1 Outlook refers to the next 12 months

Source: Principal Real Estate, March 2023

1 Outlook refers to the next 12 months

Source: Principal Real Estate, March 2023

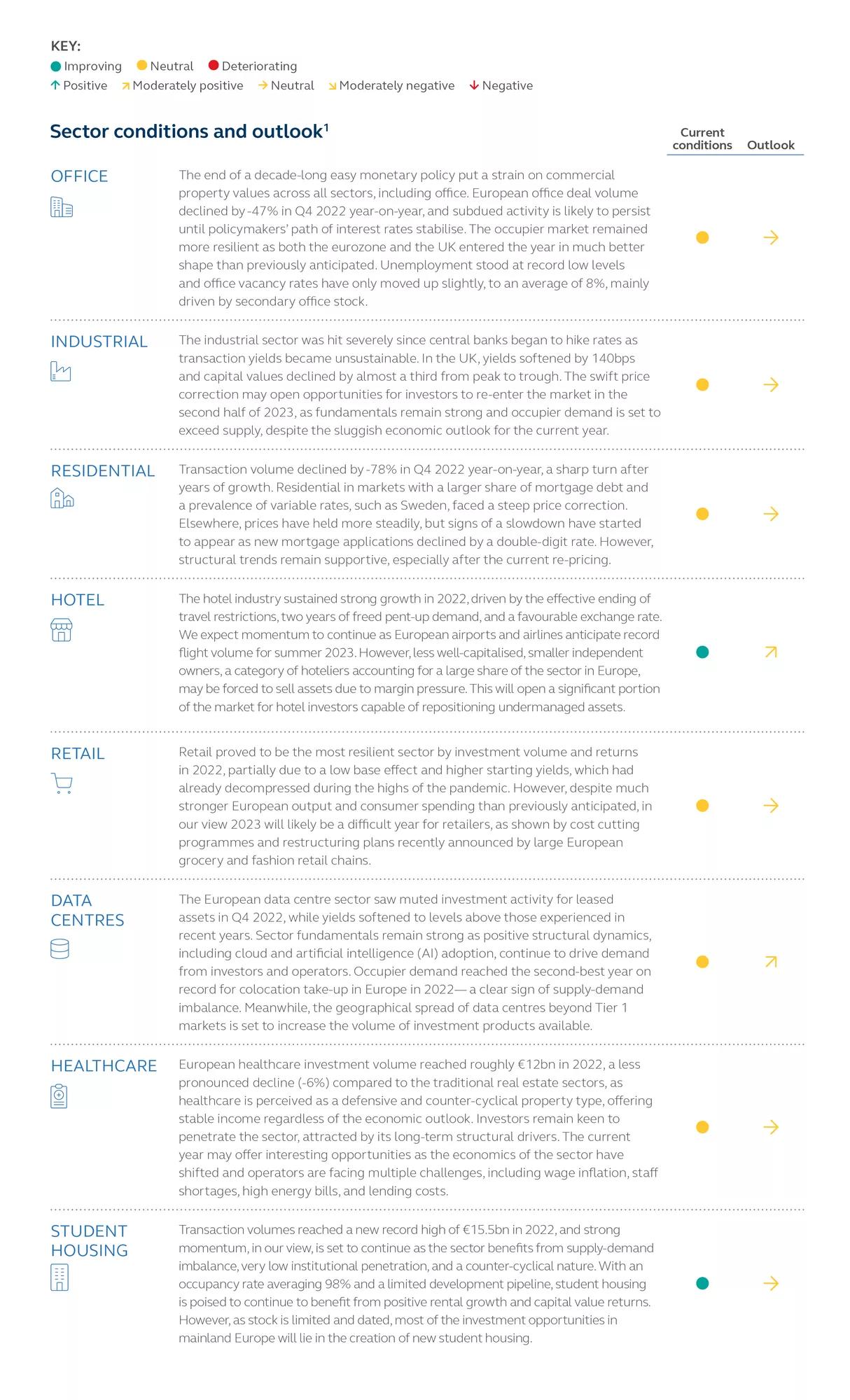

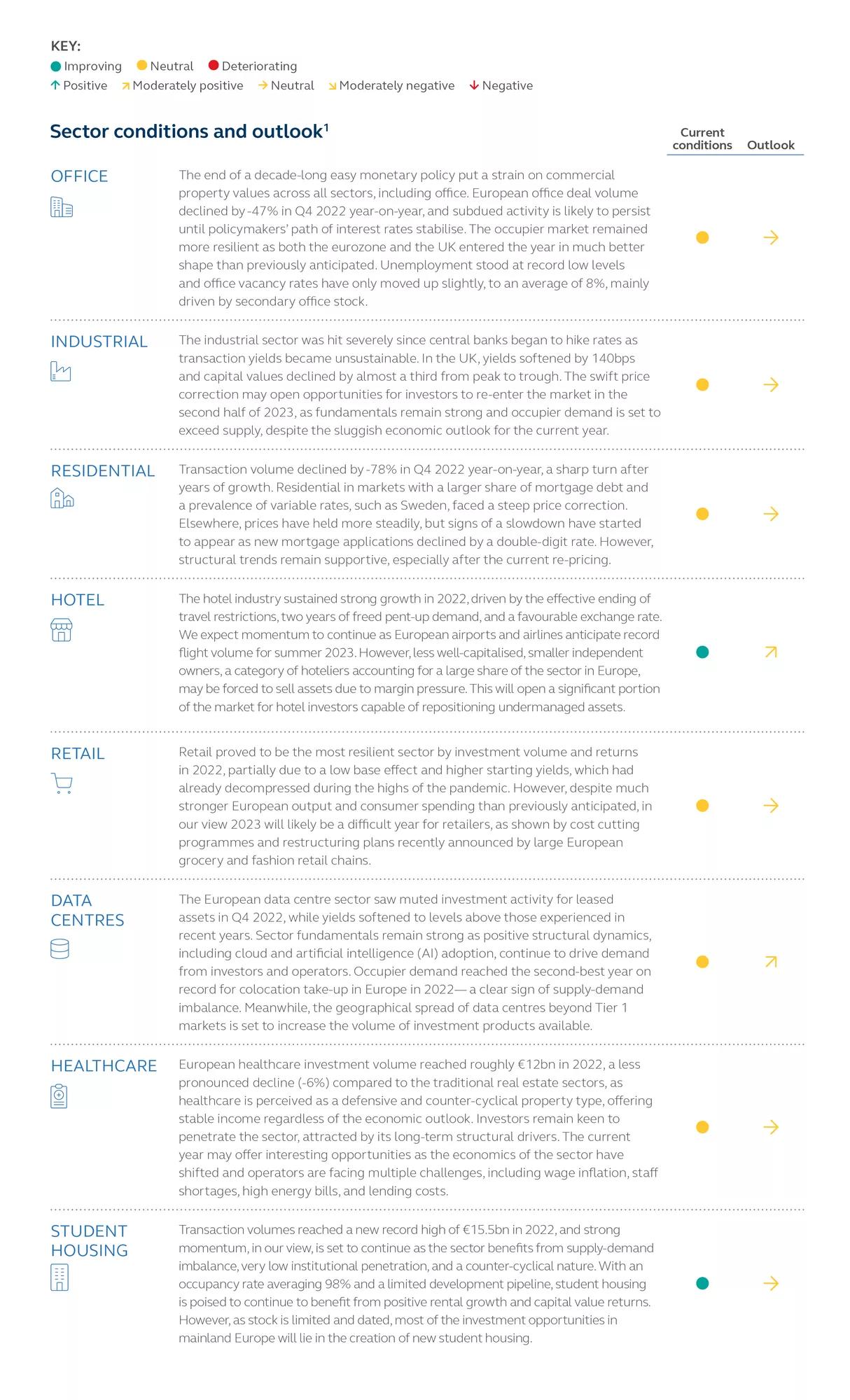

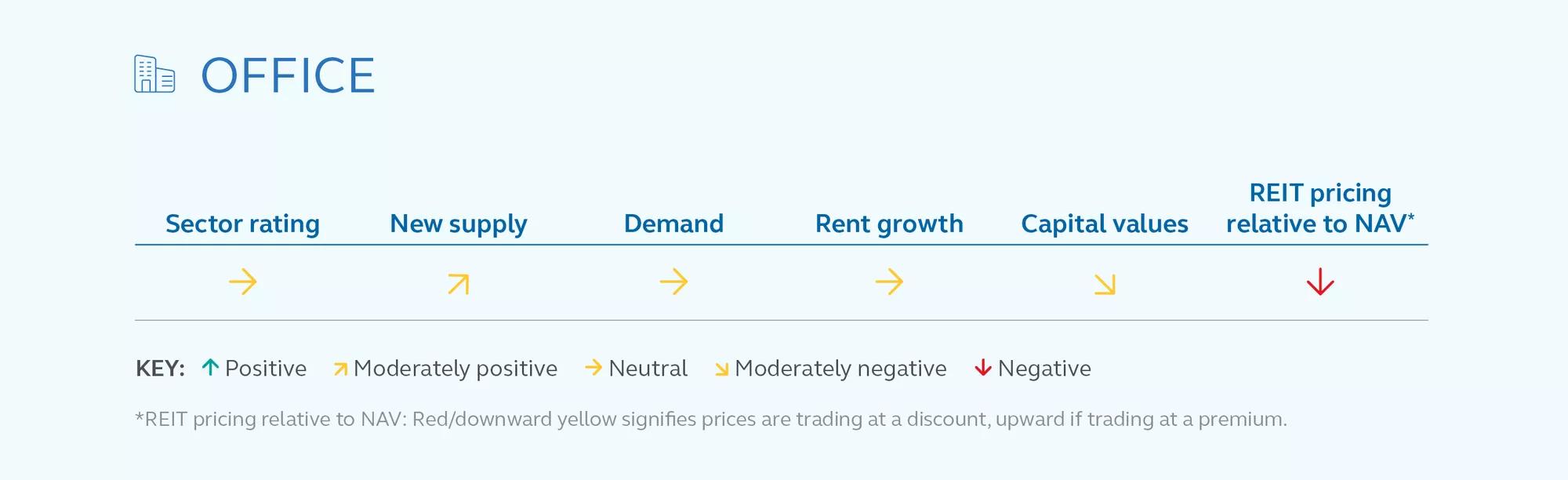

The end of a decade-long loose monetary policy, leading to a sharp repricing of debt, has put a strain on commercial property values across all sectors, including office. Since the initial rate hikes by the European Central Bank (ECB) and the Bank of England (BoE) in 2022, office yields have softened by 70bps on average across Europe, leading capital values to drop by up to a fifth in some markets. Meanwhile, European office deal volume declined by -47% compared to the same quarter last year, down to €21.4bn in Q4 2022, as investors were reticent to transact and the spread between sellers’ asking price and buyers’ bid widened. Subdued activity is likely to persist until policymakers’ stance on interest rates stabilises. In our view, this is likely to happen in the second half of 2023 or early 2024.

