A strong macro environment in 2026, supported by easier monetary conditions and robust fiscal stimulus across major economies, is likely to favor cross-regional performance. AI, which has fueled U.S. large-cap tech gains, faces greater scrutiny as investors shift focus from aggressive AI-related spending to profitability. While U.S. tech allocation remains important, it may be prudent for investors to diversify into regions offering direct or indirect AI exposure at more attractive valuations and benefiting from supportive policy tailwinds.

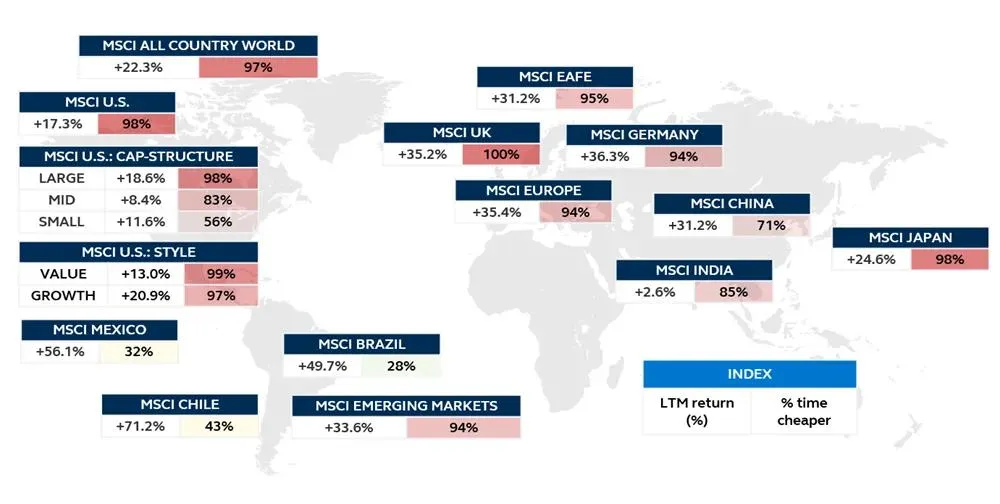

Global equity returns and valuations

Last twelve months returns and % of the time the Index has been cheaper relative to its history since 2003.

Source: FactSet, Bloomberg, MSCI, Principal Asset Allocation. LTM (last twelve months) returns are total return and in USD terms. % Time Cheaper is relative to PAA Equity Composite Valuation history. PAA Equity Composite Valuation is a calculated measure, comprised of 60% price-to-earnings, 20% price-to-book and 20% to dividend yield. Composite started in 2003. EAFE is Europe, Australasia, Far East. See disclosures for index descriptions. Data as of December 31, 2025.

Last year saw strong gains in many regions, underscoring the importance of diversification, especially against policy uncertainty. The global macro backdrop for 2026 looks favorable for risk assets, with easing monetary conditions and robust fiscal stimulus across major regions, presenting broad opportunities across geographies.

AI, a dominant theme, reinforces the importance of maintaining U.S. exposure given its tech leadership. Still, concerns over aggressive AI-driven spending and high valuations heighten pressure for companies to deliver on earnings. Given U.S. equity market concentration, investors should seek diversification.

Although non-U.S. equities have become more expensive—some reaching historically high valuations—opportunities remain, particularly in regions with supportive domestic policies.

Europe: Easier financial conditions and fiscal spending expansion, key growth drivers in 2025, are expected to persist into 2026, supporting cyclical sectors such as financials and industrials, which together represent nearly half of the Stoxx 600.

Asia: Regions such as South Korea, China, and Taiwan offer tech exposure at valuations lower than the U.S. Domestic factors also remain key performance drivers. For example, China’s export strength and policymakers’ “anti-involution” campaign may provide positive momentum despite challenges. Japan, a high-savings economy, is expected to see consumption growth through its fiscal stimulus package.

In an AI-driven landscape grappling with stretched valuations and return on equity concerns, staying anchored in fundamentals and maintaining well-diversified portfolios is essential for balancing opportunity and risk.

Explore the forces driving global markets in our 1Q 2026 Global Market Perspectives, with insights on the themes and implications for the period ahead.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. Commercial real estate (CRE) investments carry several inherent risks, including those related to the economy, interest rates, and tenant behavior. These risks can impact property values, rental income, and overall investment returns.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

5111279