Source: Principal Real Estate, March 2023

Source: Principal Real Estate, March 2023

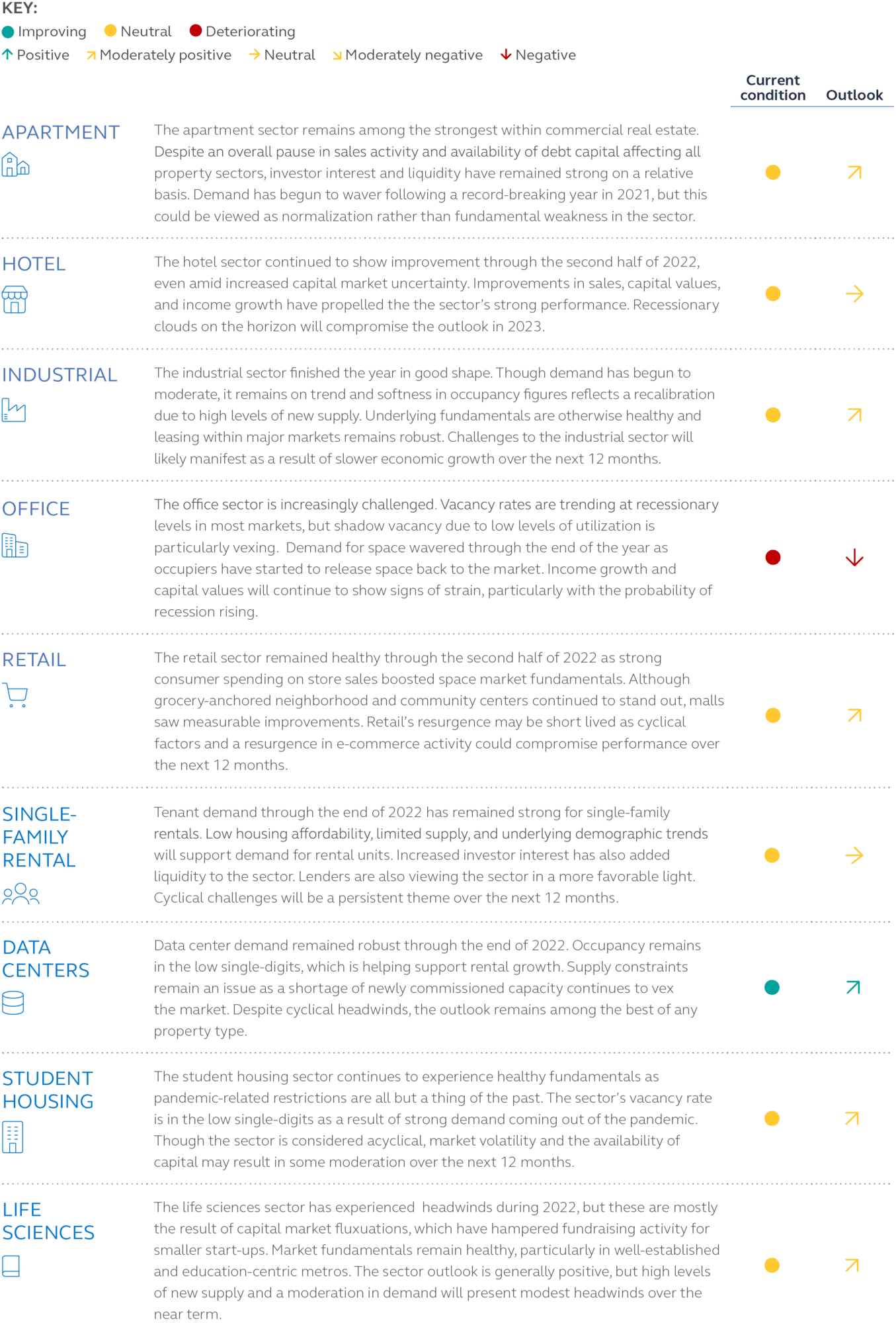

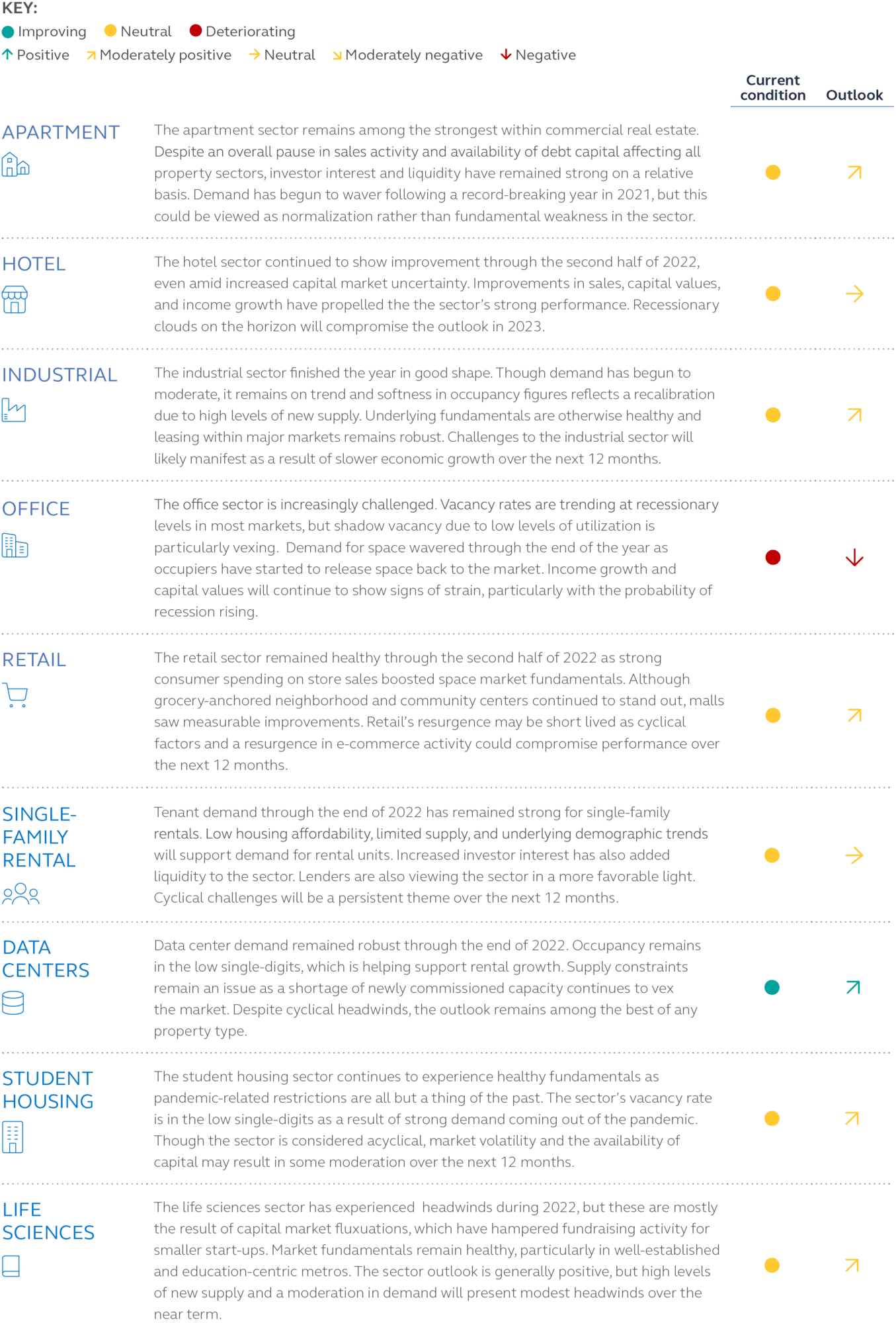

The apartment sector remains among the strongest within commercial real estate. Despite an overall pause in sales activity and availability of debt capital affecting all property sectors, investor interest and liquidity has remained strong on a relative basis. Demand has begun to waver following a record-breaking year in 2021, but this could be viewed as normalization rather than fundamental weakness in the sector.

While apartment continues to be a favored asset class among investors, capital market dislocations and a deceleration in space market fundamentals cooled investor demand in the fourth quarter. Early estimates of year-over-year transaction volume show that the sector recorded a decline of 22% from 2021 totals, though fourth quarter 2022 volume declined 75% from fourth quarter 2021, which is a reflection of transaction activity being weighted toward the first half of the year.

Strong market fundamentals have been a hallmark of the apartment sector since the summer of 2021, with record levels of demand, market rent growth, and lease trade-outs prevalent through early 2022. That dynamic changed quickly beginning late summer 2022, with both tenant demand and rent growth normalizing. Net operating income (NOI) growth will likely benefit from continued favorable lease trade- outs, though the reintroduction of rent concessions is likely to temper performance.

Apartment sector fundamentals regularly reflect some seasonality, with slower leasing volume in the fall and winter months being the norm. Operators will keep a close eye on whether leasing rebounds as the year continues, or if a lower growth profile is sustained in 2023. A still expensive for-sale market will also continue to help bolster occupancy in the rental sector.

As debt has repriced, so too has the equity. Upward pressure in cap rates, internal rates of returns (IRRs), and exit caps began to filter through apartment valuations the second half of 2022, largely mitigated by strength in market fundamentals. The combination of higher required yields, the higher cost of debt capital, and reduced availability of construction debt may exert downward pressure on supply pipelines. Properties nearing delivery in 2023 may further dampen strength in space markets over the near term given high levels of new supply projected to deliver throughout the year. The sector currently has 578,000 units expected to deliver in the next 12 months, which represents 3.4% of total inventory.