The occupier market remained more resilient. Despite economic headwinds, both the eurozone and the UK entered the year in a better shape than previously anticipated. Unemployment stood at record low levels in most markets, and we expect it is unlikely to increase significantly, now that a widespread energy crisis has been averted, and business confidence has started to recover. As such, office vacancy rates have only moved up slightly by 50 bps to an average of 8.0% across Europe. This trend was mainly driven by secondary office stock, while demand remained positive for best-in-class buildings in central submarkets, as companies continue to migrate towards modern and sustainable assets to meet ESG regulations and attract talent. In other words, the office sector is diverging, with a shortage of newer buildings in prime locations, and an oversupply of “brown” offices in peripheral areas whose prices will likely continue to fall as substantial capex will be required to bring these up to standard. Occupier preference was also reflected in rental growth, which reached 5.1% for prime offices and a lower 3.7% for secondary business districts in 2022 on an annual basis.

Meanwhile, companies are continuing to gradually tilt hybrid working towards the office space, demanding employees spend less time at home. According to JLL, office attendance in Europe is back to 70-90% of pre-pandemic levels, a much higher share compared to the U.S. where it remains stagnant at around an average of 40-60%.

The office sector, on average, performed in line with the broader property sector again in the second half of 2022 and in the first quarter of 2023, but there were some large variations and fluctuations around this mean, with France consistently outperforming and Swiss stocks more robust. Dutch offices suffered from a government proposal to increase the taxation of listed property vehicles.

