Data centers have become critical components of our growing dependence on technology. Surging demand coupled with high barriers to entry for new supply and a global search for attractive investment returns have brought the sector to center stage.

At-a-glance—The data center opportunity:

- Accelerating demand: Structural shift in how consumers and corporates use data powered by Internet of Things (IoT), Infrastructure as a Service (Iaas), e-commerce, and gaming.

- Limited supply: Data center vacancy rate at lowest point ever in the U.S.; Rising land prices, longer lead-times for power and equipment, and increased labor costs all are driving up construction costs; Hyperscale users are competing for key locations

- Compelling investment opportunity: Low correlations to other assets, a favorable risk/return profile, and new liquidity from institutional capital make data centers a portfolio component worth considering

- High barriers to entry: Given the highly specialized and niche nature of the data center industry, experience is critical to successful execution—development, leasing, technical expertise, ESG, etc.

Big data keeps getting bigger. And faster. And more valuable. The amount of digital data expected to be created over the next five years will be more than double the amount of data created since digital storage was first invented in 1956.1 By 2030, the number of internet-connected devices is expected to grow by 242% compared to 2019.2 Data centers are not only real estate, they are the infrastructure lifeblood of the modern economy.

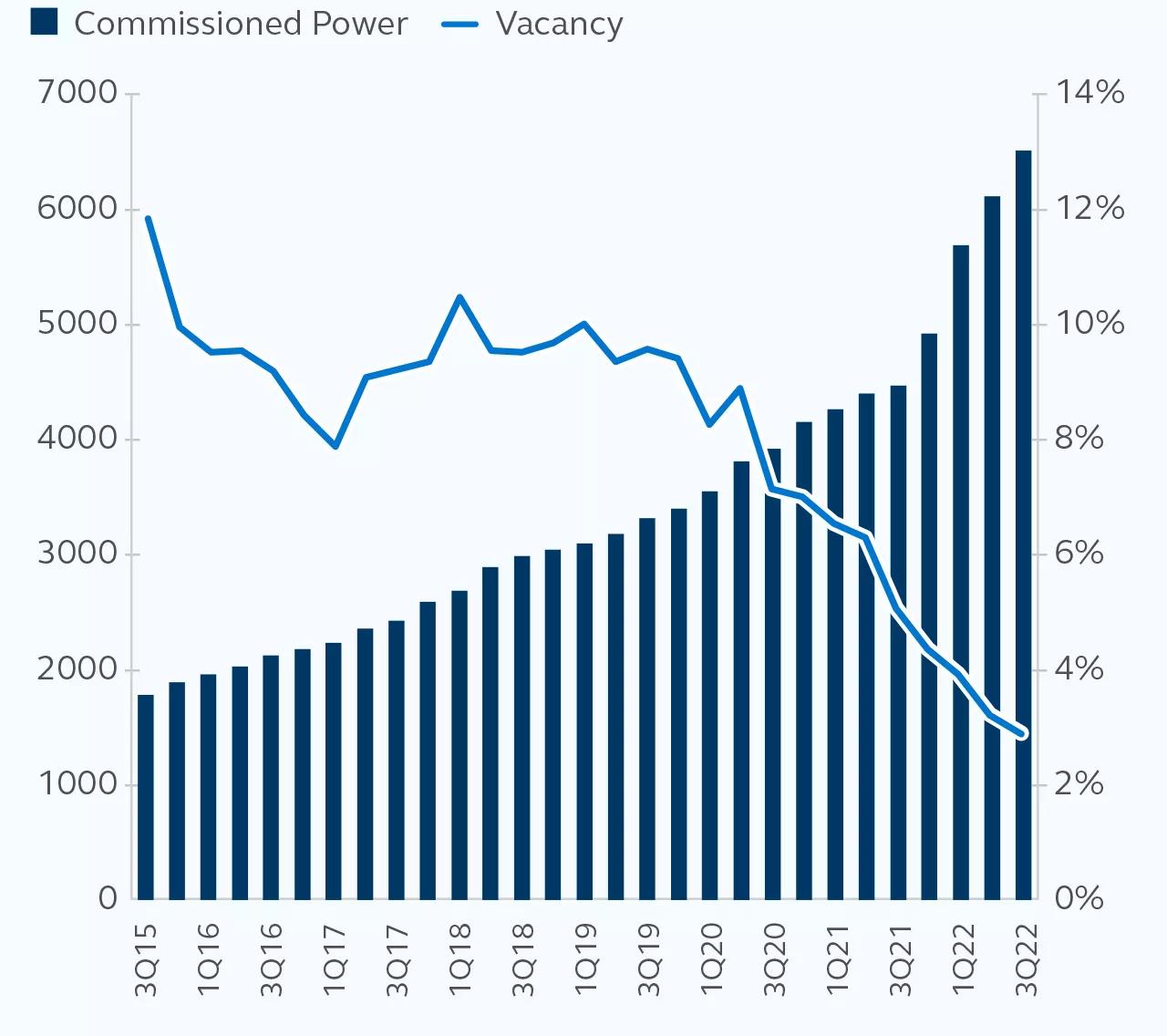

Processing, housing, streaming, and securing all this data has led to rapidly increasing demand for data centers. In fact, even though leased data center capacity has more than tripled since 20153, vacancy is at an all-time low. Given the growing awareness of the significance of data centers to the economy, investors are increasingly looking for ways to participate.

The elements that appeal most to investors today include:

- High demand for quality data center space—but limited supply of data centers able to keep pace with exponential data growth from developments in outsourcing, cloud adoption, and emerging technologies.

- Long-term leases and credit-worthy tenants have led to a stable cash flow and attractive returns in both up and down markets.

- Access to a specialized product type to diversify their portfolio.

Private data center investing requires a high degree of specialization to source, build, and lease the properties. With a favorable risk-adjusted return profile, high barriers to entry, and past resiliency in both up and down markets, we believe data centers represent an attractive long-term investment opportunity.

The demand for data centers

Data centers are the engines that propel the modern economy, as more and more systems become driven by some form of data. They’ve become the cornerstone of the information economy—the central nervous system of the interconnected internet network, further propelled by the COVID-19 pandemic which made everyday tasks from working to shopping completely dependent on data and fast connectivity. While data storage was once the primary purpose of data centers, computing power and network connectivity matter even more today. Digital technologies have transformed numerous aspects of society and the economy. Work, education, banking, healthcare, and shopping are a few examples of activities that individuals and businesses now perform online. Globally, ambitious digital mandates are underway to strengthen and expand digital data capabilities, including enhancing business usage of cloud technology, digitalizing public services, and extending 5G capabilities.