The cost of debt capital increased materially throughout the second half of 2022, though the apartment sector is supported in part by financing from government sponsored entities (GSE), which is often more attractive than that available from banks, life companies, or non-bank lenders. In early 2023, the cost and availability of debt capital improved with fresh allocations and favorable downward movement in long-dated treasury yields.

Strength in apartment market fundamentals, paired with reduced single-family home affordability, continues to drive lenders’ favorable views on the sector. As a result of lender favoritism; competitive pricing; and enhanced liquidity from GSEs, multifamily lending rates are the lowest of any property type. Interest rates on 10-year, fixed-rate loans for high- quality, well-located apartment properties with 55% to 65% loan-to-value (LTV) are in the low 5% range from insurance companies as of early February. Rates are slightly higher from many banks with occasionally tighter rates from the GSEs. Fannie Mae and Freddie Mac sometimes offer 75% LTV financing with rates in the mid-5% range for select multifamily properties, and occasionally offer more aggressive rates for properties with a strong affordability component for lower-income households.

Apartments meaningfully lagged the REIT index during the second half of 2022, especially during the fourth quarter. Faster than expected rent deceleration and a wave of corporate layoff announcements (particularly from technology companies) were the key drivers.

Despite visibility for above-average growth in 2023, boosted by the impact of 2022 leasing activity and still positive mark-to-market opportunities, public market investors were focused on the risks of further deterioration of pricing power and loss of occupancy in late 2023 and beyond if there is a recession. Within the sector, coastal markets have much less supply pressure to contend with but appear more in danger of job losses. On the other hand, more stable employment trends in the Sunbelt may not be enough to absorb new deliveries. Following the underperformance in the second half, apartment REITs are trading at a discount to NAV of roughly 15%, compared with the overall REIT index average, which is trading at NAV.