Daily office occupancy is still well below pre-pandemic levels in London, while in Paris office usage has virtually recovered to pre-pandemic levels. However, substantial bifurcation is apparent with prime buildings in the best locations noticeably stronger than secondary assets and locations in almost all markets, where vacancy rates are typically 5-10% higher than prime. Since both tenants and landlords are placing a higher priority on energy efficiency, newer high-quality assets are favoured while also offering tenants better flexibility and helping to retain staff in a tight labour market. Lower-quality offices risk becoming stranded assets unless owners invest substantial capex to counter the risk of obsolescence and while headline rents have not moved much, incentives are higher.

The listed office sector is trading at a discount to last reported NAV of approximately 30% and typically owns assets at the better end of the quality spectrum, where tenant demand is more resilient. Given the valuation gap between public and private markets and uncertain prospects, more M&A activity seems likely.

“Beds and sheds” became a common saying among real estate investors during the global pandemic as a surge in e-commerce and abundant liquidity led to record demand for apartments and warehouses. Both asset classes reached record high volumes in 2021, while cap rates compressed to unprecedented levels. But as often happens in capital markets, meteoric rises may be followed by equally spectacular repricing. Thus, when policymakers began to hike interest rates, the industrial and apartment sectors were most severely impacted, as transaction yields became unsustainable. This trend was nowhere more apparent than in the UK, the largest European industrial market by deal volume, where industrial net initial yields softened by 140bps over the six months to January 2023, and capital values declined by -27% from peak to trough, according to the MSCI UK Property index. Although the majority of repricing has already occurred, industrial yields are likely to edge out a little more over the first half of 2023, especially for secondary industrial assets, which are traditionally less liquid and slower to adjust. In mainland Europe, industrial assets followed a similar pattern, although the price volatility was less pronounced than in the UK, due to differences in valuation methodologies, transparency, and liquidity.

The swift price correction seen in industrial assets may create some opportunities for investors during the second half of 2023, given that the sector’s fundamentals remain strong and occupier demand is set to exceed supply, despite the sluggish economic outlook for the current year. Strong leasing activity pushed vacancy rates to historically low levels across most European markets in 2022. Take up in Italy, for example, totalled roughly 2.8m sqm, an increase of 14% over the previous year, driving vacancy rates down to 1.8%. Considering the country still has one of the lowest e-commerce penetration rates in Europe, we believe it offers a sound investment case. In the Netherlands, vacancy rates are expected to decline further to a record low of 1.2% by the end of 2023, according to CBRE. Limited development pipeline, shortage of available land, and increasing construction costs are some of the main factors restricting the supply of new industrial real estate, which is therefore unlikely to keep up with the rising demand.

Industrial underperformed the property index in the second half of 2022, before bouncing back and outperforming in the early part of 2023. The underperformance in 2022 was driven by concerns about higher interest rates and the potential for outsized impacts on low cap rate stocks (industrial high amongst them after strong rental growth over recent years). This saw industrial REITs de-rate heavily in the second half of 2022 when it became apparent that inflation wasn’t transitory and European central banks would be taking strong action to combat high inflation.

There has been some reversal of this early in 2023, as hopes of a soft economic landing/avoiding recession and more dovish comments from central banks have seen real estate perform strongly, with low cap rate sectors outperforming. Industrial demand and rental growth seem to be holding up relatively well so far, albeit there are concerns about slowing rental growth in the UK with elevated occupier costs coming from higher business rates (taxes). Development pipelines have generally been scaled back significantly due to higher build costs and lower yield on cost outlooks making developments less profitable. Market supply generally remains tight and pre-let development is likely to continue. Structural tailwinds look likely to continue; however, a stretched consumer in a continuing cost-of-living crisis may pressurise e-commerce growth and cause slower rental growth than before.

Industrial REITs now trade at approximately a 20% discount to NAV on average, having continued to de-rate over the second half of 2022 from the large premiums they traded at in the beginning of 2022. UK stocks suffered most in the second half of the year sell-down as they have historically had the highest rental growth and compressed to the lowest cap rates. Therefore, with higher interest rates and cap rates now going in reverse, they also saw the most pain.

