There is potential distress in the U.S. multifamily housing sector today. Overdevelopment, lower transaction volume, and declining values have characterized the market over the last year. Through 2025, those stressors will persist, including excess supply still in the pipeline, exacerbated by a wave of maturing multifamily loans.

Despite the potential distress pressuring existing multifamily owners, the underlying macroeconomic fundamentals are strong and demand for multifamily housing is steady, driven in large part by the fact that younger generations are renting longer.

As a result, we believe there is a window of opportunity over the next 12-18 months for well-capitalized investors to take advantage of select distress opportunities and to exit when capital values have recovered in three to five years, optimizing returns. Investors with dry powder at the ready will be in a prime position to enter this narrow window of opportunity.

Key takeaways

- 2023 was a challenging year for the multifamily housing market, characterized by high levels of development, lower transaction volume, and declining values that have created the potential for pockets of distress.

- Distress will persist in 2024 and 2025 as rents remain flat, vacancy rises, and $500 billion in multifamily loans mature.

- Despite the areas of distress in the multifamily sector, the underlying macroeconomic fundamentals remain healthy and demand for multifamily housing is steady.

- Healthy fundamentals and steady demand, paired with the current distress among existing owners of multifamily assets, creates a window of opportunity for new investors.

2023: The most challenging year since the Global Financial Crisis

How are the opportunities and challenges of investing in private debt being viewed by insurance investment teams, in your opinion?

Overdevelopment

Prior to the pandemic, overdevelopment in the multifamily sector was a cause for concern among investors. When the pandemic hit, new development projects and those already underway were delayed due to work restrictions, supply chain constraints, and labor shortages. But by 2021, pent-up demand and capital appreciation caused a new surge in development, exacerbating existing supply concerns. Seeing the opportunity to develop multifamily housing units and capitalize on the historically low cost of capital and increasing rental rates, some owners went as deep into the debt stack as possible, most often utilizing floating rate debt.

Lower transaction volume

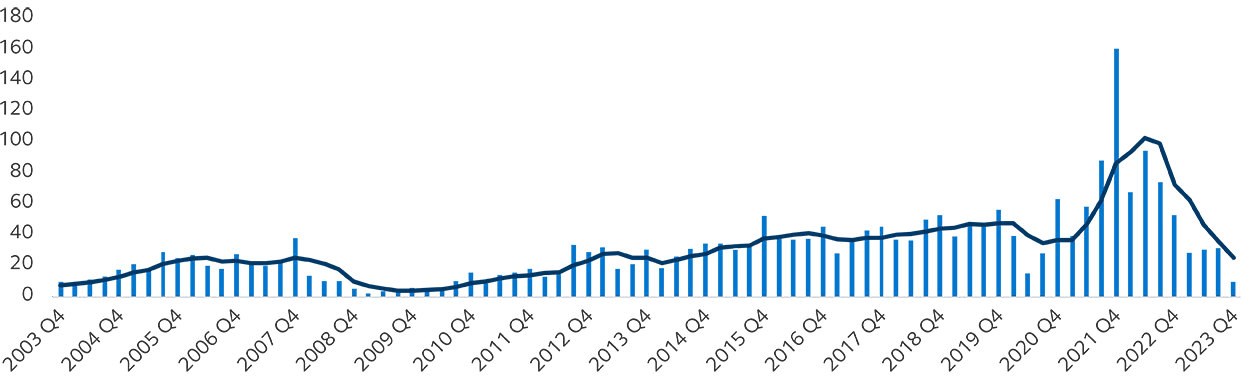

Another pain point for the multifamily sector in 2023 was the confluence of high inflation and interest rate increases. As consumer inflation reached its highest level since the early 1980s following the pandemic, the Federal Reserve (Fed) began increasing interest rates to stem the rapid increase in prices. The disruption this caused in capital markets brought commercial real estate transactions to their lowest level since the Global Financial Crisis (GFC). Apartment transaction sales volume was down 65% in 2023 (see Exhibit 1). In 2024, we see some room for improvement, as investors are more confident that the Fed’s tightening cycle is nearing completion, facilitating better clarity on pricing. At the same time, a higher interest rate environment will prevent a more robust recovery and while we believe that 2024 will be a better year for investors, the recovery will be measured.

