There’s a chip war going on. Semiconductor manufacturers continue to release increasingly powerful processors designed to manage new types of workloads, including artificial intelligence (AI) and machine learning (ML). Frequent headlines about this ‘semiconductor arms race’ have understandably made some investors concerned about whether the facilities supporting these servers—data centers— will become obsolete.

In an effort to address these concerns, we’ve gathered perspective from four of our data center experts around the world. As we’ve written before, innovation will indeed impact data centers, but we believe these risks are both limited and manageable. In fact, the global economy’s increasing reliance on data has only made these facilities more attractive real estate investments.

I have always taken great comfort from the vast quantum of capital investment being spent by the largest cloud companies (AWS, Google, Microsoft) on the basis of current data center technology. This is investment for the long term.

QUICK TAKE

- IT infrastructure has always evolved rapidly, and even data centers built 25+ years ago have not been rendered obsolete.

- Because the purpose of a data center is to power, cool, and connect IT equipment, its fundamental value is driven by power capacity and network connectivity—factors not likely to change unless new processing technologies such as quantum and biological computing are widely commercialized, and that is still decades away.

- There are innovations that affect data center design—including increasing density and evolving approaches to sustainability. But those won’t make existing data centers obsolete.

- Leading data center developers build configurability into their facilities to support innovations like higher density and new approaches to sustainability.

- Even if the data center wasn’t designed to be configurable, retrofitting an existing facility to support innovations is a much more likely course of action than decommissioning the data center entirely—in no small part because demand for data center capacity far outstrips supply. Old and new will continue to coexist.

Rapid evolution in IT infrastructure has not rendered data centers obsolete

IT infrastructure has been evolving rapidly—exponentially, in fact—for over half a century. (Intel co-founder Gordon Moore observed this exponential evolution in 1965 and predicted it would continue, which it has.)

