The Federal Reserve’s decision to raise policy rates by 25 basis points at their July meeting was no surprise to investors. However, future policy decisions are decidedly less certain and will be heavily influenced by the level of core inflation moving forward.

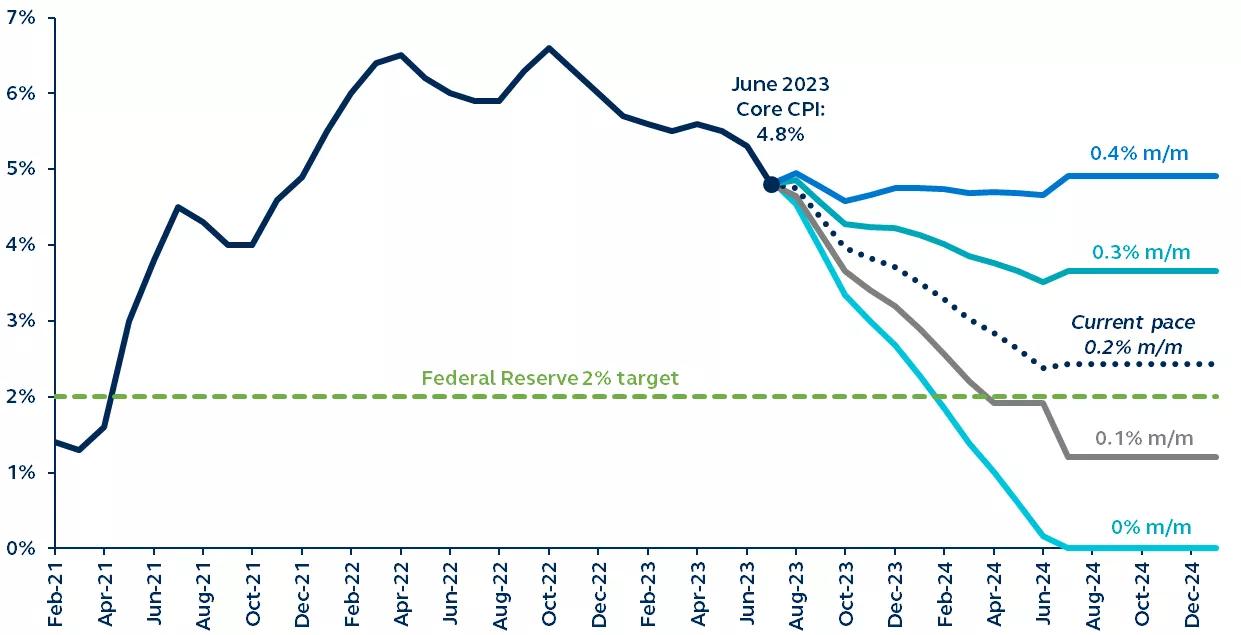

Annual core CPI level at various month-over-month growth scenarios

Februrary 2021–December 2024

Source: Bloomberg, Principal Asset Management. Data as of July 28, 2023.

The Federal Reserve (Fed) raised policy rates by 25bps to 5.25%-5.50% this week, its highest level in 22 years. Notably, financial markets assign an almost 50/50 chance of a further rate hike in the coming months. With rates firmly in restrictive territory, the future policy path sits finely balanced and heavily dependent on how core inflation, currently sitting at 4.8% year-on-year, behaves going forward.

To illustrate the relationship between core inflation and potential policy actions, examine how annual core inflation is affected by different assumptions of monthly inflation.

0.1%: The Fed will likely only cut policy rates this year if the monthly rate falls to 0.1% or below.

0.2%: The Fed would likely keep rates on hold if the June monthly inflation rate of 0.2% is maintained.

0.3%: The Fed may raise policy rates again if core inflation grows at a monthly rate of 0.3%.

0.4%: The Fed would likely raise policy rates several times if the monthly rate reverts to 0.4%, in line with the average monthly inflation rate of the first five months of 2023.

Our long-standing belief has been that interest rates will peak at their current level of 5.25-5.50%. However, the strong economy and tight labor market may still require the Federal Reserve to take further action, considering its close monitoring of inflation's impact on the economy.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3031338