The GSE’s continue to be a dominant lender in the multifamily space, but combined issuance was down 32% year-over year in 2022. While much smaller in scale, multifamily exposure in conduit CMBS deals issued in 2022 was well above the average of the past 10 years at 15%. Loan performance has remained very strong as the conduit multifamily delinquency rate is the lowest level in 15 years at 1.1%, and agency delinquency is scant at 0.1%.

Small pockets of weakness have emerged in some poorly positioned student housing properties and loans that were adversely impacted by pullbacks in oil production, but these are isolated cases. The single- asset single-borrower (SASB) and collateralized loan obligation (CLO) markets have grown significantly and have provided over $80 billion of primarily floating rate multifamily financing over the past three years. This has provided CMBS investors with a broader set of multifamily centric investment options. Overall, multifamily remains an in-favor sector within the CMBS universe given a supportive backdrop of housing affordability, inventory shortages, and NOI growth.

The hotel sector stands out among other sectors as it experienced an increase in sales volume during 2022, as well as a modest capital value increase in the fourth quarter, while most other sectors were written down. The sector is also benefiting from pent up demand for both business and leisure travel, which is evidenced in improved occupancy rates across chain scales. Room rates have continued to improve with the gap between urban, which cater to corporate travel, and suburban properties narrowing further through the end of the year.

The outlook for the sector remains shrouded in uncertainty. Despite capital market improvements— even amid policy and rate uncertainty—the sector remains highly cyclical. A potential recession in the offing will likely compromise the sector’s progress as underlying fundamentals would be certain to waver.

Many lenders returned to hotel lending during the second half of 2022, driven by improving hotel performance, a lack of appealing office opportunities, and higher yields available for hotel loans. Lending by insurance companies and large banks remains limited, but local and regional banks, debt funds, and to some extent CMBS lenders, have shown renewed interest in hotel lending, albeit with more conservative loan structures than historically required and at higher interest rates.

Most hotel loans today are structured with variable interest rates. As of early February 2023, some local and regional banks offered rates of 250 to 350 bps over SOFR with rates near 7 to 8% for high quality hotel loans with LTVs below 65% and partial recourse. The few large banks active in hotel lending tended to offer 45 to 65% LTV priced around 375 to 450 bps over the secured overnight financing rate (SOFR), sometimes with lesser recourse requirements. Debt funds frequently offered financing for high-quality hotels with 60 to 65% LTV priced at 400 to 550 bps over SOFR, and somewhat more flexible underwriting requirements.

Note that the cost to hedge interest rate movement increased significantly over the past year, with lenders consistently requiring interest rate caps for variable rate loans. This effectively increased the cost of variable rate financing further.

Lodging REITs outperformed other property sectors throughout the second half of 2022, due to continued strength in leisure travel and an acceleration in business and urban hotel demand. Throughout the fall, price-inelasticity remained in place across all chain-scales, with hotels continuing to charge meaningfully higher nightly rates compared to pre-COVID levels. The recovery in corporate travel accelerated with urban hotels narrowing their underperformance relative to suburban properties and mid-week occupancy approaching weekend levels.

Throughout earnings season, lodging REITs delivered mixed results as strong pricing power was offset by higher property operating expenses—particularly wages—resulting in weaker than expected profitability. Revenue per available room (RevPAR) in recent months has held above pre-COVID levels and is expected to continue along this trend barring a weaker macroeconomic environment. Lodging REITs are trading at 20% discounts to consensus NAV estimates, a larger magnitude than what is seen across other REIT sectors. Despite outperformance throughout 2022, lodging REIT valuations reflect the uncertain impact that a potential recession may have on both consumer and business travel demand.

Hotel operations have shown an impressive turnaround post-COVID with loan performance following suit. The conduit delinquency rate peaked near 25% in July of 2020 and now stands at 5.8%, lower than the retail sector. Leisure travel has spurred on a strong recovery in vacation destination markets with business travel returning as well. Smith Travel Research reports that RevPAR for the 28 days ending 3 February 2023, is up 14% relative to the same pre-COVID period in 2020 with upper midscale and midscale hotels leading the pack.

Interestingly, hotel operators have grown RevPAR by raising average daily rates, while occupancies are flat on average relative to three years ago. CMBS issuances in 2020-2021 included very little hotel exposure due to underwriting challenges and investor skepticism. That said, hotel loans contributed 8% of total conduit CMBS and over 20% of SASB collateral issued in 2022, showing that capital is available for better positioned properties. Importantly, hotel underwriting metrics have remained especially conservative post- COVID which seems appropriate given cash flows may have peaked in the near term. While the current environment is supportive, a recession would be detrimental to hotel performance as these properties essentially operate on one-night leases.

