Markets can be unpredictable — we provide a range of target date portfolio options that seek to withstand diverse market cycles leading up to and through retirement.

As a pioneer in the target date space—bringing one of the first target date offerings to the industry in 2001—our long-term track record of target date investing has helped deliver competitive returns for investors leading up to and through retirement.

Established retirement investment leader

Advanced active asset allocation strategy representing a wide range of asset classes and investment styles in each target date vintage

Participant-informed glide path which leverages the behavioral data from millions of retirement participants

Available vehicles: CIT, Separate Account, U.S. Mutual Fund

ACTIVE

Actively managed expertise

Seeks to drive superior outcomes

Principal LifeTime Funds

Principal LifeTime CITs

Principal LifeTime Separate Accounts

HYBRID

Strategically optimized portfolios

Gain efficiencies

Principal LifeTime Hybrid Funds

Principal LifeTime Hybrid CITs

PASSIVE

Industry leading cost efficiencies

Seeks to grow retirement wealth

Principal LifeTime Strategic Index CITs

0:30 secView video transcript

Active management can help maximize income potential while managing risk in retirement portfolios. Watch this video to discover more ways to combat challenges retirement investors are facing in 2025.

Our informed glide path

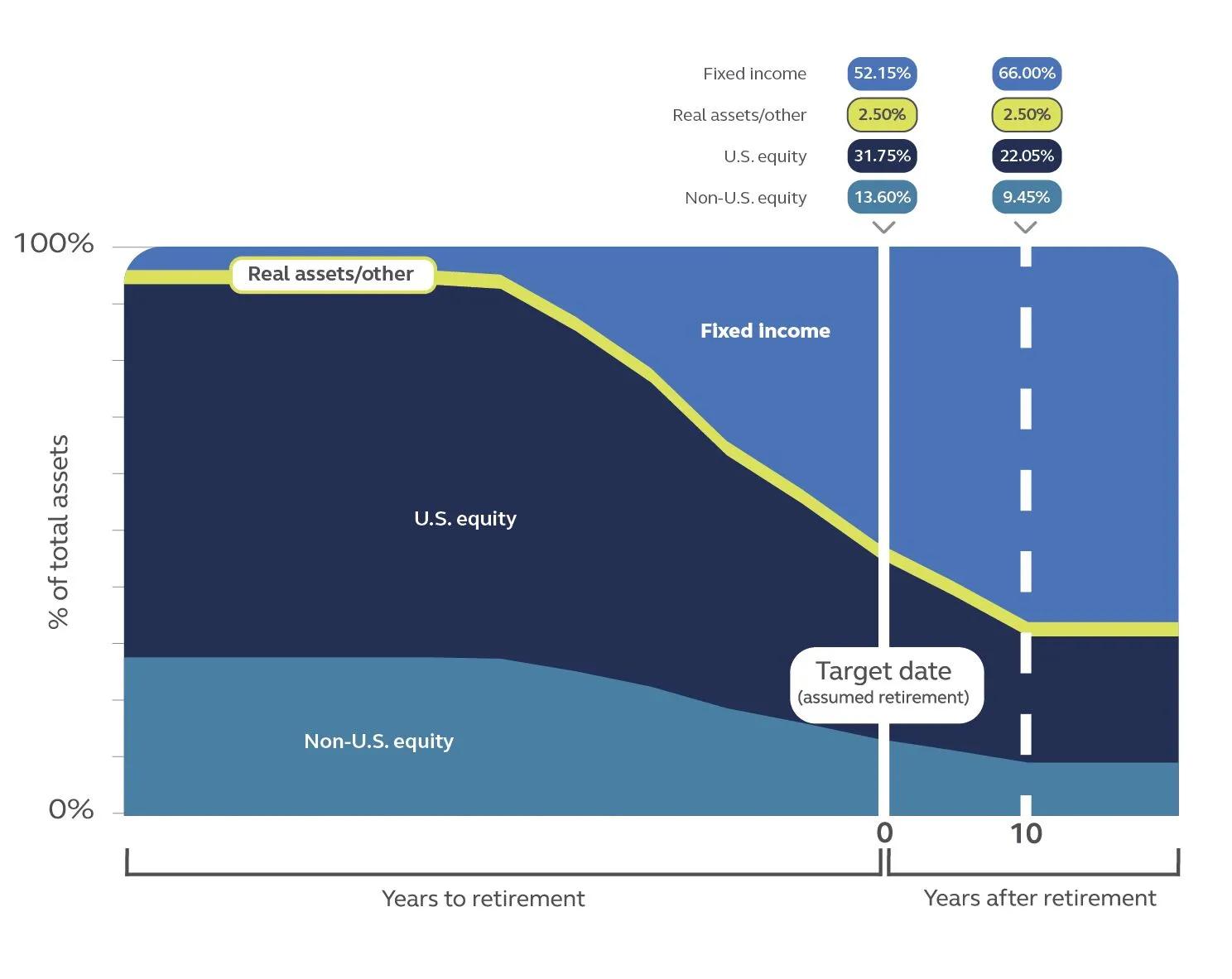

Our glide path is thoughtfully designed to help individuals stay the course with professional investment management expertise. The portfolios asset allocation is adjusted over time to help balance investment and participant risks.

Asset allocation views, grounded in industry insights inform our portfolio construction process. We seek to deliver competitive performance, tailored to your desired outcomes for risk, return, and income potential.

No information

Footnotes

Past performance does not guarantee future results.

The investment manager's investment philosophy and strategy may not perform as intended and could result in a loss or gain. Our glide path balances the probability of exceeding these thresholds with the need for capital appreciation associated with managing longevity, inflation, and savings shortfall risks. We use a risk analytics model to perform stress testing with various "market shock" scenarios to quantify the impact on the average participant experience - specifically at the retirement date, since that is typically when an investor will have the largest account balance at risk. We use this analysis to determine whether or not the market shock would materially erode the savings balance to a lower level than may have been achieved by a more conservative glide path structure.

There is no guarantee that any risk mitigation strategy will successfully protect against a loss in down markets.

Not all investment options are available in all jurisdictions. Certain vehicles have not been registered with the United States Securities and Exchange Commission under the United States Securities Act of 1933 and may not be directly or indirectly offered or sold in the United States or to any United States person.

Target date portfolios are managed toward a particular target date, or the approximate date the investor is expected to start withdrawing money from the portfolio. As each target-date portfolio approaches its target date, the investment mix becomes more conservative by increasing exposure to generally more conservative investments and reducing exposure to typically more aggressive investments. The asset allocation for each Principal target date portfolio is regularly re-adjusted within a time frame that extends 10-years beyond the target date, at which point it reaches its most conservative allocation. Principal target date portfolios assume the value of an investor’s account will be withdrawn gradually during retirement. Neither the principal nor the underlying assets of target date portfolios are guaranteed at any time, including the target date. Investment risk remains at all times. Neither asset allocation nor diversification can ensure a profit or protect against a loss in down markets.

Principal Asset Allocation is an investment team within Principal Global Investors.