The U.S. multifamily housing sector faces challenges from both overdevelopment and capital market pressures, with ongoing issues anticipated through 2025. However, solid macroeconomic fundamentals and sustained demand, particularly from younger generations favoring rentals, offer potential opportunities in the medium-term for well-capitalized investors to exploit distress in the market.

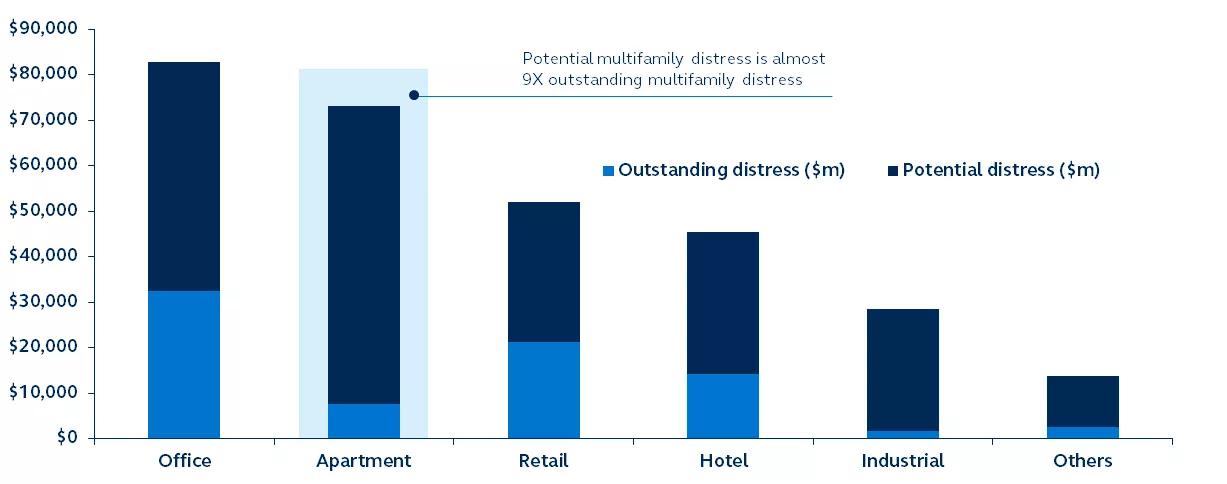

Total outstanding and potential real estate distress per sector

Distressed assets, $ billions

The multifamily housing real estate sector currently faces a slew of challenges stemming from high levels of development, lower transaction volume, declining values, and a wall of upcoming maturities that have created the potential for pockets of distress. However, it’s this distress, alongside stable demand, that is creating a unique entry point to the sector for well-positioned investors.

Notably, while the sector accounts for less than 10% of the total commercial real estate distress, potential distress looms large, representing nearly a third of the market. Additionally, distress is likely to persist in 2024 and 2025 as rents continue to trend lower, vacancy rises, and $470 billion in multifamily loans mature during a period when less well-capitalized operators are facing difficulty refinancing on favorable terms.

However, despite rental market fluctuations and challenges in loan refinancing, the sector is buoyed by strong demand. In particular, younger generations are extending their rental periods, influenced by the unfavorable economics in the for-purchase market, mobility needs, and lifestyle choices that prioritize experiences over homeownership.

For investors, despite its near-term challenges, the strong fundamentals underpinning the multifamily sector’s demand profile suggest a promising recovery in the medium term. Investors with substantial capital are well-positioned to leverage these conditions, with the market anticipated to bounce back within three to five years, offering a strategic window for investment in the coming 12 to 18 months.

For a deeper dive into the multifamily sector and its implications for investors and portfolios in the period ahead, read Opportunities in the U.S. multifamily housing sector.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

3476971