The S&P 500 enjoyed a solid start to the year, fueled by the Federal Reserve embracing optimism about inflation without sacrificing growth. During Q2, however, evidence of still sticky inflation has reduced the number of expected rate cuts, weighing on market sentiment and resulting in more modest equity gains.

As investors look toward the second half of 2024 and into 2025, the resilience of the U.S. economy – and, therefore, corporate earnings – should be more evident, laying the groundwork for further positive gains. The Magnificent 7 technology stocks have been a major driver of equity market returns over the past 18 months. Still, the combination of continued economic expansion, solid earnings growth, and eventual rate cuts should see strong performance broadening to other more cyclical sectors and markets whose valuations are as lofty.

Fixed income is also providing compelling opportunities. The combination of solid economic growth and a Federal Reserve that is clearly signaling that its next policy move will be downwards is solidifying a constructive backdrop for credit. Spreads are at historically tight levels but should remain fairly tight in a soft-landing scenario. More pertinently, bonds offer meaningful carry opportunities. However, if the soft-landing scenario is too optimistic and recession materializes, bonds can provide stability and a hedge against the downside risks.

With the potential for gains across asset classes and despite meaningful differences in both presidential nominees' approaches to trade, geopolitics, and fiscal policy, the main risk for investors ahead of the 2024 election would be to cash out.

Long term structural policy decisions and market implications

Of course, this does not mean that good policy doesn't matter. Policies on factors such as taxes, trade, and geopolitics can have important impacts on specific industries, then affecting the broader U.S. and global economy.

Despite President Biden's decision not to seek re-election, the Democratic nominee, presumptively Vice President Kamala Harris, is likely to have a similar agenda to the one Biden had been campaigning on; therefore, for the purposes of this piece, we will compare the party's policy stances.

Trade

The U.S.’s trade relationships, particularly with China, are a clear bipartisan focus for the upcoming election. Unsurprisingly, given the significant trade actions introduced by the Trump administration in 2016, including tariffs on more than $300 billion of China imports, markets are expecting a more severe trade focus under a Trump presidency than a Democrat presidency.

Trump has proposed a 60% tariff on all Chinese imports, noting that the goal is “to bring business back to the U.S.” In such a scenario, the impact to China would likely be significant – Bloomberg Economics estimates it would slash the share of U.S. imports that come from China from a peak of 22% before the trade war started to near zero and could halve China’s GDP growth rate. In addition, Trump has also proposed a 10% across-the-board tariff on all imports.

The Democrats are also proposing additional trade restrictions, albeit less severe. During his present term, President Biden targeted several segments of China’s technology capabilities, including export curbs on semiconductors and chipmaking equipment, as well as an executive order restricting U.S. investment into China for AI, semiconductors, and quantum computing. He also announced that he will raise tariffs in several key strategic areas, most notably Chinese electric vehicles, as well as other areas, including steel, batteries, solar, and critical minerals. While this policy is fairly headline-grabbling, the 100% tariffs on Chinese EVs would likely only have a minimal economic impact given China’s small market share in the U.S. for the targeted products.

While more restrictive trade policy is evidently a bipartisan policy, Trump’s more stringent proposals suggest a varying market impact based on a Democrat victory versus a Trump victory in November.

In a Democrat victory:

- Multinational companies, including the all-important Magnificent 7, which generate a meaningful portion of their revenues abroad, stand to benefit more than domestic companies.

- Relatively, China would fare better under a Democrat administration than a Trump administration.

- Given the close trade relationship between China and Europe, there would be positive knock-on effects on the European economy, as well.

- On the one hand, Mexico would likely benefit as the U.S./Mexico trade impact would not be targeted under a left-leaning administration. On the other hand, Mexico has been a key beneficiary of the reshoring trend since COVID-19 as companies have looked to relocate away from China and closer to the U.S., and there would be less need for a continuation of that trend.

By contrast, in a Trump victory:

- Domestic companies would gain, while U.S. companies with greater foreign revenue exposure, particularly those that manufacture in China, are arguably more vulnerable under a Trump administration.