EXHIBIT 1: Apartment transaction sales volume fell 65% in 2023

- Quarter sales volume

- U.S. equities

Declining values

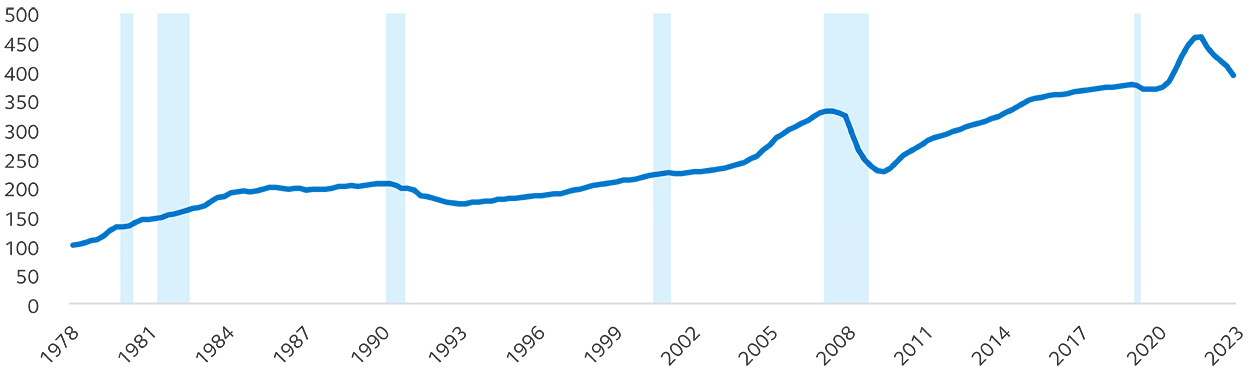

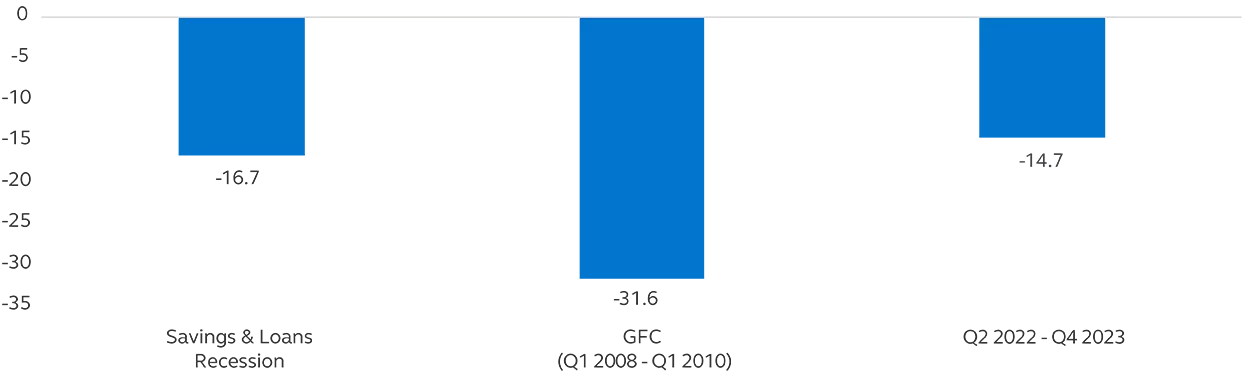

The real estate market is particularly sensitive to unanticipated inflation and rising interest rates, which makes it particularly challenging to price risk assets in the current environment. Driven by capital market uncertainty, apartment values are down 14.7% from their peak in Q3 2022 through the end of 2023—much less than during the GFC but still quite significant (see Exhibit 2). We expect values to further decline in the first half of 2024.

EXHIBIT 2: Apartment values spiked in 2022, but have declined 14.7% since their peak

NCREIF NPI Appreciation Index

Change in apartment value peak to trough (%)

