Improved diversification

While core real estate generally provides attractive and stable risk-adjusted returns, home biases can lead to more concentrated risks, dependent on a property’s geographic location. These asset-specific risks could be influenced by a host of factors, including demographics, industry concentration, and local rules regarding tenants.

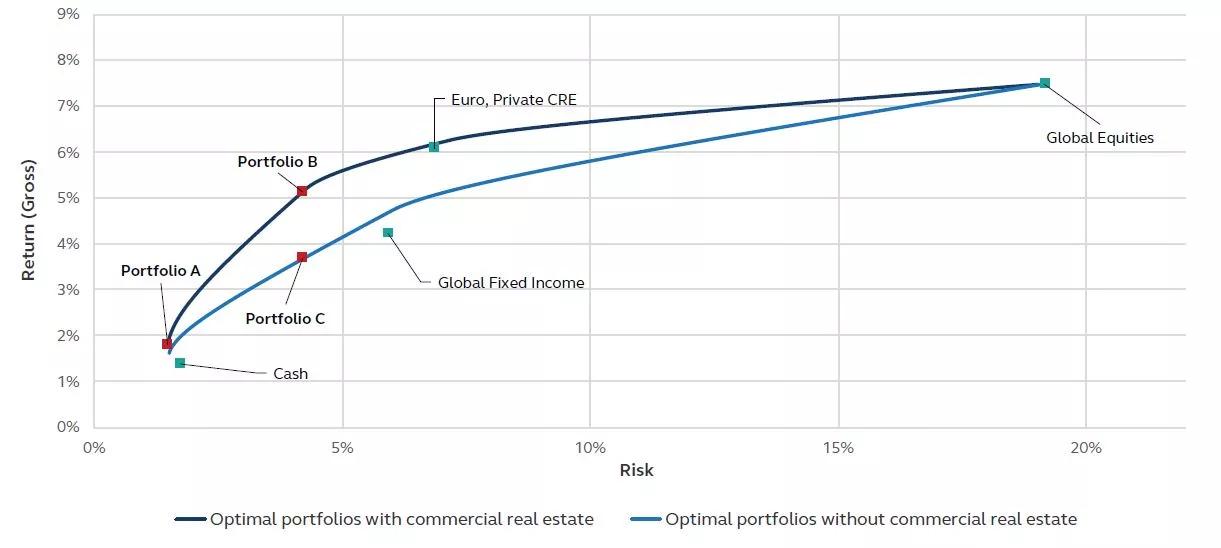

To achieve the broader set of benefits inherent in core real estate, cross-border investment is critical as it enables to minimise assets’ correlation. For example, dollar-denominated investors could enhance the overall diversification and risk- adjusted returns of their portfolio by gaining exposure to European markets.

One instructive example of these diversification benefits is the office segment in Europe which, in recent years, has demonstrated a low correlation to the NCREIF Property Index (NPI), a benchmark used to measure commercial real estate returns in North America. In fact, this correlation for total returns over the past 10 years has been -0.11,1 a low level that may help U.S. investors, navigating through property cycles.

In addition, niche or non-traditional property types (e.g., student housing, built to rent, multifamily homes, data centres, health care) are growing rapidly and becoming more mainstream throughout Europe, allowing investors to gain diversification benefits while maintaining a core approach

Emerging property types have generated significant investor interest and received more capital allocations in recent years. In the UK there is significant demand for student housing, while other non-traditional sectors such as health care are more prevalent in countries with affluent and ageing demographics, such as Germany and Finland. Indeed, given their higher purchasing powers, German and Finnish elderly are more comfortable to move into private care homes or senior living accommodations.

These differences among markets allow for targeted opportunities that can add diversification value to a portfolio. Country-specific opportunities are especially important considering that a likely deceleration of the economy in 2023 may produce uneven outcomes among European member states and tenant types.