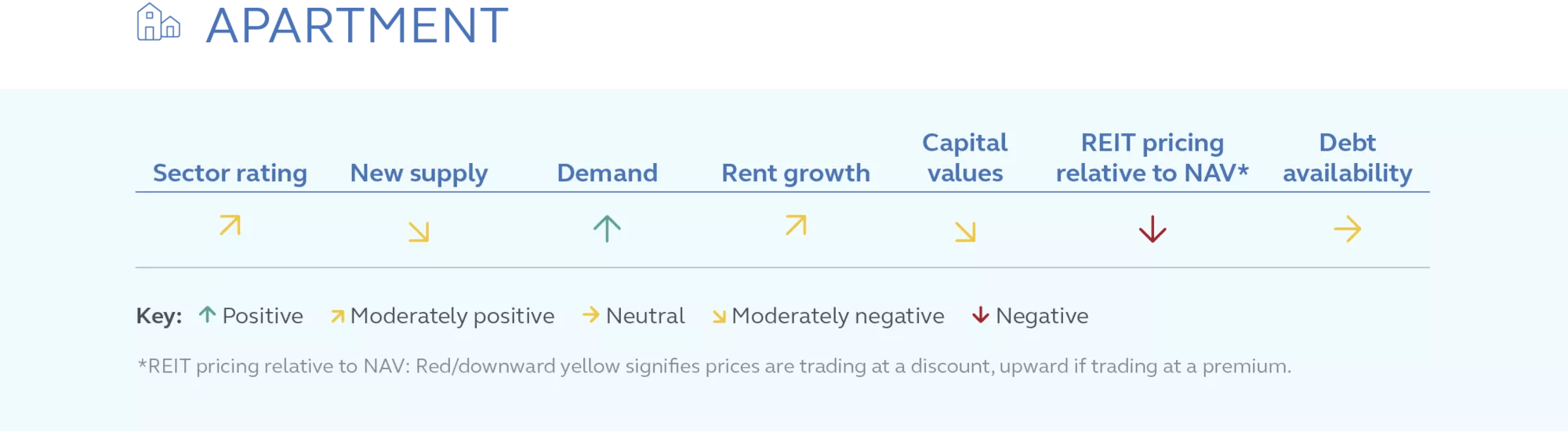

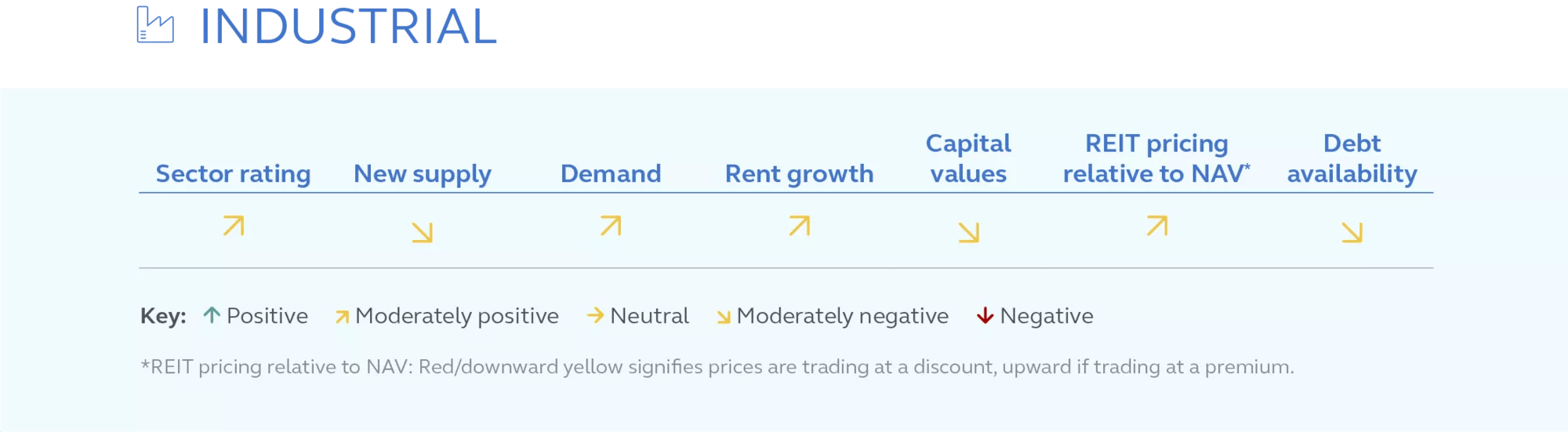

The industrial sector finished the year in good shape. Though demand has begun to moderate, it remains in-line with historical trend and softness in occupancy figures reflects a recalibration due to high levels of new supply. Underlying fundamentals are otherwise healthy and leasing within major markets remains robust. Challenges to the industrial sector will likely manifest as a result of slower economic growth over the next 12 months.

Industrial represents the single largest property sector allocation within the NCREIF Fund Index – Open-End Diversified Core Equity (NFI-ODCE), a reflection of broad-based demand for U.S. logistics assets that extends well beyond the universe of U.S. based core funds. The allocation is supported by strong market fundamentals, which continue to exhibit strength across the U.S. While net absorption for the sector moderated over the past 12 months, it is more likely a return to trend rather than an indication of weakness. The vacancy rate for industrial properties is 3%, which represents a historic low, and most large port markets are boasting rates below 2%. Strong demand and sustained rental growth have helped offset some of the downward pressure in values resulting from recalibrated valuation metrics.

Capital markets adjustments owing to tighter monetary policy during the second half of the 2022 have resulted in downward pressure on valuations in the sector. Value declines are largely due to the low nominal cap rates, discount rates, and exit cap rates prevalent within the sector given high levels of investor demand and favorable space market fundamentals. As a result, the sector was not immune from the decrease in transaction volume, posting a second half 2022 total volume of $57.3 million, a decline of 50% from second half 2021.

Key risks to the outlook remain the weakening macroeconomic picture both domestically and globally, and its potential impact on tenant demand and the current level of supply in the pipeline. While much of the country’s stock of logistics space is inadequate to meet the needs of modern distribution requirements today, industrial completions totaled nearly 400 million square feet in 2022—a record dating back to 1989. The lack of construction financing and increased investor yield requirements may serve to limit additional supply near term and act as a favorable tailwind for space market fundamentals.

The industrial sector—along with apartments— remains a favorite among lenders for its healthy market fundamentals and portfolio diversification benefits. Well-located, high-quality warehouse and logistics properties in major markets today often garner 10-year, fixed rate financing with 55 to 60% LTV ratios and interest rates near 5.25%. Pricing tends to be somewhat less competitive than that offered by lenders for multifamily properties, perhaps due to multifamily competition from the government- sponsored enterprises, which does not exist for industrial properties. The industrial sector is clearly a very close second to multifamily in terms of lender preference and aggressive pricing.