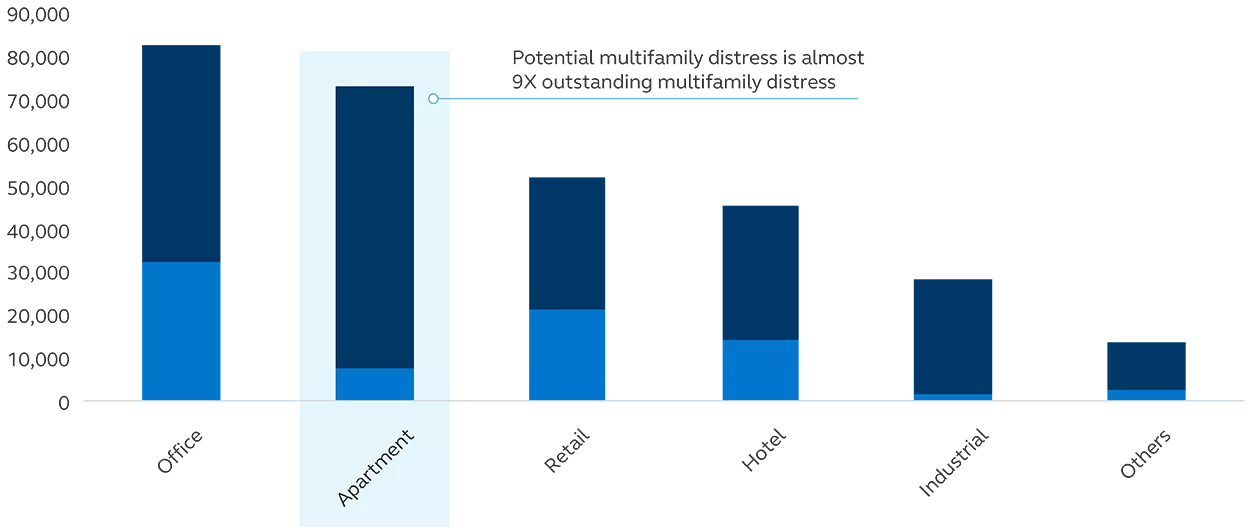

Multifamily distress

The amount of existing and potential distress in the apartment sector is somewhat surprising, given the liquidity and preference the sector has maintained among investors since the onset of the pandemic. In a sense, the sector has become a victim of its own success where ample liquidity has created a false sense of security. The high levels of development, lack of a fully functioning transaction market, and declining values have conspired to pressure weaker developers and operators within the multifamily sector. As shown in Exhibit 3, while outstanding apartment distress comprises less than 10% of total commercial real estate distress, potential distress comprises nearly a third of the entire market.

EXHIBIT 3: The multifamily sector share of total outstanding distress is just 9%, but its share of total potential distress is 30%

Distressed assets, $ millions

- Outstanding distress ($ millions)

- Potential distress ($ millions)

The surfeit of potential distress relative to other sectors, combined with healthy demand tailwinds, creates a unique entry point for well-positioned investors in 2024 and 2025. Space market fundamentals have certainly weakened over the past 12 months, which is due more to an overhang of new supply hitting the market at a time when demand has reverted to a more stabilized trend. All of that said, we do not believe that the apartment market is on the brink of collapse. The sector continues to have better access to debt capital than most, which is provided through government sponsored entities (i.e., Fannie Mae and Freddie Mac) and balance sheet dislocations that were the impetus for the GFC are not apparent. Absent an unforeseen economic shock, we continue to believe the apartment market will reach its trough in 2024, although distress will persist through 2025.

Distress will likely persist through 2025

We expect distress will persist in 2024 and 2025 as rents continue to trend lower, vacancy rises, and $500 billion in multifamily loans mature.

