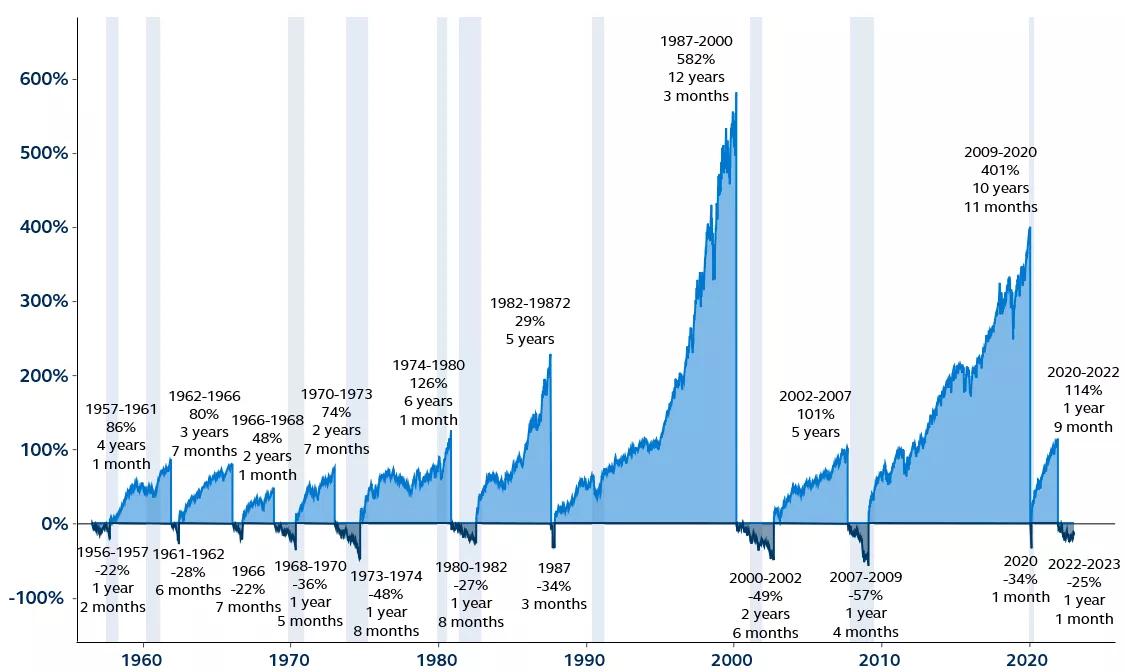

S&P 500 price index, recessions are shaded, 1956–present

Note: Bear markets are 20% declines in price from prior peaks. Bull markets begin at each market bottom.

Source: Clearnomics, Standard & Poor’s, Principal Asset Management. Data as of February 7, 2023.

Despite recent outperformance, with the possibility of a recession still at the forefront of many investors’ minds, some may be tempted to withdraw from this market. Yet, while downturns can indeed be difficult, history shows that they are often shorter-lived than bull markets.

On average, bear markets since World War II have lasted 14 months and resulted in a market decline of 36%. In contrast, the average bull market lasts 5 years, 9 months and returns 192%. While the Global Financial Crisis (GFC) did lead the S&P 500 down 57% and lasted 16 months, once the market troughed in early 2009, it took just seven months to rise back 57%. Furthermore, the ensuing bull market lasted almost 11 years and delivered 401% of return for the S&P 500! Staying invested, even through the GFC, would have duly paid back.

Investors can reduce portfolio volatility by maintaining proper diversification, as assets rarely all move in the same direction during challenging market environments. Even last year, when it seemed that all broad indices were down, commodities returned over 15%. This year, while economic weakness likely means drawdowns for equities, it should spell good news for fixed income—particularly as further rate hikes should be limited.

Historical cycles, even recently, show that staying invested through the market cycle, in a diversified portfolio, is typically the best investment approach.

Want more on this topic? Read Coping with market downturns: Staying invested as markets threaten to decline.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Diversification cannot ensure a profit or protect against loss in a declining market. It is a strategy used to help mitigate risk.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2732113