Recent banking sector volatility, coupled with a February CPI report that shows inflation is still running hot, means the Federal Reserve now has a stability dilemma: Cut rates to alleviate market angst and risk spurring inflation higher. Or, alternatively, persist with aggressive rate hikes to avoid reinvigorating inflation, but risk accelerating contagion to the broader financial system. Their decision to favor either price stability or financial stability will be instructive for the crisis outlook moving forward.

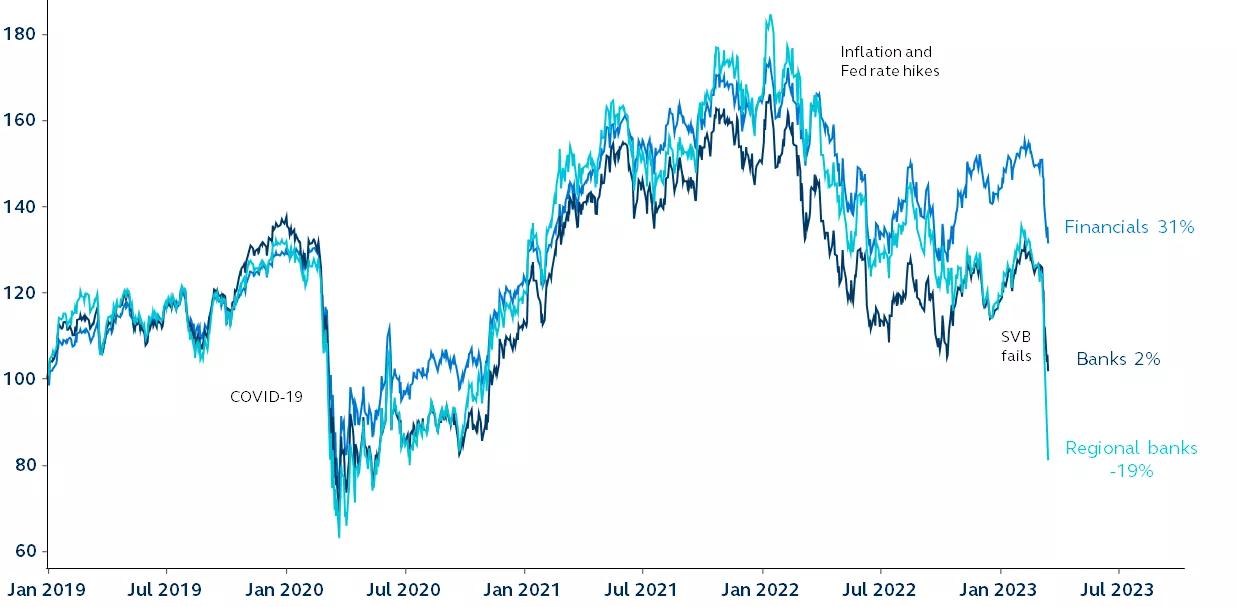

Financials sector performance

S&P 500 financials sector, banks industry group, and regional banks sub-industry, price returns, indexed to 100 at January 2019

Source: Clearnomics, Standard & Poor’s, Principal Asset Management. Data as of March 15, 2023.

Just over a week ago, a materially more hawkish narrative from Federal Reserve (Fed) Chair Jerome Powell at his Congressional Testimony had convinced financial markets that the Fed could revert to a 50 basis point hike in March. However, a wild week of volatility marked by the collapse of three U.S. banks suggests the policy arithmetic for the Federal Reserve has likely changed.

February’s CPI report confirms that the inflation problem is still very present, and, on its own, would likely have cemented a 50 basis point hike at next week’s FOMC meeting. However, with the recent bank failures sending the financial sector into disarray, and unless the Fed’s new Bank Term Funding Program (a lending facility which will provide additional funding to banks that run into liquidity problems) can successfully sooth market angst, the Fed will likely need to put extra focus on the financial stability side of its mandate. As a result, a 25 basis point hike is the most likely outcome from the FOMC meeting next week. If market turmoil deepens over coming days, even a pause is possible.

Ultimately, financial conditions will tighten further—either via additional central bank tightening as they try to tame inflation or via a deterioration in the current banking crisis. High-quality, defensive assets should be sought out, while diversification will be increasingly important in the volatile period ahead.

For more on the factors causing pressure in the market, read Further concerns, or crisis contagion? Additionally, check out our Global Insights homepage for our latest perspectives on markets, economies & investing.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2799491