As the U.S. Presidential election draws nearer, many investors are eyeing the future of the soon-to-expire 2017 Tax Cuts and Jobs Act— a significant individual tax code overhaul that reduced taxes across income levels—and more specifically, it’s potential impacts to the municipal bond market. Although each possible election outcome will likely result in different tax scenarios, municipal bonds are set to maintain their tax-equivalent-yield advantage no matter the outcome.

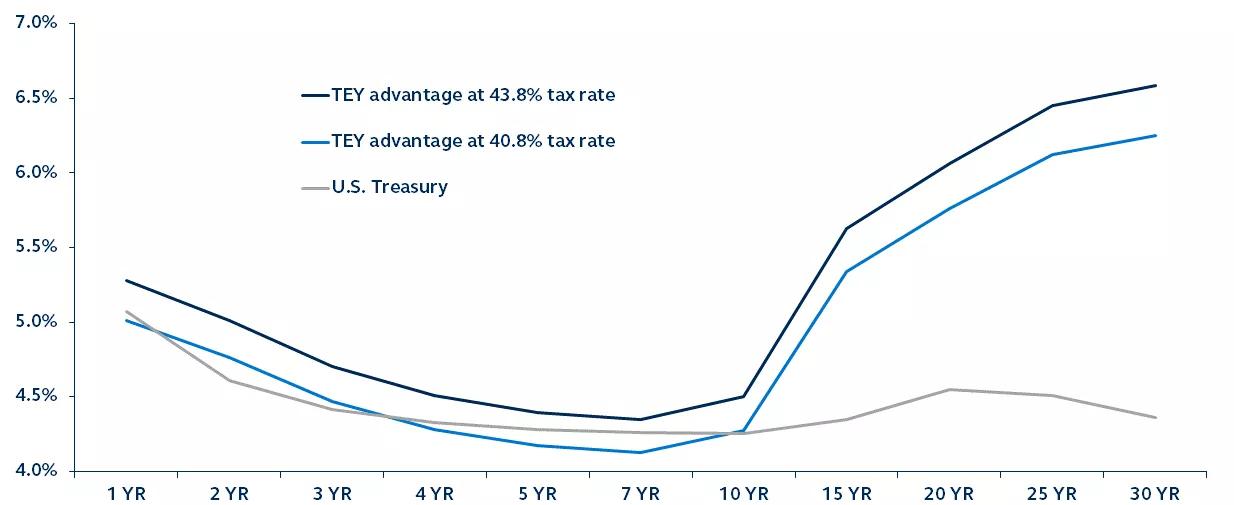

Taxable equivalent yield (TEY) advantage of municipals at different tax rates

TEY by maturity

Source: Bloomberg, Principal Fixed Income. Data as of February 29, 2024.

The upcoming Presidential election is increasingly capturing the market’s attention. One of the most significant policy issues is the future of the 2017 Tax Cuts and Jobs Act (TCJA), an individual tax code overhaul that reduced taxes across income levels, set to phase out in 2025. Its sunset presents crucial fiscal decisions for the next administration, and each election outcome is likely to have implications on municipal bond markets:

- Divided Government: The TCJA likely expires, raising tax rates for all—notably, top earners with a hike to 40%. This would boost demand for tax-exempt municipals as exemptions become more valuable. The corporate tax rate would likely rise as well, increasing demand from taxable buyers (e.g., insurance companies).

- Democratic Sweep: Municipal demand would grow with expected increases in individual and corporate tax rates, aligning with President Biden's proposals for higher taxes on wealthy individuals and corporations.

- Republican Sweep: The status quo likely persists, with the TCJA's cuts extended, maintaining the top rate at 37% with minimal impact on tax-exempt municipal demand. On the taxable side, demand would remain low. Even at 37%, the TEY advantage that municipals offer is significant.

Regardless of the election outcome, the ever-increasing federal deficit underscores the importance of revenue, with individual income taxes remaining a primary source for the U.S. This is unlikely to change, and individual tax rates are unlikely to move lower. In fact, the opposite is more likely, further enhancing the value of the tax-exemption and leading to greater investor demand for the municipal asset class.

For additional insight into the key themes and investment implications across global fixed income markets, read our second quarter 2024 Fixed Income Perspectives.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. The market for municipal bonds may be less liquid than for other bonds. Income from municipal bonds may be subject to state and/or local taxes, and it may be subject to federal alternative minimum tax (AMT) for certain investors.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax or accounting advice. Consult your own tax, and accounting advisors before engaging in any transaction.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Fixed Income is an investment team within Principal Global Investors.

3507594