Principal Morley is a specialist U.S. stable value manager, focused almost exclusively on managing stable value assets for our institutional client base. Our seasoned investment and service teams collaborate to offer innovative solutions, tailored to meet client investment needs, as well as a distinct client experience, designed to provide preservation of principal with stability and consistency of returns.

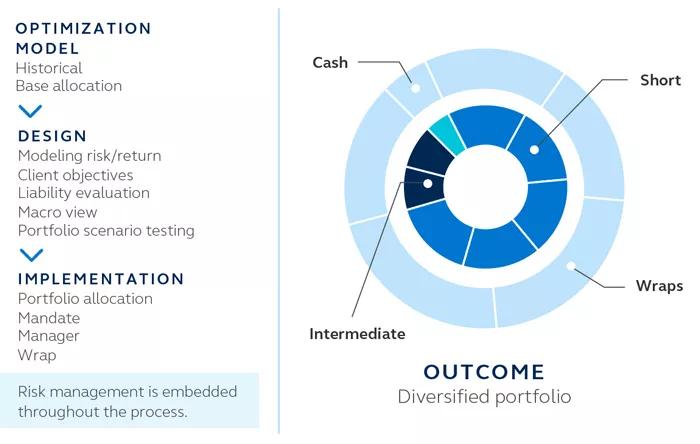

We believe the best way to maximize stable value performance is through a quantitative portfolio construction process that focuses first on client needs, combined with empirically supported risk and return expectations. We combine in-house active management with external sub-advisers to achieve a diversified portfolio seeking to provide complementary sources of excess return.