Rising interest rates have posed challenges for REIT stock prices over the last two years, leading to historically large discounts relative to broader equity markets. However, yields peaking has historically been a catalyst for strong REIT market outperformance, and when combined with attractive valuations, the stage looks set for a bounce-back year for REITs.

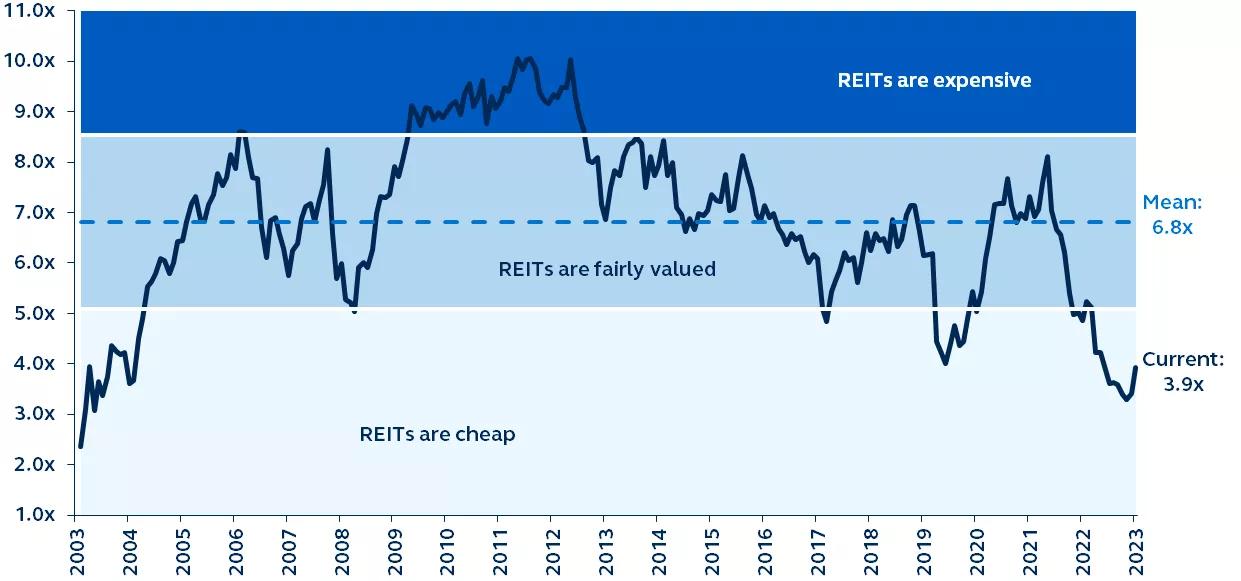

Relative valuation: REITs versus equities

EV/EBITDA spreads, U.S. REITs minus equities, 2003–2023

Source: Factset, Principal Real Estate. Data as of December 31, 2023.

The past two years have been tough for public REIT stock prices, both on an absolute basis and relative to other equities, as rising interest rates created headwinds for real estate. However, with interest rates having peaked, prospects for future outperformance in the REIT market appear more favorable.

REITs are trading at historically significant discounts relative to broader equity markets, thanks mainly to the interest rate sensitivity of the REIT market. While rising yields are a headwind for real estate values, the peaking of long-term real yields has historically been a significant catalyst for REIT market total returns and their relative performance to broader equity indices. As yields declined in late 2023, REITs did indeed rally but are still presenting investors with pronounced valuation discounts.

REIT relative valuations also reflect investor concerns about real estate's challenges—rising financing costs, lower capital availability, outsized debt maturities, and office market struggles. However, these concerns are largely misplaced as balance sheet leverage is, on average, below 30%, REIT debt maturities are quite manageable, multiple capital sources, such as equity or unsecured debt, are open, and exposure to U.S. traditional office is below 4%.

The combination of peaking yields and attractive relative valuations could deliver a bounce-back year for REITs in 2024, and the durable, long-duration nature of REIT cash flows should provide defensiveness as economic growth slows.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3353589