When rates decline, investors face unique challenges trying to generate income and grow their assets. Settling for lower yields or paying a premium to get higher yields are two tradeoffs. Yet investors have another choice—expanding their opportunity set. Preferred and capital securities can offer higher yields than traditional fixed income asset classes.

Window of opportunity for income and total return potential

Federal Reserve rate cuts signal the beginning of a new easing cycle and the beginning of increasing prices for preferred and capital securities. As markets begin to shift, investors have a window of opportunity to purchase discounted preferred and capital securities. Focusing on discounted securities with adjustable rates and higher back-end spreads may lead to two attractive outcomes: income or total return.

CASE STUDY

Discounted preferred and capital securities may offer two attractive outcomes.

POTENTIAL OUTCOME

Higher income

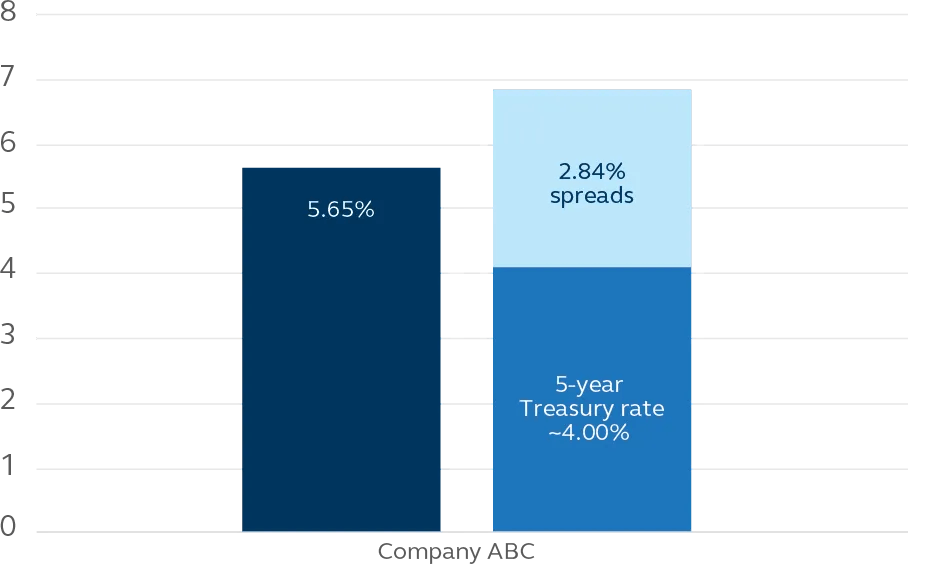

If a preferred or capital security with a 5.65% coupon resets at the 5-year Treasury yield (roughly 4%) plus 2.84% spread, the new coupon would be roughly 6.84%.

Coupon %

- Coupon before reset

- Coupon if reset

POTENTIAL OUTCOME

Total return

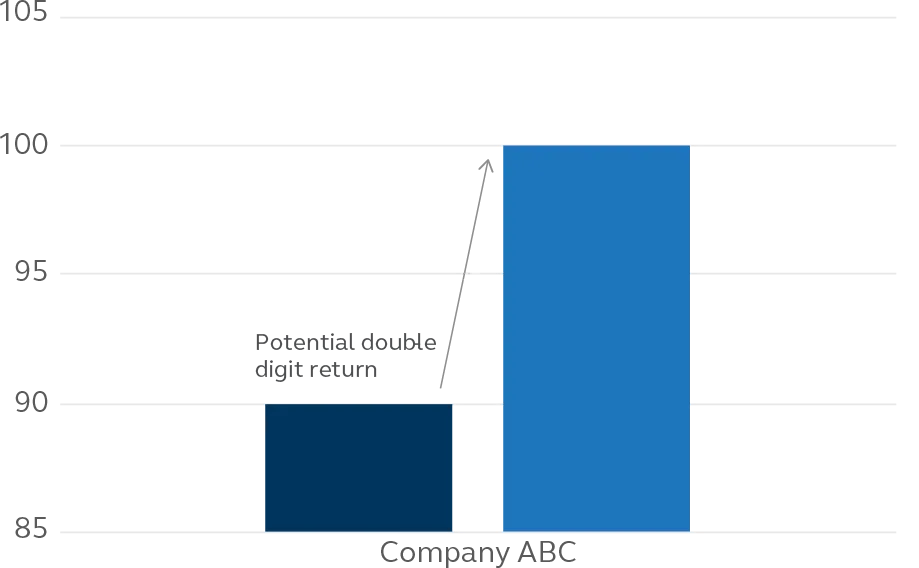

If the same preferred or capital security traded at $90 was called to par ($100), the investor would receive $10 more for the security than it was currently worth.

Total return

- Trading at a discount

- When called to par

Invest with an experienced, active manager

Invest with Spectrum Asset Management, an investment team of Principal Asset Management that specializes in preferred and capital securities.

- A leader in managing global preferred and capital securities for institutional and wealth investors around the world

- 30 years of experience guiding client portfolios through a variety of credit, interest rate, regulatory, and market conditions

- History of investing with a high-quality bias to mitigate risk

3 ways to invest

Footnotes

Contingent Capital Securities carry greater risk compared to other securities in times of credit stress. An issuer or regulator’s decision to write down, write off or convert a CoCo may result in complete loss on an investment.

Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise.

Risks of preferred securities differ from risks inherent in other investments. In particular, in a bankruptcy preferred securities are senior to common stock but subordinate to other corporate debt.

Spectrum Asset Management, Inc. is an affiliate of Principal Global Investors. Spectrum is a leading manager of institutional and retail preferred securities portfolios and manages portfolios for an international universe of corporate, insurance, and endowment clients.

Principal Asset Management℠ is a trade name of Principal Global Investors, LLC.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

MM14144-01 | 10/2024 | 3950450-102026