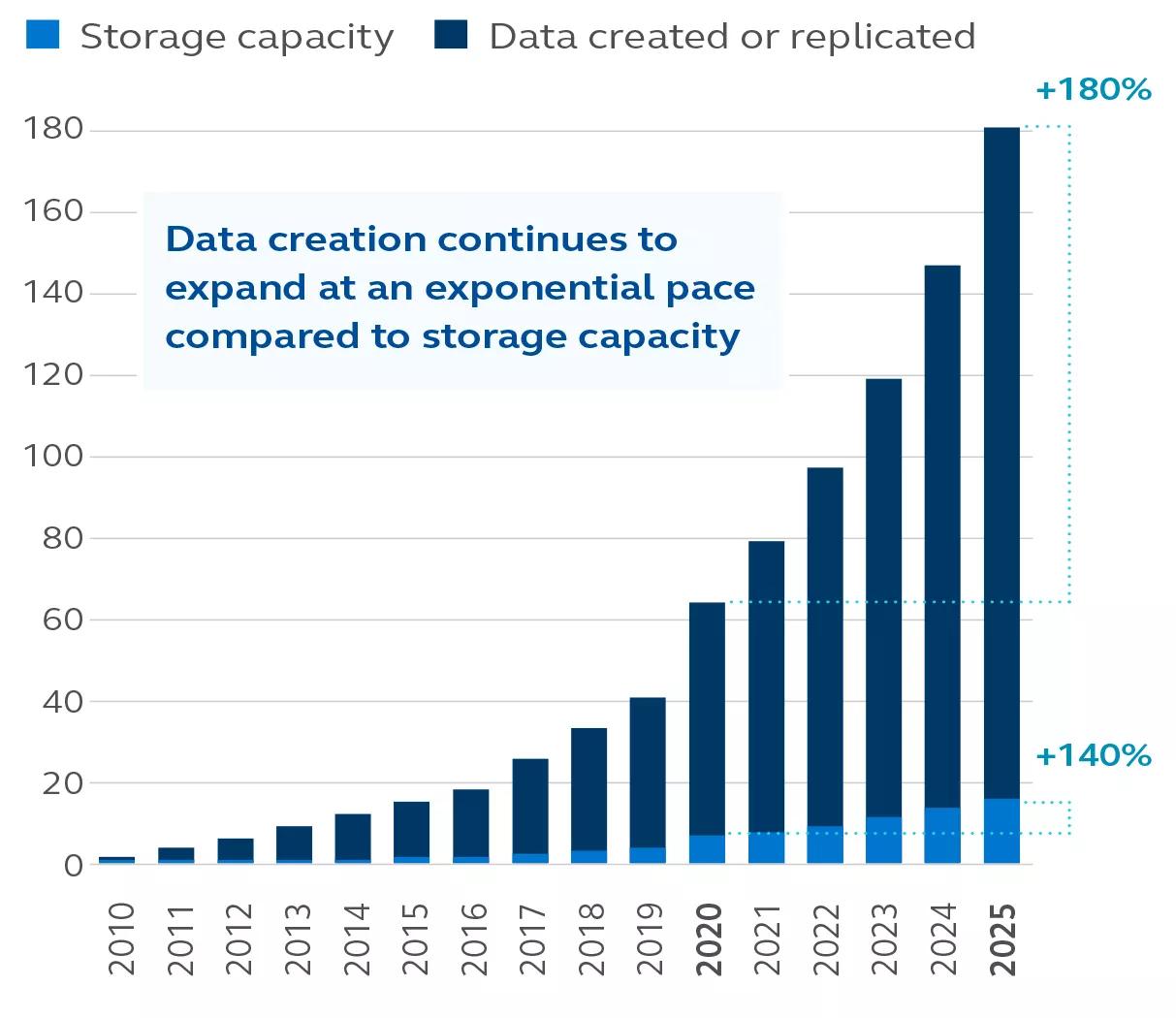

Exhibit 1 shows that the amount of digital data created in 2025 will be nearly ten times the amount of data created in 2015. The adoption of new technologies including personal devices and smart everything, in conjunction with the growing penetration of internet in developing markets are the main drivers behind this exponential growth. IDC, a global market intelligence provider, estimates that the volume of data in the world will pass 180 zettabytes by 2025. For reference, a single zettabyte is equivalent to one sextillion bytes, or a one followed by 21 zeros, enough data to fill 250 billion DVDs. Put simply, that’s a lot of data that will drive significant investments in storage infrastructure.

Exhibit 1: Volume of data generated vs. storage capacity

IDC 2022.