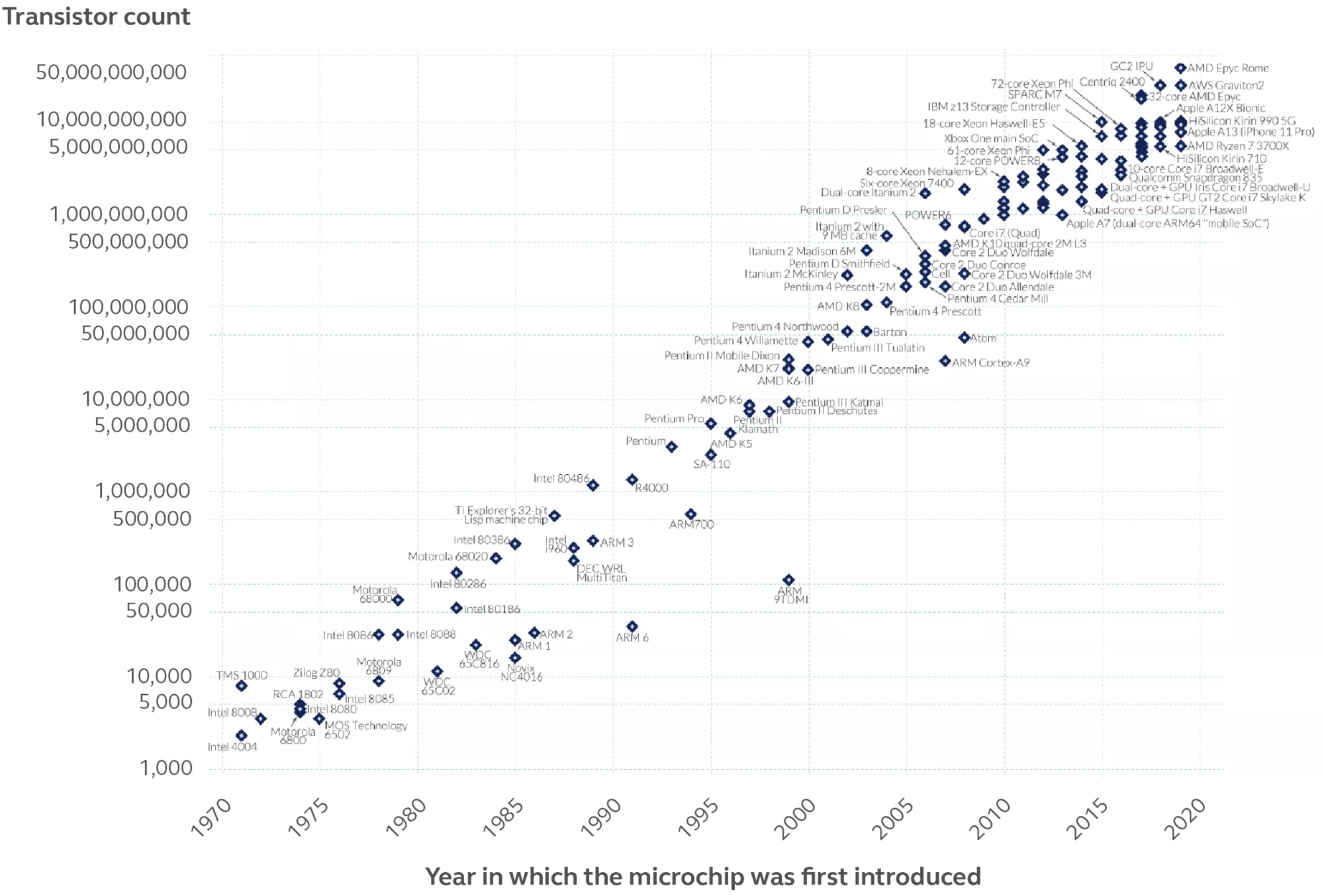

Moore's Law: The number of transistors on microchips has doubled every two years

Moore's law describes the empirical regularity that the number of transistors on integrated circuits doubles approximately every two years. This advancement is important for other aspects of technological progress in computing—such as processing speed or the price of computers.

Source: Our World in Data, What is Moore's Law?, March 2023

Moore’s Law—the doubling of components in a dense integrated circuit every two years—is the reason IT leaders ‘refresh’ (i.e., replace) their servers every 3-5 years. The cost is substantial—about $20 million per MW of IT gear—but worth it, because that doubling every two years means server performance dramatically improves, and IT leaders have worked out that the cost of equipment replacement is worth the value of improved performance about every 3-5 years.

But even while IT leaders have been refreshing their servers every 3-5 years, they tend to stay in the data centers that house the servers for 15 years or more.

The value of a data center is driven by its fundamentals

Rather than seeing innovation as a threat to data center demand, we view it as critical to driving demand. Our focus is on three universal factors that make good investment traits: Good connectivity to fiber cable networks; access to a power supply that can support the data center’s capabilities; and proximity to the population it serves. For investors, owning properties with these difficult-to-find attributes will help ensure the data center will retain its relevance over time.

A data center’s purpose is to facilitate the secure storage, processing, and transfer of data. That involves power (computers work by sending electrons around a circuit board), cooling (moving electrons around a circuit board creates heat), and connectivity (moving data from one place to another). The particular approaches for powering, cooling, and connecting a data center have and will continue to evolve. Some of these innovations do affect data center design. But we believe none of them will make existing data centers obsolete.

Unless new processing technologies such as quantum and biological computing are widely commercialized— still decades away—the data center fundamentals of power, cooling, and connectivity will persist, and in our opinion, the facilities that fulfil those obligations will remain in high demand.

Rich Miller, Editor at Data Center Frontier, offers an illuminating anecdote:

“On Oct. 22, 2009, CNBC personality Jim Cramer warned his legions of viewers that the data center industry was ready for a fall. ‘Get out of the data center stocks,’ Cramer told viewers. ‘I think the data center industry is in decline. I see an industry that’s about to be brought low by new technology, so I think you should sell, sell, sell.’

Short version: Cramer’s ‘Sell, Sell, Sell’ was Wrong, Wrong, Wrong. Investors who followed his advice missed out on a historic rally in data center stocks, with Equinix gaining 88% in value during that period, and looking like a laggard compared to industry rivals Terremark (up 172%), NaviSite (up 151%), Rackspace (up 139%) and Savvis (up 122%). Digital Realty, DuPont Fabros and Akamai were all between 50-65% higher.

Cramer seemingly didn’t understand the historic relationship between faster chips and data center demand. He noted strong sales for Intel’s new family of Nehalem DP processors, one of which can ‘take the place of eight to nine older- generation servers.’ Cramer did some math and concluded that data centers will soon be seven-eighths empty.