- Companies less dependent on foreign supply chains would be relative beneficiaries, suggesting that U.S. small caps could receive a strong boost.

- China would fare poorly, and investor sentiment towards China and Europe would likely deteriorate. This would likely have a favorable impact on India, which is considered an alternative to China. Other segments of Southeast Asia and Mexico would pick up the largest share of the slack, as trade flows shift away from China.

- The dollar would likely strengthen, although a Trump administration may indicate a preference for a weaker dollar, subduing its potential strength.

Geopolitics

Aside from trade policy concerns, the U.S. election is raising serious concerns about potential geopolitical tensions, particularly with European allies, NATO, and the Middle East/Israel. The substantial increase in U.S. military spending in recent years, coupled with the mounting fiscal deficit, has led some in Congress to question its support for Ukraine and the U.S.’ contribution to NATO. The potential impact of the U.S. election on these regions cannot be overstated.

A second term for Donald Trump would likely be less supportive of providing further funding for the war in Ukraine than a Democrat administration, with negative repercussions for Europe. The threat of fighting without the military and financial strength of the U.S. would force Europe to boost its own defense capabilities, involving increased fiscal funding that it can ill afford. Furthermore, it would likely strengthen Russia’s hand and destabilize the broader region.

The Middle East conflict is also firmly in the spotlight as a key issue during the upcoming U.S. election. Although the election outcome is unlikely to impact bipartisan support for funding aid to Israel, a Trump administration may increase restrictions on Iran, increasing the risk of oil supply disruptions.

