Soaring natural gas prices in Europe have delivered a significant blow to the region’s economy, but potential gas shortages in the winter months threaten a very severe recession. With such a grave threat hanging over the region, the investing landscape in Europe looks much less favorable than that of the U.S.

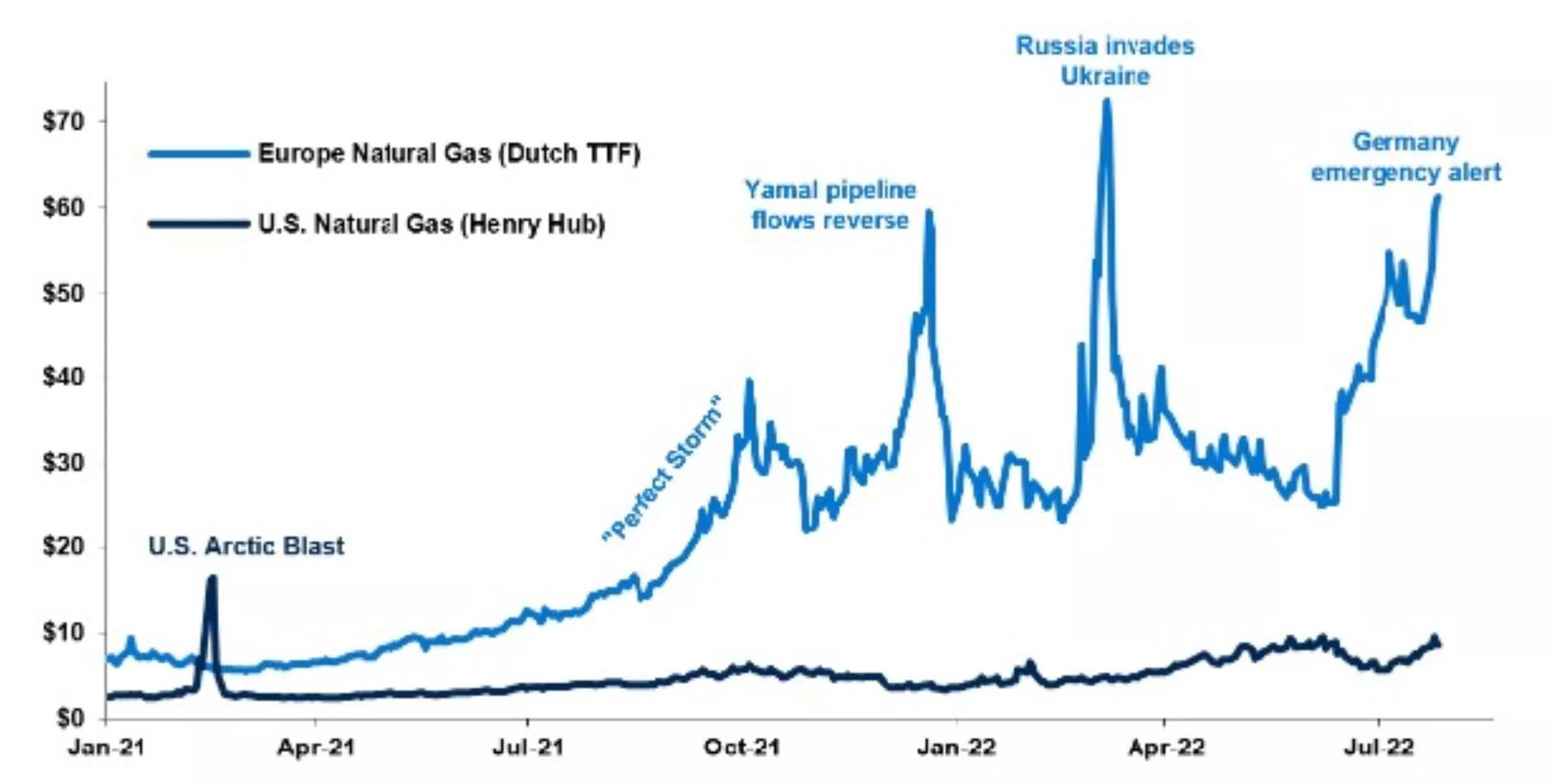

Europe and U.S. natural gas prices

US$ / MMBtu, 2021 – present

NYMEX, Scoville Risk Partners, Bloomberg, Principal Global Investors. Data as of July 28, 2022.

The energy crisis in Europe is escalating. With natural gas flows from Russia to Germany through the Nord Stream 1 pipeline having fallen to just 20% of capacity, the threat of a gas supply shortage has become meaningfully more acute in recent weeks.

The increase in European gas prices has been particularly sharp. Since January 2021, natural gas prices have risen almost 760%, significantly more than the 240% increase seen in the U.S. The surge is deeply impacting Europe’s economy, pushing inflation to record highs, driving up household bills, and straining Europe’s industrial sector.

Price increases are not Europe’s only problem. Germany, which imports 55% of its gas from Russia (compared to the 40% EU average), also faces a potential gas supply shortage.

- The European Commission estimates that, if supplies are sustained at 40% of capacity, Germany could narrowly scrape through the winter without shortages.

- At 20% of capacity, Germany would face shortages, therefore needing some notable rationing, with clear negative growth implications.

- If Russian gas flows stop entirely, the Bundesbank estimates that the necessary rationing of gas would lead German GDP to slump 5%.

As with any geopolitical risk, the situation elevates uncertainty for investors. However, with such a grave winter threat hanging over the region, the European investment proposition looks considerably less enticing than that of the U.S.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal® , Principal Financial Group® , and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®

2319105