Since the Global Financial Crisis, the flow of capital targeting the European apartment sector has steadily expanded. From a low of around €8bn in 2009 to a peak of €100bn in 2021, investors’ appetite seemed insatiable, driven by a low-interest rate environment and structural undersupply across several markets. The sector continued to defeat gravity until the second half of last year when a surge in base rates and borrowing costs set the conditions for a rapid turn. Transaction volume declined by -78% in Q4 2022 year-on-year and some markets started to appear overvalued. Specifically, those with a larger share of mortgage debt and a prevalence of variable rates were poised to face a steeper correction. Sweden was first in line. Houses and apartments in Stockholm are now selling for -20% and -12% from their respective peak, according to SBAB, a Swedish bank. Elsewhere in Europe, prices have held more steadily, but signs of a slowdown have started to appear. In Germany, residential values have fallen by -2.5% over the last six months and further declines remain likely, although moderate. In France, forecasters are expecting declines between 5-7% in 2023, while in Spain, one of the fastest-rising housing markets last year, prices have plateaued, and new mortgage applications declined by -23% according to the Spanish National Council of Notary.

All told, medium-term structural trends remain supportive for investing in the European residential market, especially after the current re-pricing. Demand fundamentals remain supportive, including positive demographics, restricted development pipeline, high construction costs, and land prices. Additionally, the sharp increase in mortgage costs will deter a growing number of households from purchasing a property, which in turn will sustain the rental sector over the medium term. According to the latest data from Eurostat, the statistical arm of the European Commission, 30% of the European population lived in rented accommodations in 2021, with significant differences across countries. Of all tenants, almost 70% were living in a dwelling with a market rent, while the remaining benefited from free or reduced rent levels. Going forward, the share of tenants is expected to increase further amid socio- economic factors including affordability, late marriage, single-person households, and growing mobility. Therefore, we believe the emerging segments of the residential sector, including built-to-rent, co-living, and senior living, offer a solid investment opportunity

The European housing sector continued underperforming over the second half of 2022 and year-to-date in 2023 (apart from a short, sharp rally around year-end), hurt by rapidly rising bond yields, while rental growth lagged severely behind inflation and property values softened. Although historically over the longer-term residential rents have been a good inflation hedge, the backward-looking multi-year periods used to calculate the rent indices for regulated housing in markets, such as Germany, mean that it will be some time before in-place rental growth catches up with or overtakes inflation again.

The cost of refinancing maturing bonds rose dramatically as higher real yields and credit spreads in the corporate bond market pushed up refinancing costs, squeezing the margin between property yields and finance costs. While mortgage finance from banks remains readily available, costs are also sharply higher.

Higher energy and construction costs also hurt the housing sector, because in those markets (like the Nordics) where heating costs are included in the rent, margins suffered from higher energy costs. In markets where energy costs are paid by tenants, reduced disposable incomes have decreased housing affordability.

Given the positive reversionary potential, strong demand, and limited supply of affordable housing in most markets, rents should continue growing, but the outlook for values remains uncertain and in Sweden values have already fallen more than 15%. Higher base rates and credit spreads, along with most large companies looking to reduce debt through portfolio sales, has many investors worried that the current low cap rates are unsustainable, and low transaction volumes reinforce this perception of fragility. The sector has derated sharply as companies moved from acquisitive growth to deleveraging, with the sector now trading at an average discount of approximately 48% to last published NAV.

