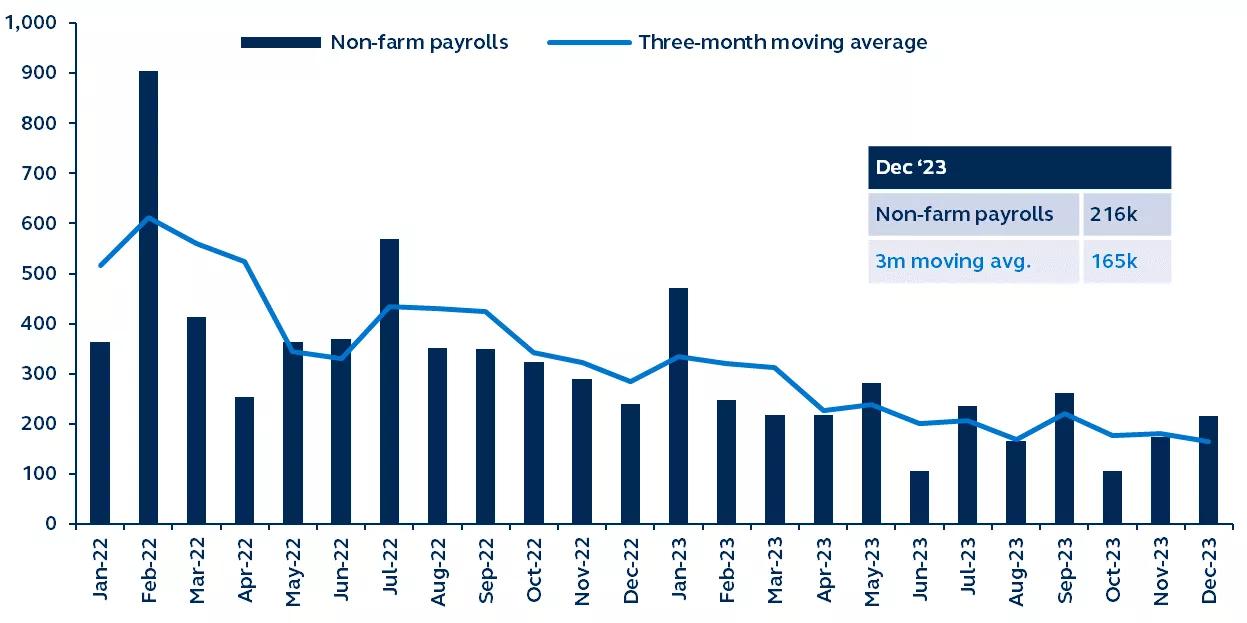

The latest jobs report suggests that the U.S. labor market remains resilient, reinforcing the notion that the Federal Reserve (Fed) will likely not rush to cut rates. In December, the economy added 216,000 non-farm payroll jobs, an increase from the previous month and above consensus expectations. With labor demand still so strong, wage pressures are failing to ease as much as the Fed would like, validating growing market skepticism that the economy will be ready for policy rate cuts as soon as March.

Non-farm payrolls

Thousands, January 2022–present

Report details

- Total non-farm payroll employment increased by 216,000 in December, up from 180,000 the prior month and above consensus expectations for a 175,000 increase. Payrolls for the last two months were revised down by 71,000, pulling the three-month moving average down to 165,000. December's payroll gain is only slightly below the 2023 monthly average, suggesting that although the labor market appears to be softening, it likely is not at the pace the Fed hoped to see.

- The unemployment rate held steady at 3.7%, lower than the 3.8% consensus forecast. Overall, in 2023, the rate only rose from 3.4% to 3.7%, evidence of a highly resilient labor market. The participation rate slipped 0.3% in December—the most significant drop since January 2021—to 62.5%, and is now only marginally higher than where it started in 2023.

- Wage growth remained broadly stable in December despite expectations for a further cooling. Average hourly earnings growth was 0.4%, unchanged from the previous month but above expectations for a slowdown to 0.3%. On an annual basis, hourly earnings rose from 4.0% in November to 4.1% in December. The report's wage numbers are consistent with a still-tight labor market and will likely make the Fed further hesitant to cut rates in March.

- Recently, there has been some focus on job gains' sectoral makeup, with evidence emerging of a hiring slowdown in the more cyclical sectors. Yet, today's data showed a broad gain across the economy, with cyclical and defensive sectors recording job growth. More than half the payrolls increase came from education & healthcare and leisure & hospitality.

Employment & rates outlook

The December FOMC minutes indicated that continued progress in reducing inflation might need to come from softening labor demand. Today's employment report suggests that the required softness has yet to materialize.

Markets are now reconsidering rate cut expectations. Just a few weeks ago, the market was pricing in a 100% probability of a March rate cut, but following the jobs report, that probability has moved to a 50/50 chance. We continue to expect the first rate cut to come in late 2Q, provided that there has been clear evidence of labor market softness in the economy.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3310614