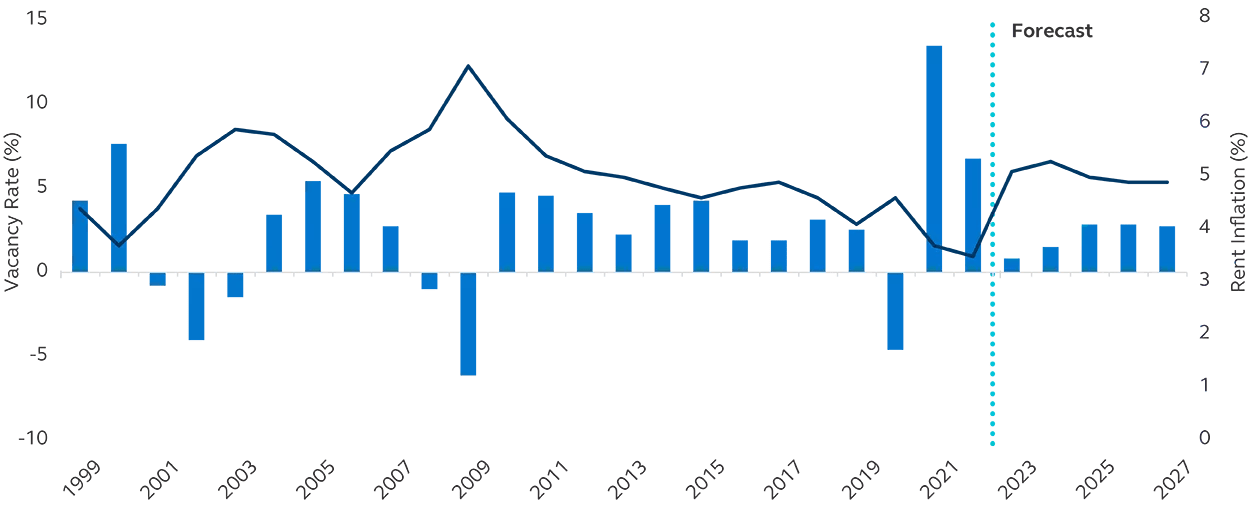

Rents and vacancy rates

Apartment fundamentals are in the process of resetting after a stellar run. While rental rates fell during 2020 by 5%, they increased by 20% over the following two years (see Exhibit 4). Partially as a result of outsized rent growth following the pandemic, rental affordability has come into focus. In fact, the median renter is now rent-burdened, as more than 30% of their total income needs to be used to pay for shelter costs.1 This has had the effect of slowing both the pace of the net absorption of apartment units and the ability of landlords to push for more robust increases on in-place leases. In 2023, for example, rental growth totaled just 1% on a year-over-year basis.

While vacancy rates have increased over the past 12 months, they remain below their long term historical trends, which we expect to help rental growth to return to its historical norms in 2026 and beyond. This will be driven by a moderation in new development starting in 2025, at a time when demand is in lockstep with economic growth and household formation.

EXHIBIT 4: Rents spiked in 2021 and 2022, and vacancy rates were at historic lows

- Vacancy rate

- Rent growth

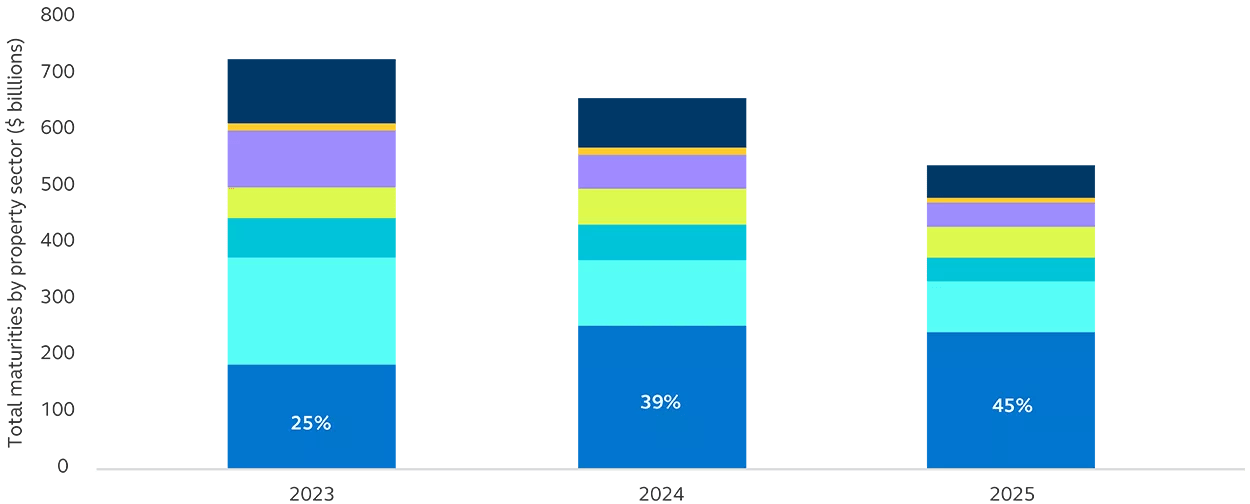

Hitting a wall of maturities

We believe that 2024 will be a pivotal year for the multifamily sector. While values and market fundamentals regain their footing, the maturity schedule will prove daunting. In total there is roughly $500 billion in apartment loans set to mature by the end of 2024, by far the most of any sector over the same time period. The multifamily sector represents 45% of the total loans set to mature across all sectors (see Exhibit 5).

EXHIBIT 5: The multifamily sector has by far the largest share of loans maturing

- Multifamily

- Office

- Industrial/Warehouse

- Retail

- Hotel/Motel

- Healthcare

- Other

Source: Mortgage Bankers Association, Loan Maturity Report, 2023

Given lower transaction volumes and values well below their previous peak, the wave of maturities could force many owners to sell at discount. The increased cost of capital and a valuation decline has made it nearly impossible for some operators to recapitalize today. With debt coming due and net operating income under pressure due to slower rent growth, poorly capitalized owners face a dilemma: they either need to refinance their debt at a time when cap rates are higher than their existing interest rates, which leads to an unstable capital stack, or inject more equity into troubled assets. Many will be forced to sell at discounted prices.