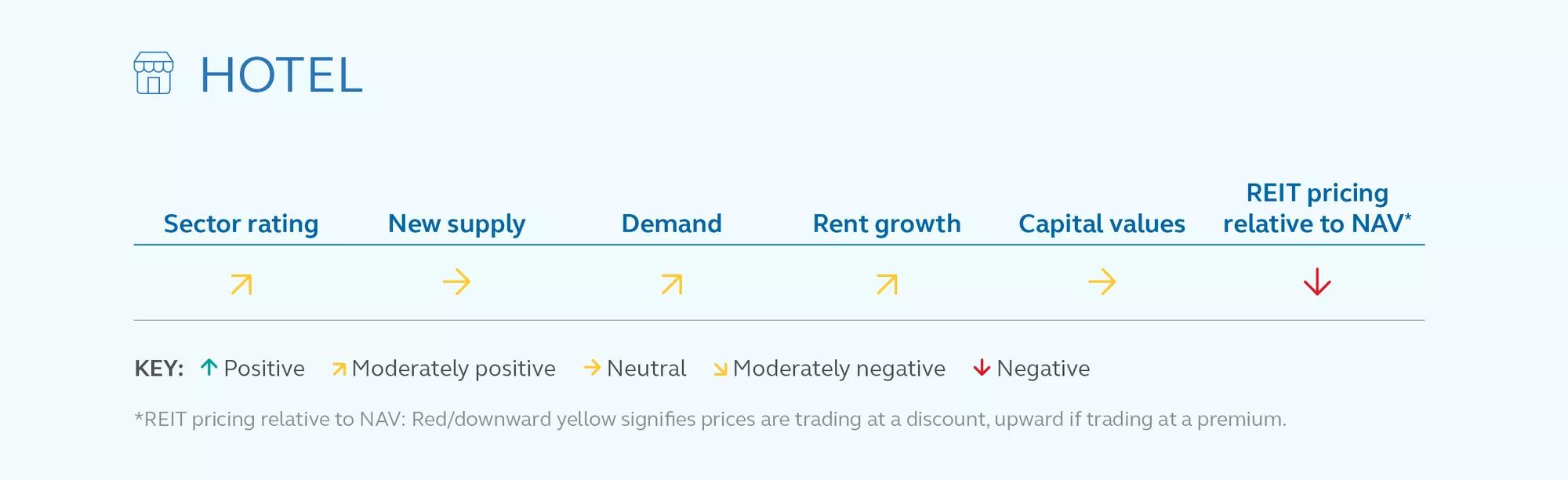

In contrast to the industrial and residential sectors that boomed during the pandemic and slowed sharply in recent months, the hotel industry sustained strong growth in 2022 and its outlook continues to improve, driven by the effective ending of travel restrictions, two years of freed pent-up demand, and a favourable exchange rate.

From a capital markets perspective, despite rising rates and borrowing costs, transaction volume increased in Q4 2022 compared to the previous three quarters of the year, although it remained below the sector’s long-term quarterly average of roughly €5bn. Deal activity was boosted by a large portfolio deal in Portugal, which included 18 hotels predominantly located in the Algarve region. On the occupier side, most of the European hotel markets returned to pre- pandemic revenue levels, as measured by RevPAR, the industry benchmark tracking top-line financial performance. Operators took advantage of strong demand levels to hike prices, with the average daily room rate (ADR) increasing above inflation in most markets. Occupancy still offers significant margins for improvement, and we expect it to increase now that travel has resumed its long-term growth trajectory and European airports and airlines anticipate a record flight volume for summer 2023, according to ACI World, an airport trade group.

However, while the medium-term outlook for the hospitality industry is promising, the steady increase in interest rates, borrowing costs, utility expenses, and staff wages is likely to put pressure on operating margins, particularly for less well-capitalised, smaller, and independent owners—a category of hoteliers accounting for a large share of the European accommodation sector. Against this backdrop, we believe interesting opportunities will arise over the next 12-18 months. A significant portion of the market that has historically been difficult to penetrate could become available for hotel investors capable of repositioning and turning around undermanaged assets.

Hotels are a relatively small listed sector in Europe, with only one index play available, while other non-index plays are mostly through asset-light operators. The sector has outperformed the broader property index in the second half of 2022 and YTD 2023, as strong pent-up demand post-COVID lockdowns continued to play out with continued improvements in business travel and a gradual return of group travel (albeit in early stages). As inflation continued to surge in the second half of 2022, hotels were seen as a good inflation hedge due to the ability to re-price rooms daily, unlike other property types. We now appear to be past the inflation peak creating renewed hopes this will ease the pressure on hotel cost bases. Cost of living concerns have largely been shrugged off, assisted early in 2023 by renewed hopes of a soft economic landing in Europe and avoiding a recession, which has seen the sector continue to outperform early in the new year. Recovery is still very much rate-driven, with occupancy still lagging and Ukrainian refugees taking up a significant portion of rooms in some locations, reducing supply.