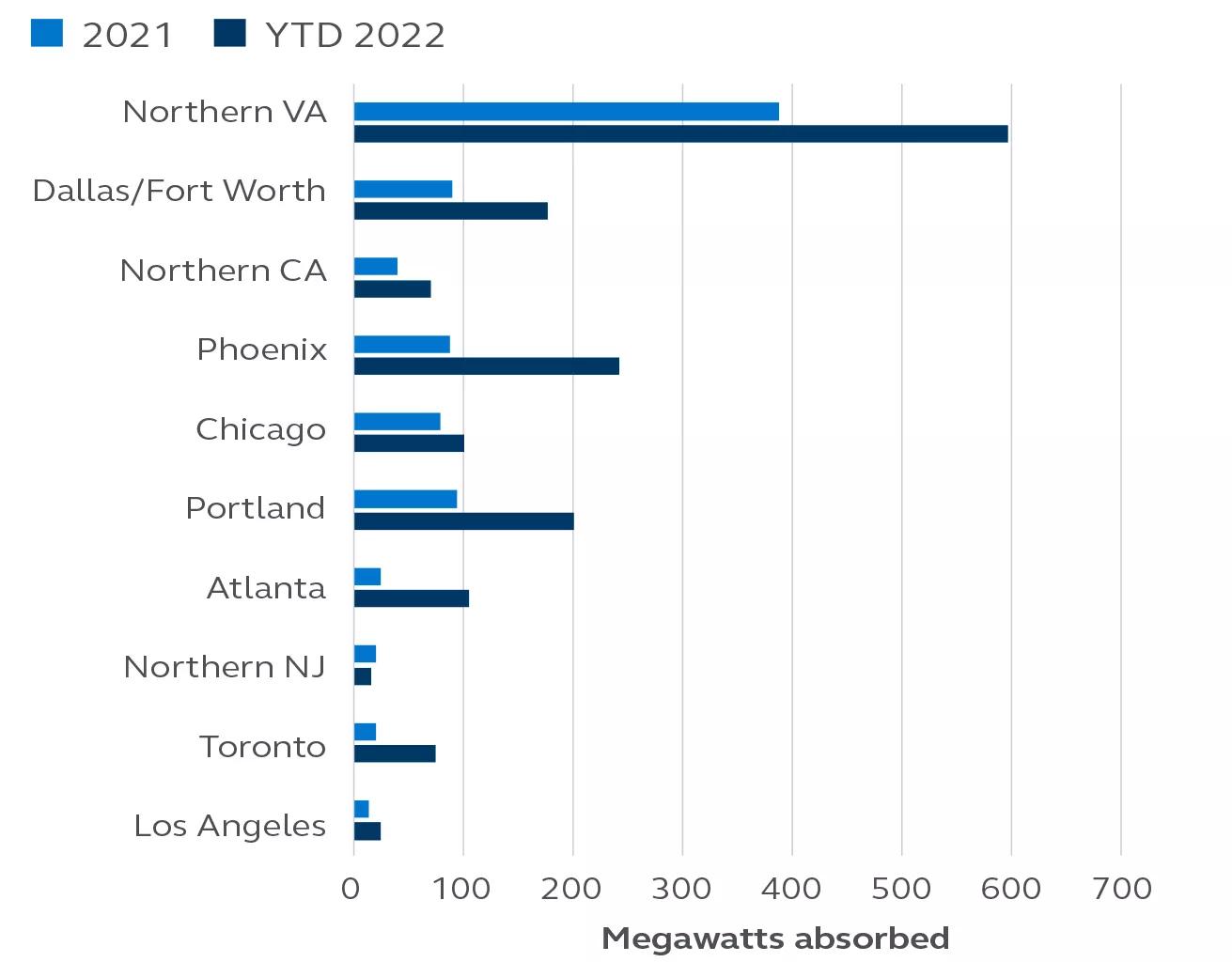

Data centers are attractive in that they occupy physical infrastructure space but are also vital to the virtual infrastructure on which modern society depends. It is an asset class that sits at the intersection of infrastructure and real estate. Tenant demand for existing space continues to increase, with hyperscalers—the largest cloud computing providers—driving near-record demand. Hyperscalers continue to aggressively expand their operations to accommodate end users’ needs, including social media, entertainment, gaming, and cloud services. Absorption of space has accelerated in most key markets, particularly in the largest data center clusters as shown in Exhibit 2.

Exhibit 2: Demand for data centers continues to accelerate

Net absorption by key market through 3Q 2022, megawatts (MW)

datacenterHawk, Principal Real Estate, 3Q 2022.

Demand is far outpacing supply

Growing demand has not been satisfied by the supply side, due in part to power grid limits imposed by local government. While rental growth slowed for a period of time, more recently the industry has seen a return to strong rental growth. Record low vacancy rates in key markets and accelerating demand have shifted the balance of pricing power toward landlords. We anticipate that this shift will result in higher rates and contract escalations going forward. This is important as data center tenants are not immune to many of the same concerns such as rising energy prices, supply chain issues, and labor shortages that are prevalent in other property sectors. Given the lack of supply, hyperscale users are having to compete for key locations and there are limited options for enterprise requirements.

