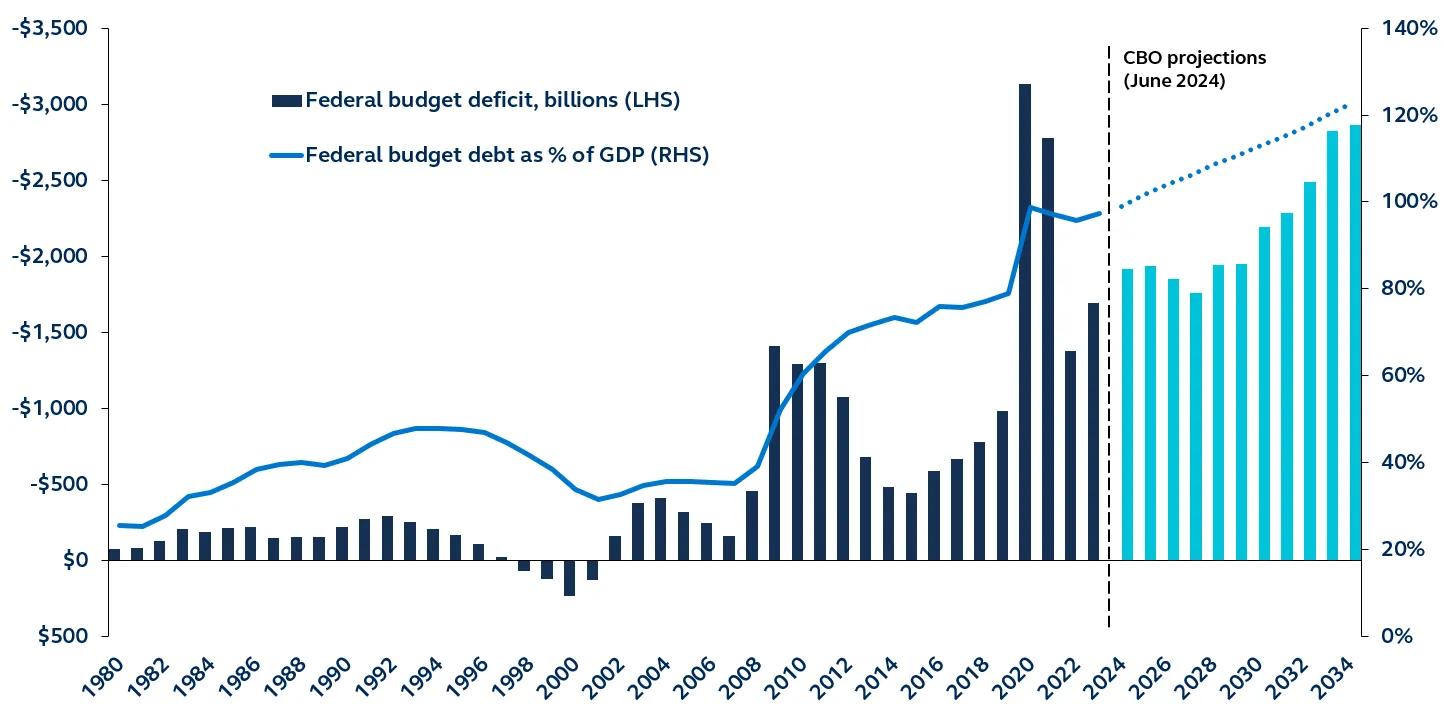

Heading into a contentious U.S. election season, investors need to avoid the noise and remain focused on the factors that will drive markets in the period ahead, including U.S. trade policy (particularly with China), geopolitics (particularly any impact on oil markets), and fiscal deficit management (given the CBO projection that the U.S. budget deficit is set to rise to 122.4% of GDP by 2034).

Government debt and deficit

1980–present, CBO projections through 2034

Amid high inflation and low housing affordability, and despite a strong economic backdrop, the upcoming U.S. election is expected to be one of the most contentious in history. For investors, however, staying invested should be a more straightforward decision despite the political turbulence.

Inflation is trending lower, supporting Federal Reserve rate cuts. This, coupled with a still robust economic outlook and strong corporate earnings, should bolster risk assets and lead to a broadening of returns away from just technology. With ample investment opportunities, the main risk ahead is not election-related at all—it is holding cash rather than remaining invested.

Ultimately, cyclical and secular economic factors tend to influence the market more significantly than politics - election noise shouldn't prompt drastic changes in portfolio allocations.

This does not mean that influential policy doesn't matter. Taxes, trade, and geopolitical policy can all impact specific industries and the global economy. This election season, investors should pay attention to proposals about U.S. trade (particularly with China), geopolitics (particularly impacts on oil markets), and fiscal deficit management (given the CBO projection that the U.S. budget deficit is set to rise to 122.4% of GDP by 2034), which may influence market volatility.

Historically, avoiding market participation during election volatility has not been advantageous. Investors should thus remain focused on long-term fundamentals and stay invested, allowing election-related noise to pass.

Read about the themes impacting markets and portfolios ahead of November’s U.S. elections in, Election 2024: Economics, policy and positioning for a soft landing.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations. In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3749512