Hotel NAV estimates are slowly paring back again in the new higher interest rate environment, but look to be more resilient that other property types which can’t pass through inflation increases as efficiently. In 2022, asset-heavy hotel stocks traded at an approximate 30% discount to consensus NAV, reflecting concerns over cap rate expansion and continued uncertainty over central bank policy, despite broadly positive operating fundamentals. Asset-light players have generally performed in line with the sector’s average as well.

“Blessed are the last for they shall be first” states the gospel to hearten those who didn’t enjoy earthly pleasures. That saying may also apply to the neglected retail sector, which returned to vogue lately after years of weaker performance compared to the other property types. Retail proved to be the most resilient sector by investment volume in 2022, as it increased by 8% to €40bn over the year prior, while all the other sectors (excluding student accommodation) recorded double-digit declines ranging from -10% (offices) to -40% (apartments) over the same period. This outperformance can partially be explained by a low base effect and higher starting yields, which had already decompressed during the highs of the pandemic, and now hover around 5.9% on average. Additionally, prospects for the retail sector were also lifted after the risk of a disruptive energy crisis was averted and the economy closed the year beating analysts’ expectations. However, although European output and consumer spending have been stronger so far than previously anticipated, in our view, 2023 will still be a difficult year as central banks continue to apply the brakes and the full impact of higher interest rates gradually passes through to the rest of the economy, a process which can take up to 18 months. According to the Centre for Retail Research, a British information provider, a total of 15,000 retail job cuts have been announced in the UK since the start of the year as large retail chains, defined as those with ten or more stores, are carrying out cost-cutting programmes and restructuring operations, including clothing retailer New Look and supermarkets such as Tesco and Asda. Meanwhile in mainland Europe, German online fashion retailer Zalando announced in February plans to axe hundreds of jobs to help it confront a “more challenging” economic environment.

Retail REITs have outperformed over the second half of 2022 and so far in 2023, despite inflation hitting multi-decade highs eroding consumer confidence and real disposable incomes, with the sector benefiting from investors’ renewed appetite for value stocks. With markets still driven mainly by high inflation and tighter monetary policy, retail property has benefited from its higher starting yield and low investor expectations at the start of the year. After the extreme stress of COVID-related closures and rent holidays, rent collections and vacancies have now normalised for the listed sector after suffering steep falls in previous years. While typical footfall has recovered to around 15-20% below pre-COVID levels, tenant sales are typically now above pre-COVID levels as basket sizes have expanded to compensate (although after adjusting for inflation, volumes are often still lower). After surviving the stress test of the COVID shutdowns, partly thanks to generous rent concessions from landlords, almost all surviving tenants are honouring rent indexation agreements despite inflation spiking, helping retail rents recover rapidly.

Retail REITs still trade at large discounts to NAV, at an average of around 35% below last published NAVs. While there is now less concern about retail REIT balance sheets, most retail REITs continue to deleverage by selling assets and paying down debt. The return of liquidity in pockets of the market has allowed most companies to show progress in this direction, with uncertainty still high regarding the size and price level for the largest regional malls, where only the biggest investors compete and there are still some over-leveraged sellers. Retail property owners continue repurposing excess space for alternative uses where this makes economic sense.

The European data centre sector saw muted investment activity for leased assets in Q4 2022 as price expectations between buyers and vendors diverged. The mismatch in the bid-ask spread was largely due to economic headwinds causing fluctuations in the cost of debt and ongoing macro- economic uncertainty. As such, yields for leased data centres softened to levels above those experienced in recent years. Nevertheless, sector fundamentals remain strong as positive structural dynamics, including cloud and AI adoption, continue to drive demand from investors to enter the sector, and for operators to expand their networks.

Occupier demand reached the second-best year on record for colocation take-up in Europe in 2022, equal to 698MW. In Tier 1 markets, which accounted for 56% of the total demand, the level of take-up exceeded new supply in the last quarter of the year, a clear sign of supply-demand imbalance, pushing vacancy rates down by almost four percentage points according to CBRE.