Industrial REITs rebounded in the fourth quarter, but not enough to overcome the underperformance from earlier in the year. The sector lagged in 2022 relative to the broader index because of concerns around oversupply and weakening e-commerce demand, particularly from Amazon, as well as the impact rising real yields had on structural growth sectors that trade at lower cap rates. Despite this negative sentiment, recent industrial REIT earnings results highlight continued strength in rent growth, solid leasing activity, and accelerating cash leasing spreads.

REITs describe the market as less frenzied than a few quarters ago but note that demand remains robust such that elevated supply growth in 2023 is expected to increase vacancy levels only modestly. After continued strength in the fourth quarter, REITs are suggesting another year of positive rental growth lies ahead (albeit at slower pace than in 2022). Industrial REITs have turned more cautious on developments and acquisitions due to recession risks, higher interest rates, and uncertainty around valuations. However, they maintain active development pipelines which might be expanded later in 2023 given the improved supply outlook for 2024 (starts are down 40% in recent months). As a result of the underperformance in 2022, industrial REITs are trading at a 10% premium to NAV versus the REIT average, but at a smaller premium than they’ve commanded in recent years.

Industrial loans currently carry the lowest delinquency rate within the CMBS universe and continue to be viewed positively, especially relative to office, retail, and hotel exposures given the current economic outlook. The CMBS SASB market provided over $35 billion of floating rate debt to industrial owners between 2020 and 2022, offering an efficient source of financing for very large portfolio deals. More recently, the significant increase in floating rates and widening in credit spreads has made these financings relatively unattractive to borrowers, and the pace of new issuance has fallen dramatically.

Industrial allocations within conduit CMBS issuances have nearly doubled over this same time frame, generally considered a positive. Conduit CMBS industrial loans are typically smaller than the large SASB deals and exposure to tertiary locations, less functional layouts, and non-investment grade tenancy must be properly evaluated. Underwriting metrics for conduit industrial loans are more conservative than SASB industrial loans on average; that said, ongoing prospects for solid net operating income (NOI) growth should benefit both CMBS sectors.

The office sector is increasingly challenged. Vacancy rates are trending at recessionary levels in most markets, but shadow vacancy due to low levels of utilization is particularly vexing. Office demand wavered through the end of the year as occupiers have started to release space back to the market. Income growth and capital values will continue to show signs of strain, particularly with the probability of recession rising.

By all measures the nascent office recovery of 2021 has come to a complete halt. The sector is the most challenged today with headwinds stemming from both capital markets and weak physical occupancy. Market fundamentals eroded further throughout the second half of 2022, with negative net absorption and increased vacancy rates across most markets. Top-tier office assets continued to capture most of the tenant demand—a reflection of the ongoing flight-to-quality, persistent in office well before the onset of COVID.

Capital market conditions have also eroded considerably. Increased investor yield requirements, a higher cost of debt capital, and a dearth of lenders willing to finance office transactions caused fourth quarter 2022 transaction volume to decline by 75% on a year-over-year basis. In many cases, traditional bank and life company lenders are addressing upcoming maturities within their current portfolios, limiting the bid for new office financing.

Uncertainty will remain a key theme in the office sector, as tenants assess space requirements and test hybrid return-to-work strategies. Despite the best efforts of corporate CEOs to induce workers to return to the workplace, the physical office utilization rate remains just under half of its pre-COVID level. Additionally, fears of a weaking economy and a potential recession will also act as a cyclical headwind, exacerbating an already challenging outlook for the sector.

Office debt availability remains compromised by weak fundamentals; uncertain prospects for improvements; and lender over-exposure to office in their legacy portfolios. Most balance sheet lenders today are unwilling to make any new office loans. Various industry reports suggest that perhaps 10 to 12% of recent lender activity has been in the office sector, but anecdotal evidence suggests this has been almost exclusively refinancing of existing loans. A small volume of new office loans has been originated recently by CMBS conduits, but even this activity has been limited.

With new financing unavailable for most office properties, some sellers of properties have turned to seller-provided financing to effectuate sales. Such transactions typically provide buyers low-to-moderate leverage at interest rates unavailable in the market, while allowing sellers to reduce their exposure to the property type.

Office REITs—especially those focused on gateway metros—started 2022 with strong performance, driven by deeply discounted valuations and the expectation of a smoother trend of return to office. However, in the remainder of the year, rising recession fears, and announced layoffs—particularly in tech industries—dampened optimism causing office REITs to end the year as the worst performing sector. Underperformance in Q4 can also be attributed to several REITs issuing disappointing 2023 guidance and cutting dividends. While NOI growth is weak and under pressure, higher interest expenses are the main earnings drag for this relatively high-levered sector.

The anticipated return to office trend has disappointed, with office utilization subdued across the board, but comparatively higher in select Sunbelt markets. Leasing activity slowed significantly after the summer and remains well below 2019 levels. Vacancy and sublease availability reached new all-time highs in many markets and is still rising. Many REITs reported negative absorption and declines in leased occupancy, but earnings generally met expectations, which are low for the sector.

Flight-to-quality remains an overriding theme as tenants continue to relocate to new supply or consolidate into buildings with high level of amenities and better efficiency. Transaction markets have largely paused given higher interest rates. Despite a roughly 20% year- over-year decline in consensus NAVs for the broader index, office REITs underperformance has widened NAV discounts to roughly 40% on average, making it the most discounted sector in the public markets.

Office exposure in CMBS deals is facing ever-growing scrutiny as the sector faces secular headwinds. At first blush, this is problematic for conduit CMBS as office exposure has averaged approximately 29% in deals issued over the past ten years. However, a closer look shows that the general themes of haves and have nots are likely to play out in CMBS, necessitating a more granular approach. Loan originators have tried to address concerns through more conservative underwriting. Case-in-point, from 2020-2022, LTVs, debt service coverage ratios (DSCR), and debt yields for office loans have averaged 52%, 3.1x, and 10.8% respectively. Office delinquency rates remained remarkably stable throughout the pandemic and have yet to show a sustained upward trend, still holding around 2%.