Fiscal policy

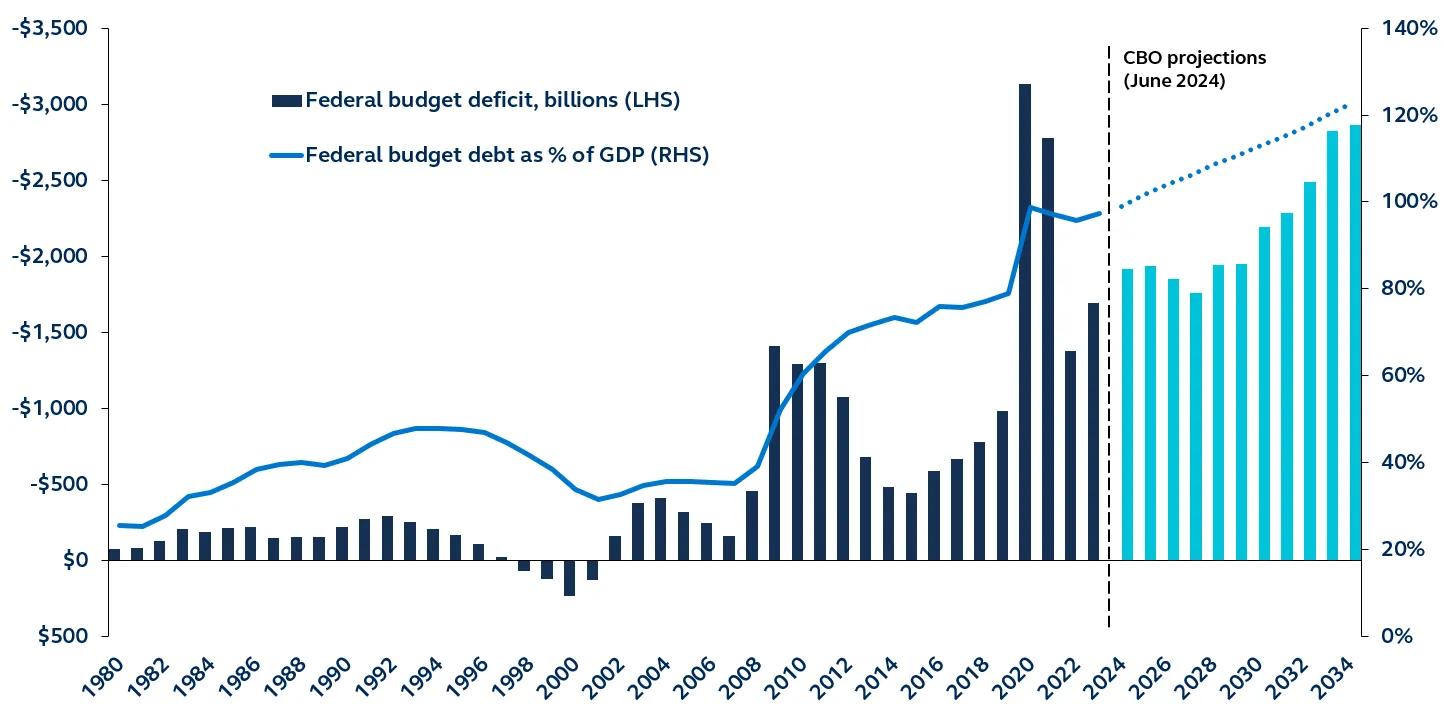

A key theme for this year’s presidential election is federal finances. At 6.3% of GDP, the budget deficit is already sizeable. With interest rates set to stay higher for longer, net interest payments will likely remain elevated, the fiscal picture is set to continue deteriorating. According to the Congressional Budget Office, public debt is projected to increase from 99% to 122% of GDP in the next 10 years. Last year, the market’s fiscal fears spilled over, driving up bond yields, creating significant volatility in risk markets, and assuring the spotlight on this topic at this year’s election.

Government debt and deficit

1980-present, CBO projections through 2034

Source: CBO, Principal Asset Management. Data as of June 30, 2024.

A key point of debate will be the major tax cuts enacted during Trump’s first term, portions of which will be up for renewal next year. Whether they are extended or expire will depend greatly on who controls the White House and Congress after the 2024 election. A unified Republican government would likely strive to extend the main provisions largely impacting individual taxpayers and may even consider further corporate tax cuts. A Democrat president would likely support a modified extension of the individual tax provisions while raising taxes on corporations and high-income households to offset new discretionary spending.

Neither the Democrats nor Trump have proposed substantial new fiscal measures. After all, both sides are constrained by the increased focus on fiscal sustainability and a macro environment that isn’t nearly as conducive to new spending. Indeed, in 2016, the structural deficit was much smaller, providing space for a significant tax cut. In 2020, although the deficit was significant, low interest rates permitted fiscal easing. Now, however, interest rates are much higher, and the deficit has only continued to grow. As such, while some fiscal expansion cannot be discounted, any measures proposed are likely to be smaller and less market-friendly.

Implications for investors

The November U.S. election is shaping up to be another polarizing, volatile and partisan ballot. With households struggling with elevated inflation and low housing affordability, the environment may be tense despite the still-strong economic backdrop. However, while difficult decisions are being made at the polls, for investors, the decision on how to position their portfolios ahead of the election should be much more straightforward.

Although prices are elevated, inflation itself appears to be trending lower which should open the door to Fed rate cuts in the near-term. Policy easing, alongside the solid economic backdrop and robust earnings outlook, are important supports for the market. Technology remains the major driver of market returns, but a broadening of the strong market performance to date should be anticipated if the Fed can successfully pilot a soft landing. In this environment, with such a broad spectrum of market opportunities, the main risk to investors ahead of the election is sticking to cash.

Ultimately, while election-related noise may feel concerning, we do not believe that any potential election outcomes should be a reason to go against fundamental market drivers and significantly change portfolio allocations.

Looking beyond the election, some structural issues could impact markets and are worth investors’ attention. Most notable are U.S. trade policies, geopolitics, and how the government will navigate the massive fiscal deficit. While the rest of the world looks more vulnerable to the U.S. election than the U.S. itself, growing concerns around the fiscal picture suggest some upside to Treasury volatility in the long term.

It's important to remember that staying on the sidelines during election-related volatility has rarely proven to be a winning strategy. Instead, investors should keep their focus on the fundamentals, which are the key long-term drivers of market performance. This upcoming U.S. election, while significant, should not distract from the bigger picture. Stay invested and let the noise of the election pass.