Nehalem was the latest in a series of regular technology updates from Intel, each of which introduced faster and more powerful processors, and none of which emptied out data centers. Here, history could have been an aid to Cramer. It would have been simple to compare the launch of faster Intel chips and data center growth to test his thesis.

There are innovations that affect data center design, but they won't make existing data centers obsolete

Rapid evolution in IT infrastructure has not rendered data centers obsolete, in part because the value of a data center is in its fundamental ability to power, cool, and connect IT equipment. However, that’s not to say data centers haven’t evolved. They have. Rising density, for example, has led to innovations in both power and cooling infrastructure. Cooling infrastructure has also evolved as approaches to sustainability have changed. But none of these innovations have made existing data centers—even facilities built 25+ years ago—obsolete.

Rising density does affect data center design, but doesn't make existing data centers obsolete

When the components in a dense integrated circuit double every two years, the practical effect is increased performance—the ability for a given chip, or server, to do more compute work or store more data. All else equal, refreshing IT equipment with higher- performance gear increases the amount of work a set of servers in a rack can do, and since ‘work’ is moving electrons around a circuit board and therefore directly proportional to power input, it increases the power input to a given server rack (i.e., density).

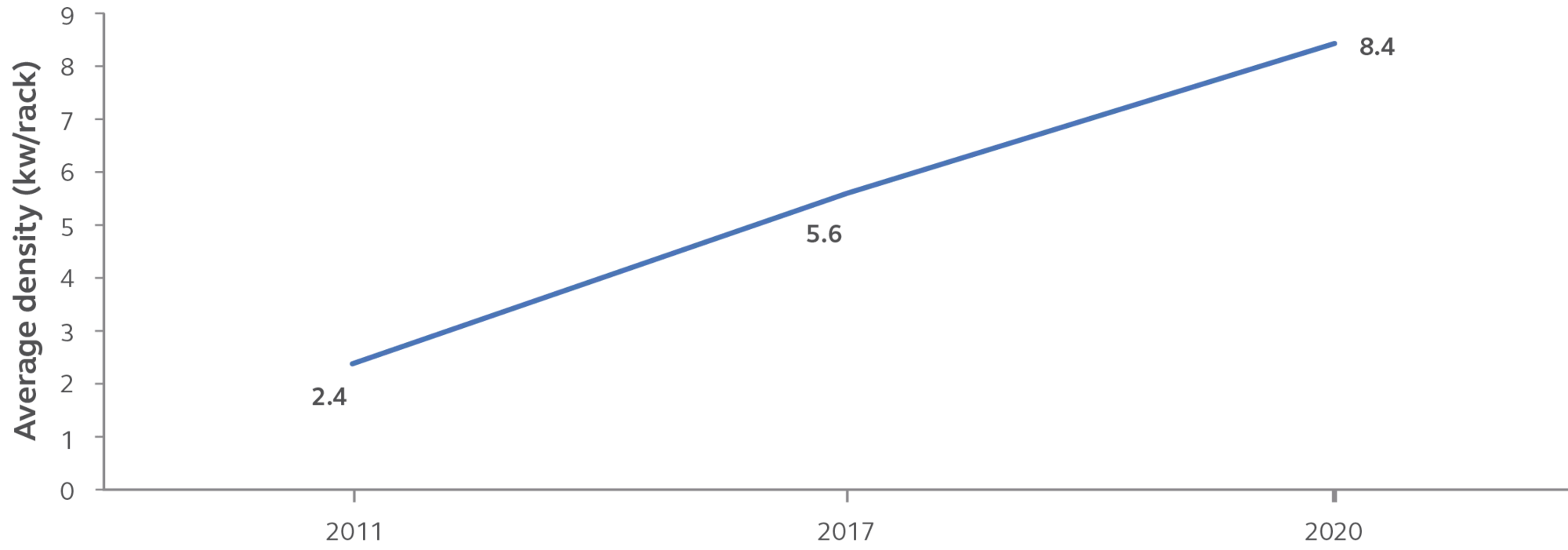

Average density per rack is rising

Source: Uptime Institute Member Research, December 2020.