Long-term leases, diversified rent rolls, and high DSCRs are all helping to mitigate term default risk; however, balloon risk is elevated given challenged fundamentals and highly constrained capital markets. Given the difficult refinance environment, CMBS servicers are working with borrowers by providing loan extensions in exchange for fresh equity contributions, cash flow sweeps, and other lender friendly requirements, ultimately seeking to improve bondholder outcomes.

The retail sector remained healthy through the second half of 2022 as strong consumer spending on store sales boosted space market fundamentals. Although grocery anchored neighborhood and community centers continued to stand out, malls saw measurable improvements. Retail’s resurgence may be short lived, however, as cyclical factors and a revival in e-commerce activity could compromise performance over the next 12 months.

Full year 2022 transaction volume in the retail sector increased 10% from the level recorded in 2021, a reflection of strong tenant demand and very little new supply across the retail real estate landscape. The sector, however, was not immune to the capital markets shift at mid-year, with transaction volume dropping significantly in the second half of the year.

Investor demand continues to favor well-located, grocery anchored neighborhood and community centers, reflecting the strength of the operating fundamentals for that retail format and the perceived resilience of non-discretionary consumer spending in a weakening macroeconomic environment. The highest quality mall properties have also performed well and continued to report strengthening operations, with improved foot traffic, high sales per foot, and negligible new supply in the pipeline.

The higher level of nominal valuation metrics characteristic of the retail sector helped mitigate downward pressure on values in the second half of 2022. Retail cap and discount rates experienced only modest increases in response to the higher cost of capital.

Despite a resurgence in both investor interest and occupancy, the retail sector will face considerable headwinds over the next 12 months. Inflation and weakening consumer confidence remain key areas of concern, particularly across discretionary retail formats such as malls, power centers, and high street properties. Household balance sheets are also falling prey to above trend inflation, which is evidenced in recent retail sales reports.

A growing number of lenders are pursuing new investments in neighborhood and community shopping centers with healthy tenants achieving healthy sales. Properties featuring major grocers, as well as creditworthy discounters home improvement stores are often finding receptive lenders willing to aggressively compete for financing assignments. Nonetheless, interest rates for the highest quality retail properties remain perhaps 10 to 15 bps higher than debt for similarly leveraged apartment and industrial properties.

Debt for high street properties, power centers, and lifestyle centers remains difficult to procure even at lower leverage levels, and significant loan structure (e.g., escrows and amortization) is often required. Debt for regional malls remains unavailable for all but the very best assets with top operators. Lenders continue to focus heavily on tenant creditworthiness, tenant sales history, remaining weighted-average lease terms (WALTs), and sponsor quality, with widely disparate loan terms offered.

Open-air shopping centers and malls were the best performing sectors in the fourth quarter and outperformed the broader REIT index in 2022. Signs of slowing inflation, falling gas prices, and a strong job market in the second half of the year alleviated some of the fears of a discretionary spending pullback. REITs reported better than expected results driven by occupancy gains and improved pricing power thanks to continued strong retailer demand for space through the end of the year. Fundamentals have also been supported by low store closures and bankruptcies.

Looking forward, after a surprisingly fast and strong recovery following the pandemic, there is fear that 2023 will likely be a more challenging year for retail as consumer spending trends are showing signs of stress. Low savings rates have diminished excess pandemic savings, and greater recent use of credit highlights some of the risks specific to the property type in addition to broader macroeconomic concerns. While an uptick in store closures and retailer bankruptcies is likely, the fallout could be more limited than in previous cycles as the pandemic has already culled some weaker retailers. Larger than usual committed pipelines of store openings should also help REITs to absorb some of the potential tenant issues. Shopping centers and malls are trading at between a 5% and 10% discount to consensus NAV estimates compared to the broader REIT average.

The recovery in brick-and-mortar retail continues to hold its ground in the CMBS market, driven by a resilient consumer and an uptick in spending on services vs. goods. However, the possibility of recession in 2023 is giving investors pause for concern as they weigh recently strong employment and spending data with deteriorating consumer balance sheets and potential margin pressure as retailers adjust to a slowing economy. Retail center tenant credit has improved but weaker names such as Bed Bath & Beyond point to the benefit of diversification across multiple properties, borrowers, and locations inherent in CMBS.

The conduit CMBS retail delinquency rate has improved materially since the pandemic but remains elevated at 6% as seasoned loans facing cash flow and capital markets challenges are taking time to resolve. CMBS servicers continue working with mall operators as loans approach maturity by providing extensions on performing properties, typically in exchange for fresh equity contributions. This approach seeks to maximize bondholder outcomes by keeping strong mall operators in place, while avoiding near-term foreclosure at a time when valuations are depressed.

Refinance needs for retail properties are significant in 2023 with approximately $10 billion in loans coming due, including a relatively large number of malls. Retail loan contribution to new CMBS issuances has grown moderately after very depressed pandemic- era levels, averaging 19% of pool collateral in 2022 although new mall exposure remains very low. Retail underwriting metrics have remained generally conservative on average with LTVs below 60%, DSCRs at 2.0x, and debt yields hovering around 10%. A higher cost of capital is likely to keep LTVs and debt yields elevated while going-in DSCR’s are likely to fall for new loans.

Tenant demand for scattered-site single-family rentals and build-for-rent remains strong, with fundamentals supported by demographics, limited supply, and challenged home ownership affordability. Capital markets have been supported to date by growing institutional interest in the space, though upward pressure on cap rates is evident in single-family rentals as well.