Demand from edge data centres, a crucial infrastructure for the rollout of 5G technology, continues to expand across Europe, with many operators seeking to gain exposure in new Tier 2 markets. Berlin, Milan, Madrid, Zurich, and other secondary markets will benefit from the geographical spread of data centres, and should achieve significant growth in the medium term, also increasing the volume of investment products available. New data centres and subsea cables are being installed in the Nordic countries as well. The region is set to become an important data centre hub as the abundance of renewable energy lures those hyperscalers and colocation operators seeking to decarbonise their businesses. Google, for example, acquired large plots of land in Sweden and Denmark in 2021, and in Finland in 2022, where it plans to expand its existing sea-cooled data centre facility. According to Altman Solon, a consultancy, demand for data centres in the Nordic region is set to grow by 17% CAGR over the next seven years.

European healthcare investment volume reached roughly €12bn in 2022, down 6% from the record level seen in 2021. The decline was less pronounced compared to the traditional real estate sectors since healthcare is perceived as a defensive and counter-cyclical property type offering stable income regardless of the economic outlook.

The care home segment accounted for nearly half of the total volume, or €5bn. Although the amount was -30% below the year prior, it is still triple the average seen before the pandemic as investors remain keen to penetrate the sector, attracted by multiple long- term structural drivers. One of these—perhaps the most obvious—is that the European population above 65 years old is projected to increase by 20% within the next 10 years. Age expectancy has increased, meaning chronic diseases will rise as well. In the UK, for example, the Alzheimer’s Society forecasts that the number of people with dementia in the country will increase by 70% by 2040, up to 1.6 million.

All said, the care home market is still fragmented and dominated by small independent operators, offering a fertile territory for investors to increasingly institutionalise the space and secure the provision of better-quality care services. From this perspective, the current year may offer an interesting window of opportunity as the economics of the sector have shifted and operators are facing multiple challenges including wage inflation, staff shortages, high energy bills, and lending costs. In our view, this could lead to a number of not-for-profit operators in poor financial condition selling out to private operators, who are expected to gain market share in the medium term. Additionally, larger private operators may decide to release capital and raise finances through sale and leaseback agreements. One of the largest European listed operators has recently announced the intention to sell assets worth more than €1bn.

A large series of portfolio deals propelled the student housing sector to a new record high despite the macroeconomic headwinds. Transaction volumes reached €15.5bn in 2022, almost double the amount of the year prior and 60% above the previous historic high of 2019. This upward trend, in our view, is set to continue, as the sector benefits from supply-demand imbalance and very low institutional penetration in several geographies across the continent.

The UK, Europe’s largest student housing market with roughly two-thirds of the total volume, saw a spike in deal activity in the last quarter of 2022, while all other property types recorded sharp declines. Although the performance was boosted by a large portfolio deal, this is still evidence that investors found comfort in the counter-cyclical nature of the sector (student numbers tend to increase during economic downturns), and its short-term price dynamic linked to the academic calendar. In mainland Europe, the stock of purpose-built student accommodation is still small, therefore most of the investment opportunities may lie in the creation of it.

According to Savills, the average provision rate across European cities, defined as student-to-bed ratio, stands at 13%, ranging less than 5% in Italy to 20% in Denmark and Sweden. But in addition to the undersupply, it must be noted most of the existing stock is also dated and not suitable to meet the needs of a growing population of mobile international students. Nevertheless, with an occupancy rate averaging 98% across Europe and a development pipeline which lags the projected increases in students’ number, this asset class is posed to continue to benefit from positive rental growth and capital value returns over the medium term. No wonder institutional investor capital is shifting towards it.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

These are the current views and opinions of Principal Real Estate and are not intended to be, nor should they be relied upon in any way as a forecast or guarantee of future events regarding particular investments or the markets in general.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Real estate investment options are subject to some risks inherent in real estate and real estate investment trusts (REITs), such as risks associated with credit, liquidity, interest rate fluctuation, adverse general and local economic conditions, and decreases in real estate values and occupancy rates. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility. Direct investments in real estate are highly illiquid and subject to industry or economic cycles resulting in downturns in demand. Accordingly, there can be no assurance that investments in real estate will be able to be sold in a timely manner and/or on favorable terms.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections, and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

2812504