Average server rack density has been rising steadily. And while the average server deployments remain under 10 kW per rack, some more recent deployments are reaching five times that level. Applications such as artificial intelligence run at those much higher densities, as they require more power-intensive computations from servers and storage systems than traditional workloads.

Generally, as time has progressed, facilities have become larger and the power density increased. But the original facilities are far from redundant and utilization from the operator perspective is high.

Density affects data center infrastructure in two ways: power and cooling.

Density affects power infrastructure

Data center density is a measure of how much power is delivered to each server rack. From a pure power perspective (ignoring cooling for a moment), a data center’s ability to support higher density deployments depends on two factors: the amount of utility power capacity it has, and the capacity of its existing power infrastructure.

If there is unused utility power and infrastructure, the data center can support tenants’ higher density deployments with minimal modifications. In many cases, a data center may have additional utility power available but needs to deploy additional power infrastructure such as transformers and electrical backup systems to support increased density. If there is no extra utility power capacity, then supporting higher density deployments would require either bringing more utility power to the facility or reducing the number of servers to keep the total power consumption the same even as each server consumes more power.

We are increasingly focused on sites that have or allow for the development of a dedicated power substation, as they generally provide for more flexibility in terms of power access and delivery. Sites with dedicated substations commonly enable more room for rapid expansion.

In any case, the facility is not rendered obsolete. Actually, the fact that utility power is an increasingly scarce resource, especially in primary data center markets, is one reason existing data centers have a distinct advantage over new construction.

Density also affects cooling infrastructure

In reality, we can’t ignore cooling, and because increasing density means more power in, it also means more heat out. So, for most data centers the bigger challenge associated with rising density is cooling (or more accurately, heat removal). Each cooling technology has limits on how much heat it can remove from the environment, and technologies have evolved over the years to remove more heat.

In the early 2000s, most data centers were designed with air-conditioning-like systems that cooled the entire data hall—not very efficient, but sufficient for rack densities under 2 kW. Then many data centers adopted new technologies where heat emitted from servers is drawn away by fans and then cooled with water or a refrigerant—much more efficient and effective for rack densities up to 20 kW or so.

Immersion cooling is still a very new technology. I have only heard of a few instances of it being commercially used. But even immersion cooling systems can likely be retrofitted into existing data centers, and the other end of the cooling system (i.e., dispelling the heat from the data center as a whole) remains the same or similar. The floor loading would likely have to be higher as the units are heavier than existing racks, but this is something we believe can be worked around.

Supporting significantly higher densities, the likes of which we see with AI workloads, for example, will likely require either liquid cooling to the rack or immersion cooling. In liquid cooling to the rack, a cooling medium (typically chilled water) is piped to the server racks and then utilized by heat exchangers in the row or mounted on the server racks; or piped into cooling plates attached to servers or into plates and pipes integrated into the computing equipment itself. Immersion cooling is a very different technology; specially designed servers are fully immersed in a cooled, nonconductive refrigerant, although the building’s heat-rejection equipment remains fairly similar for all cooling strategies.

Many modern data centers are designed to accommodate water to the rack, a cooling technique that is likely to see more widespread adoption for today’s high performance computing deployments. Liquid immersion is a very different process that requires entirely different server equipment as it needs to be designed specifically for immersion in the cooling medium. This will likely put a damper on the rapid growth of liquid immersion as it's not compatible with most existing tenant equipment, including the GPUs that are driving today's AI compute.

New approaches to sustainability do affect data center design, but don't make existing data centers obsolete

Besides density innovations that demand new approaches to cooling, sustainability concerns also impact the choice of cooling systems. For a long time, sustainability in the data center meant optimizing energy efficiency, as measured by Power Usage Effectiveness (PUE). More recently, data center operators and tenants have added measures of water efficiency to their ESG goals.

There are tradeoffs between energy efficiency and water efficiency. All else equal, water-based evaporative cooling systems are the most energy efficient, but more water intensive. Closed-loop air-cooled chillers are the most water efficient, but more energy intensive. Especially in water-contrained markets and markets where renewable energy is readily available, leading data center developers are increasingly relying on air-cooled chillers.