Production home builders are a key potential source of new supply. In 2021 and early 2022, builders favored retail home buyer executions to maximize sales price and capture robust volume, though today, wholesale transactions are a more likely execution mechanism to clear excess inventory. This dynamic may support further institutionalization of the space in the near term.

Despite declining home prices starting during the second half of 2022, affordability of single-family homes remains near historic lows, which should provide some runway for demand in the rental sector.

The private debt market for single-family rental properties remains bifurcated, with certain lenders expressing interest in financing properties purposely developed for rent and located on contiguous parcels of land, while a dearth of private debt capital appears available for other single-family rentals.

The single-family rental sector meaningfully underperformed the REIT index to end the year. Operations remain generally healthy with strong visibility for robust top line growth in 2023. This is driven by continued rental growth, sizeable mark- to-market opportunities (low-teens), and low turnover. Property tax increases, however, surprised to the upside and were the cause of the poor stock performance. Investors are concerned that high expense growth may continue and fear risk of rising supply from build-to-rent programs, homebuilder product, and a weaker for-sale market. Single-family rental REITs are trading at close to 10% discounts to consensus NAV estimates relative to all REITs, which are trading even with NAV.

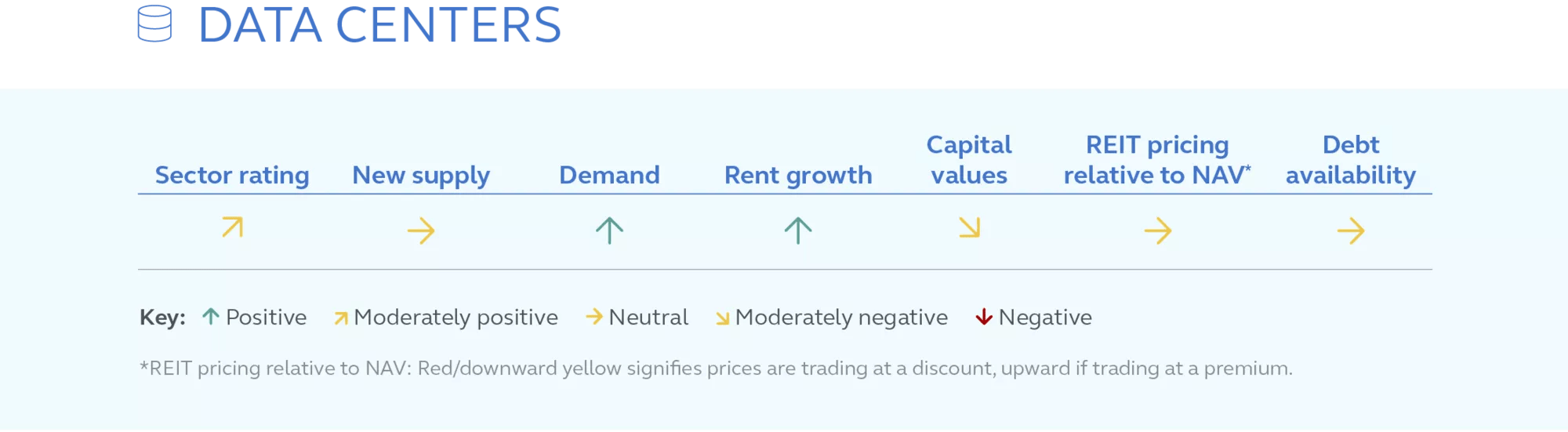

Demand within the sector remains white hot with the North American market experiencing a 137% increase in megawatt hours (MWH) on a year-over-year basis, according to DatacenterHawk. Demand in Atlanta, Dallas, Denver, Las Vegas, Phoenix, Portland, and Salt Lake City accounted for over half of all data center net absorption over the past 12 months.

On the supply side of the market, concerns and uncertainty continue to cloud the outlook. The vacancy rate is now 3.6% and much of that space is broken up into non-contiguous pieces (under 5MW apiece), which leaves little space for large scale leases. Pricing and rental growth remain in-tact due to high demand and a shortage of newly commissioned capacity. Investor interest remains elevated within the sector, despite capital market headwinds facing other sectors.

Insurance company and bank lenders occasionally seek to invest in data centers today, offering interest rates like those offered for high-quality retail properties. Loan terms and amortization schedules may be shorter for data centers than those offered for other core property types as lenders seek to limit their balloon exposure to data centers subsequent to anchor tenant lease expirations and potentially at a time when technological needs might have changed.

Data center REITs rebounded during the last quarter of the year. Fundamentally, the demand backdrop remains healthy with continued leasing momentum and positive commentary around sales funnels. It is worth noting, however, that select REITs indicated seeing demand softness from smaller enterprise customers. Meanwhile, on the supply front, new construction deliveries and starts in many key markets have been impacted by supply chain delays and power provisioning issues. These market dynamics, along with broader inflationary pressure, appear to be providing an uplift to pricing on both lease renewals and new or expansion leases.

As with many other real estate segments, data center mergers and acquisitions activity has materially cooled down over the last several months with the asset class adjusting to the changes that have occurred in capital markets and undergoing a period of price discovery. Data center REITs currently trade in-line with NAV estimates, which is consistent with other property types on average.

The student housing sector continues to gain traction as pandemic-related restrictions have been removed. Demand for beds is robust and leasing for the 2022- 2023 school year outperformed expectations for both occupancy and rate. The current vacancy rate is in the low single-digits. Robust demand and rent growth could position the sector to outperform traditional apartments over the near-term horizon. The lack of construction financing amid banks limited lending capacity and a higher cost of capital available will also serve to limit additional supply near term and act as a favorable tailwind for space market fundamentals.