Macroeconomic fundamentals are strong and multifamily demand is steady

Despite the areas of distress in the multifamily sector, the underlying macroeconomic fundamentals are strong and demand for multifamily housing is steady.

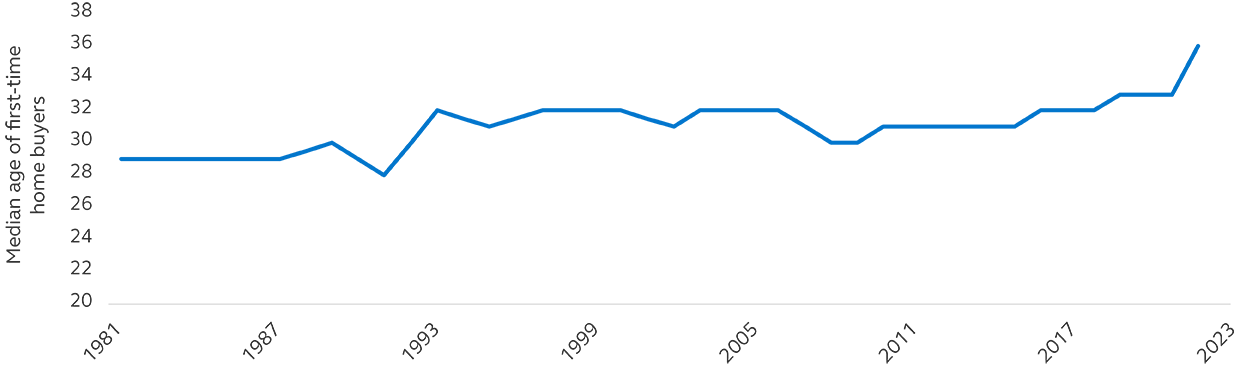

The economics of the residential sector has shifted dramatically over the past decade. Affordability remains a key constraint to accessing the purchase market. The younger generations which make up a large part of the population―Millennials and Gen Z―are renting or living at home longer than their parents did (see Exhibit 6). There are several reasons influencing the delay on home purchases. For starters, younger generations tend to be more prone to inter-city and regional movements than prior generations, which promotes mobility. Apartment rentals offer flexibility that home ownership does not. They also place a higher value on experiences, such as travel, which may require significant savings or discretionary income.

EXHIBIT 6: More people are renting for longer

Source: CDC, National Mortgage Database, Bloomberg, Moody's Analytics, Principal Real Estate, 2024.

Not only do younger generations rent longer by choice but the mortgage interest rates that followed the GFC and pandemic have put downward pressure on the affordability of the single-family purchase market. Consequently, homeownership rates among key demographics have lagged, which is creating a large source of potential demand for rental units. Moreover, these younger generations are currently in the primary renter cohorts. They constitute a substantial portion of the population, making them a significant source of demand in the rental market.

Conclusion: A window of opportunity for new multifamily investors

Given strong fundamentals and steady demand, distress among existing owners of multifamily assets creates a window of opportunity for new investors.

The multifamily sector faces several challenges over the next 12 months. Market fundamentals have weakened, and demand is reverting to its historical norms at a time when construction remains at near record levels. Combined with a higher interest rate environment, which we expect to persist over the longer run, weaker and less well capitalized operators will face increased pressure to look for an exit strategy. We believe that in the next 12-18 months, well-funded investors can take advantage of the distress and exit when capital market appreciation is firmly in recovery in three to five years, realizing opportunistic-like returns. Investors with dry powder at the ready will be in a prime position to enter this narrow window of opportunity.

Principal Real Estate: A trusted partner in multifamily investing

Principal Real Estate brings extensive market experience to bear for our clients. Our approach is marked by patience, discipline, and adaptability—qualities that enabled us to successfully navigate market upheavals like the GFC and the COVID-19 pandemic. We have a unique and valuable ability to swiftly seize opportunities in even the most dynamic market environments.

Our deep-rooted presence in the market, coupled with nimbleness and adaptability, position us to make quick and informed investment decisions to navigate potential stress points and capitalize on market shifts.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/ qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Global Investors, LLC (PGI) is registered with the U.S. Commodity Futures Trading Commission (CFTC) as a commodity trading advisor (CTA), a commodity pool operator (CPO) and is a member of the National Futures Association (NFA). PGI advises qualified eligible persons (QEPs) under CFTC Regulation 4.7.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2024 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM13886 | 02/2024 | 3370065-122024