After years of lackluster performance, UK stocks now trade near their lowest relative valuations in modern history. However, despite local economic weakness, many of the UK’s leading companies are multinational, and derive the majority of their revenues from offshore sales—presenting an opportunity for active investors to tap into the robust global growth potential of these discounted UK multinationals.

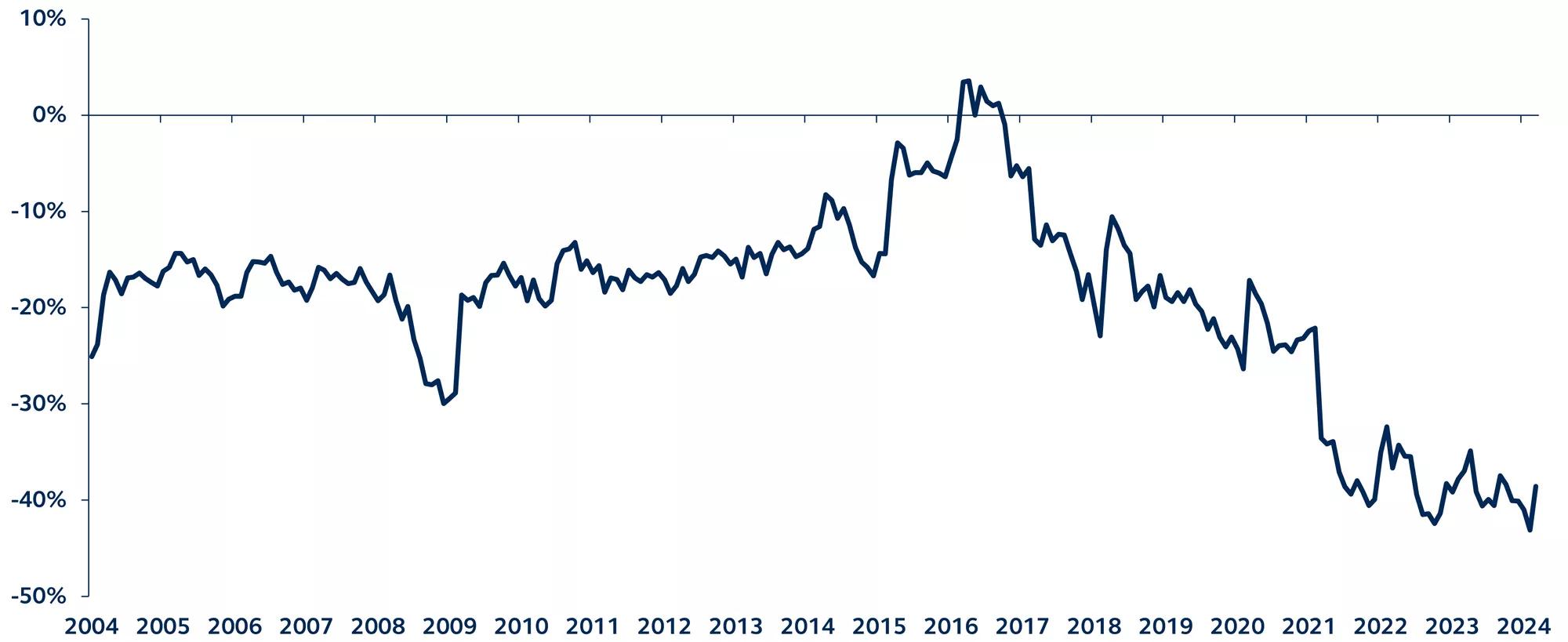

UK price/earnings relative to the world

MSCI United Kingdom Index PE divided by MSCI World Index PE, 2004–present

Over the past 20 years, the weight of U.K. stocks as a share of the global equity market has slid by more than two-thirds, now standing at less than 4%. The 2016 Brexit referendum only worsened the UK's equity position, and since, broad market returns have significantly lagged global peers. With a weakening currency, complex pension framework, and stamp taxes on trading frustrating local and foreign investors and further discouraging equity exposure, the challenged backdrop has even inspired some U.K. companies to relist their shares in the U.S.

However, despite this cautionary macro backdrop, the UK remains home to many of the world's most competitive global multinational companies that conduct significant business outside the UK. In fact, among the largest 100 UK-listed companies, over 70% of their total revenues are derived from foreign sales.

Amidst the indiscriminate outflows, particularly from passive funds, there are multinational leaders in the UK that can offer access to robust global growth opportunities. Importantly, these companies are trading at historic valuation discounts, presenting a potential opportunity for investors. Furthermore, the weakness in exchange rates has enhanced the export pricing competitiveness of many of these companies, adding to their appeal.

For investors, active management could be key to navigating and capitalizing on these unique opportunities. The current landscape offers a chance to unlock value among strong multinational companies, making this a compelling time to consider select U.K. equities within international/global equity portfolios.

Click here to learn more about our global equity investment capabilities.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3569741