Capital markets within student housing largely mirror those of apartments, with strong investor interest in 2022 and modest upward pressure in cap rates. For 2022 volume has totaled $19.4 billion, based on transactions through the end of December, an increase of 60.5% 2021. We anticipate the same headwinds affecting the broader commercial real estate asset class to impact student housing sector as higher rates of inflation and cost of borrowing will present challenges in early 2023.

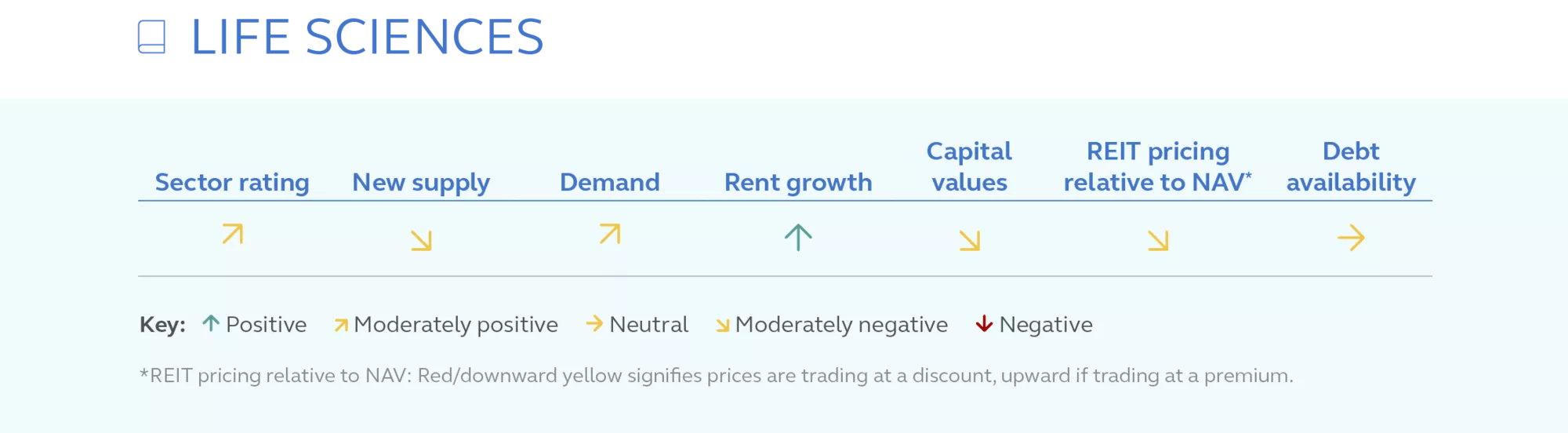

While the life sciences sector remains a favored asset class among investors, both capital market and space market fundamentals deteriorated throughout 2022. Retrenchment in venture capital funding impaired a key source of funds for tenant expansion in the space. Debt capital has also become much more selective within the sector compared with 2021 and early 2022.

Despite the likelihood of a slower new supply pipeline going forward, there is an onslaught of new supply under construction today. Fringe markets with newer life sciences nodes may be most challenged, though even key clusters like Boston (Cambridge) and San Francisco face high levels of new construction underway and decelerating levels of tenant demand. Longer-term, fundamentals are likely to be most resilient in the education-centric key life sciences clusters of Boston (Cambridge), the Bay Area, Raleigh, Baltimore, Washington, D.C., and San Diego.

Lender appetite for life sciences property investments has been tempered somewhat in recent months as lenders increase their focus on tenant creditworthiness and reliance on venture capital financing for the sector. Life sciences properties in major research hubs may still find receptive lenders, but those located in secondary markets are likely to have greater difficulty procuring financing.

Life sciences focused REITs saw a rebound in stock performance during the last quarter of the year and outperformed the broader REIT benchmark. This followed material underperformance earlier in the year. Notably, this coincided with improved market sentiment towards biotech as evidenced by key biotech ETF indices outperforming broader stock market indices. Leasing volume continues to be heathy, albeit slower than prior quarters, and given low vacancy rates in many markets, is supporting healthy rental growth. Meanwhile, new supply under construction or in planning is still a sticking point for the segment but REITs have commented seeing ground up and conversion projects being delayed or put on hold.

On the transaction front, acquisitions and disposition activity has slowed as buyers and sellers of life sciences real estate continue to digest changes that have occurred in capital markets. Valuations of REITs with high life sciences exposure are trading in a range of between roughly 10% to the low single-digit discount to NAV, which is slightly below par with the average NAV valuation across all REIT sectors.

Life sciences properties represent a bright spot in the CMBS office landscape and have risen in prevalence, especially in the SASB market. Investors are currently requiring elevated risk premiums to compensate for anticipated office stress. While downside scenarios are concerning, risk-adjusted returns look attractive in select situations where market credit assumptions seem overly conservative.

For public distribution in the United States. For institutional, professional, qualified, and/or wholesale investor use only in other permitted jurisdictions as defined by local laws and regulations.

Risk considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Potential investors should be aware of the many risks inherent to owning and investing in real estate, including: adverse general and local economic conditions that can depress the value of the real estate, capital market pricing volatility, declining rental and occupancy rates, value fluctuations, lack of liquidity or illiquidity, leverage, development and lease-up risk, tenant credit issues, circumstances that can interfere with cash flows from particular commercial properties such as extended vacancies, increases in property taxes and operating expenses and casualty or condemnation losses to the real estate, and changes in zoning laws and other governmental rules, physical and environmental conditions, local, state or national regulatory requirements, and increasing property expenses, all of which can lead to a decline in the value of the real estate, a decline in the income produced by the real estate, and declines in the value or total loss in value of securities derived from investments in real estate. Direct investments in real estate are highly illiquid and subject to industry or economic cycles resulting in downturns in demand. Accordingly, there can be no assurance that investments in real estate will be able to be sold in a timely manner and/or on favorable terms.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

2760040