A data center designed for a water-based evaporative cooling system can be retrofitted to support closed- loop air-cooled chillers. Even where the operator doesn’t retrofit the facility, most manage a mixed portfolio of both water-based evaporative cooling systems and closed-loop air-cooled chillers. In other words, evaporatively cooled data centers are not obsolete—especially considering the ESG implications of decommissioning an entire evaporatively cooled facility in favor of a new facility that uses a closed loop chiller.

As ESG considerations become increasingly important, the desire to break ground for a new data center instead of using what has already been built will likely fade, again supporting the supply-demand imbalance benefiting investors in this space.

A revolution in how computers work will dramatically change data center design, but it's decades away

As long as computers in the data center rely on electrons, the data center fundamentals of power, cooling, and connectivity will remain. (Even quantum computing depends on those same fundamentals, though its widespread commercialization would require significant changes to data center design, in large part because quantum computers must be kept very cold.) There is one innovation that could render existing data centers obsolete: computers that rely on biological media rather than electrons. But biological computers only exist in the simplest form today, and commercial viability—much less widespread adoption—is likely decades away.

Molecular and biological data storage and quantum computing could help minimize the amount of electricity needed to store data. However, game-changing technologies such as these are likely decades away, let alone commercially feasible, while demand for data transmission and storage continues to increase exponentially.

Leading data center developers design for configurability

Because there are innovations—like rising density and new approaches to sustainability—that affect optimal data center design, leading data center developers build configurability into their facilities to support innovation without rendering existing facilities obsolete. So even if higher density requires changes to how a data hall is laid out or cooled, those changes can be made within the existing data center—ensuring its usability for many years to come.

Leading data center developers are very focused on future proofing their facilities and have a close relationship with their key customers to understand their current and future requirements. The major industry players all of course have a long term interest in the viability of their facilities

Existing facilities can be (and are often) retrofitted to support innovations

Even if a data center wasn’t designed to be configurable, retrofitting it to support innovations like higher density and a focus on water efficiency is a much more likely course of action than decommissioning the data center entirely—in no small part because the industry needs all the capacity it can get. (The average vacancy rate of the top 10 North American data center markets is 2.88% according to datacenterHawk, and “demand is still outpacing providers' ability to deliver new capacity.”)

A great example of the long term functionality of data centers is a facility we own which was originally commissioned nearly 15 years ago. It had been a bank-owned data center, originally designed to meet the highly redundant, low-density attributes characteristic of its time and for its use—nothing like today’s hyperscale deployments. The key is that it had the functionality to deliver significant amounts of power and cooling. With some updating, this asset was retrofit and fully leased to a specialty cloud service provider to deploy an AI/ML strategy that at full deployment will be one of the largest supercomputers in the world.

Old and new will continue to coexist

Data center developers are already innovating the design of new facilities to support higher density and evolving approaches to sustainability. For example, Meta, which both leases and develops its own facilities, recently announced that its new generation of data centers will be liquid cooled, to support AI workloads at scale.

But even as more data centers run AI or other workloads that require higher density, old workloads will continue to run, and need existing data centers to support them.

It’s not an either/or discussion. The workloads of today aren't going away anytime soon, so users aren't giving up existing capacity in exchange for the next big thing. And while we think of technology changing very quickly, changes at the data center infrastructure level are gradual; mission-critical workloads aren't conducive to rapid transition to new, unproven technology. Being on the front line with tenants we're going to see these changes being implemented in plenty of time to position our portfolios appropriately.

Bottom line

IT infrastructure has always evolved rapidly, and even data centers built 25+ years ago have not been rendered obsolete. Because the purpose of a data center is to power, cool, and connect IT equipment, its fundamental value is driven by power capacity and network connectivity. These factors are not likely to change unless new processing technologies such as quantum and biological computing are widely commercialized, and that is still decades away.

Innovations that do affect data center design, including increasing density and evolving approaches to sustainability, won’t make existing data centers obsolete. That’s because leading data center developers build configurability into their facilities to support innovations. And even data centers not designed to be configurable can be retrofitted— much more likely than decommissioning, especially as industry demand for data center capacity far outstrips supply.

So, will big advancements in technology—like AI—render existing data centers obsolete? Quite the opposite; more likely, technological advancements will further increase the value of existing assets as they drive increased demand for data center capacity. For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted

Risk Considerations

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM13586 | 07/2023 | 3002665-122024