Principal Fixed Income has experience that spans all major fixed income sectors and partners with clients to establish standard and custom solutions to achieve personalized objectives. Our globally integrated platform, with specialized teams worldwide and over 100 investment professionals, helps to directly access global fixed income markets and deliver comprehensive investment perspectives.

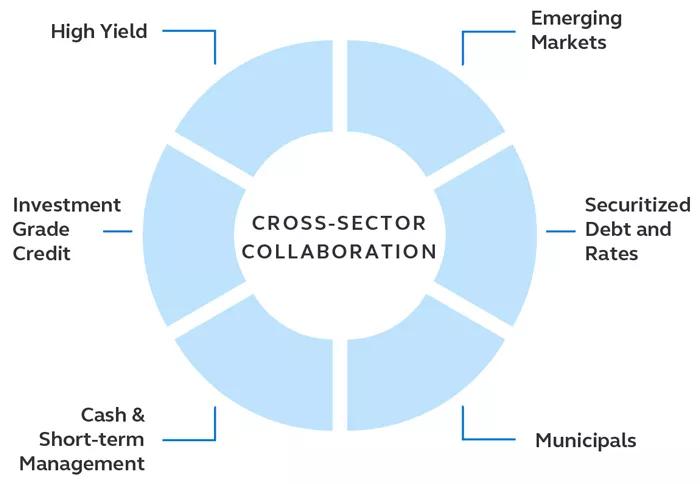

Our platform’s structure and proprietary investment tools foster cross-sector collaboration amongst sector-specialty teams. This diversity of insight helps each team formulate richer investment theses and make better-informed investment decisions.