Principal Alternative Credit is a market leader in private credit with a heritage of serving clients for over 50 years.1 We focus on relationship lending by providing flexible financing solutions to both sponsor- backed and non-sponsored middle market companies throughout North America as well as global investment grade private debt issuers.

Get to know our investment team.

-

Strong industry track record

Over 150 years of credit investing experience among senior investment team. -

Diverse origination capabilities

Dedicated coverage of more than 300 private equity firms and 40 agent bank relationships, plus non-sponsored loan origination direct with borrowers and co-lenders, through advisors and the global Principal client network. -

Stable capital base

Stable and committed capital base from Principal’s balance sheet, as well as dedicated outside capital, offering a multiplier effect to capital commitment levels. -

Flexible offering

Ability to invest up and down the capital structure and credit spectrum with a variety of financing offerings and structures. -

Expansive capabilities

Robust originations, underwriting, and portfolio staff comprised of seasoned credit investors with experience across industry verticals and debt securities.

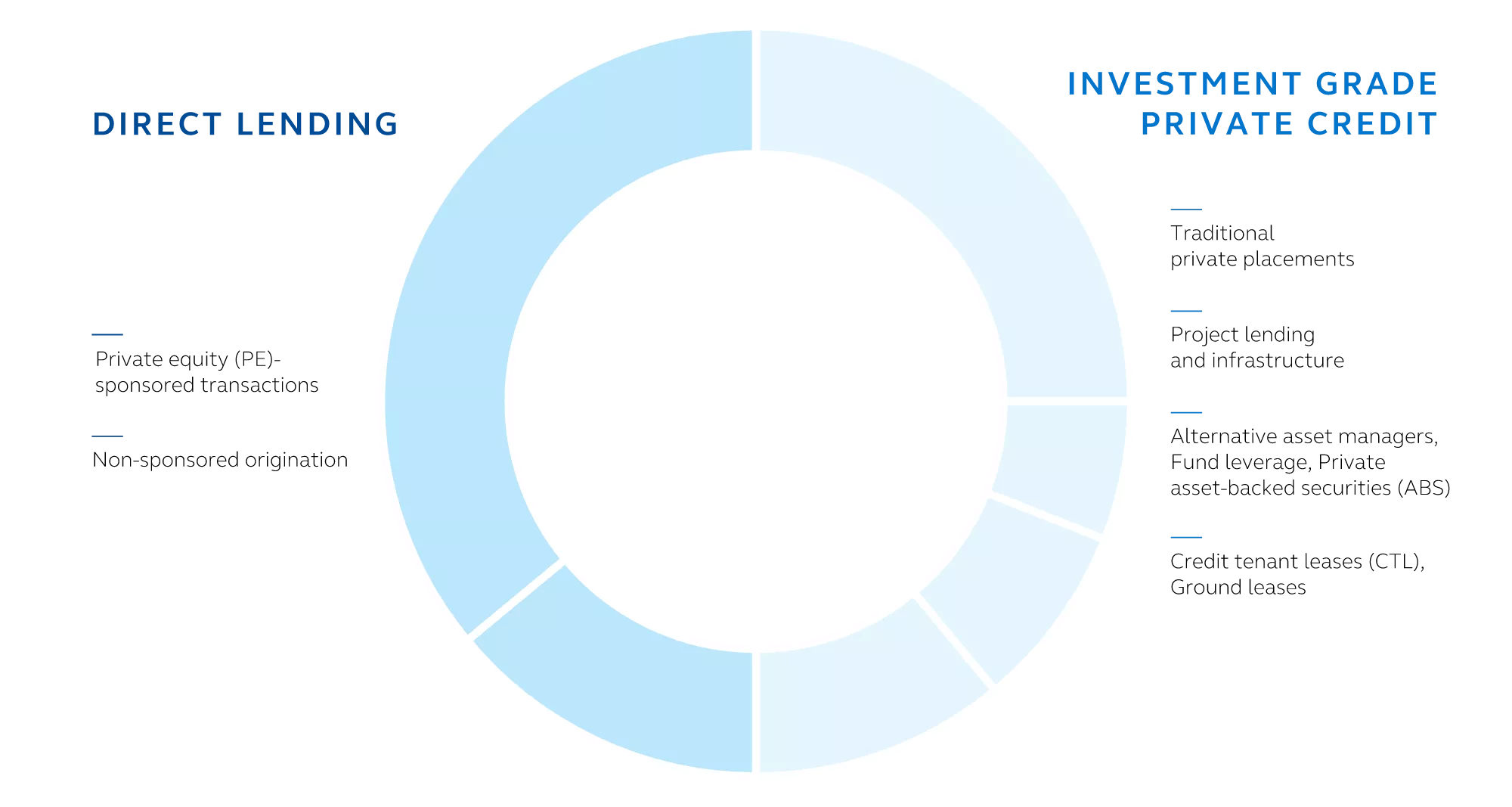

Our investment capabilities

Delivering value through forward-thinking private credit experience and focus.

Get the latest insights.

1Experience includes investment management activities of predecessor firms beginning with the investment department of Principal Life Insurance Company.

Past performance does not guarantee future results.

Private credit involves an investment in non-publicaly traded securities which are subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss.

Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise.

Principal Alternative Credit is an investment team within Principal Global Investors.