Exhibit 3: Market size and vacancy rate

datacenterHawk, September 2022.

Structural demand is driving investment opportunities

Data centers present a unique opportunity for real estate investors. With growth and defensive attributes, the data center industry has proven resilient in both economic downturns and periods of economic expansion. Low correlations to other assets, a favorable risk/return profile, and new liquidity from institutional capital make data centers a portfolio component worth considering. Longer leases, many times in excess of 10 years, also make data centers attractive giving investors exposure to cash flows from high-quality credit tenants at higher yields than most other property types.

For long-term investors—particularly those aiming to fund obligations by matching income and liabilities— stabilized data centers may offer some inflation mitigation—an attractive benefit given today’s inflationary environment. Further, while sourcing opportunities in growth sectors during economic uncertainty is challenging, data centers are among the few areas where the structural growth story is intact.

The options to gain investment exposure to the data center sector are scarce due to limited offerings—core investments rarely trade and the pool of highly-technical developers who have capacity to build hyperscale datacenters is thin.

Investors who are able to partner with a strong developer may potentially achieve both an enhanced return and continued access to this sector, which is primed to further strengthen due to a number of factors, including the continued supply and demand imbalance, tenant preference to do repeat business with existing developers, increased headwinds to procure suitable sites with necessary power and fiber, and the long lead time on equipment necessary to commission a data center. All of these aspects point to the valuable opportunity in the develop and lease-to-core strategy, which we believe will prove advantageous for both tenants and investors going forward.

Attributes to focus on

While the technology supported by data centers has advanced rapidly, from a real estate perspective, most of the important requirements have remained unchanged. We believe key attributes of these assets include:

Location: As with all real estate investing, location is critical. The ideal data center location offers:

- Dependable access to low-cost power

- Proximity to a large population

- Fiber connectivity

- Low risk of natural disasters

- Sales tax incentives

Given the importance of these criteria, a handful of markets have emerged as more dominant than others, including: Northern Virginia, Dallas, Northern California, Phoenix, Chicago, Portland, Atlanta, and Austin/San Antonio.

Facility: Because these assets host critical applications, they’re constructed with zero tolerance for downtime. They must offer multiple layers of protection, including:

- Structurally enhanced walls, floors, and roofs

- Multiple sources of power from multiple substations, as well as backup power through generators

- Temperature- and humidity- controlled environment with air handler components

- Controlled access with 24x7 security, mantraps, and biometric screening

Importance of experience in execution

Given the highly specialized and niche nature of the data center industry, we believe experience and access are critical to successful execution. As an active commercial real estate investor for more than 60 years4— including more than 14 years in the data center sector—we have witnessed the asset class evolve and adapt to the changing needs of occupiers. Our experience has resulted in a favorable track record and meaningful industry relationships:

- A top-10 global real estate manager with a fully integrated real estate platform.5

- Over 440 total development and value-add projects since 2001, valued at nearly $25.1 billion. Invested more than $2 billion in 20 data center transactions.6

- Our substantial equity and debt business gives us a distinct perspective of real estate and capital markets.

- In-house expertise in responsible property investing and ESG - data centers have many unique development, operational, maintenance, security, and energy requirements.

- Demonstrated ability to source and close significant volume of high-quality investments.7

- Able to source experienced partners that bring significant technical and location-specific expertise, as well as ability to attract strong tenants.

1 BusinessWire, Data Creation and Replication Will Grow at a Faster Rate Than Installed Storage Capacity, March 24, 2021; IBM.

2 Statista, July 2022.

3 datacenterHawk, September 2022.

4 Principal Real Estate Investors became registered with the SEC in November 1999. Activities noted prior to this date were conducted beginning with the real estate investment management area of Principal Life Insurance Company and, later, Principal Capital Real Estate Investors, LLC, the predecessor of Principal Global Investors Real Estate.

5 Managers ranked by total worldwide real estate assets (net of leverage, including contributions committed or received, but not yet invested; REOCs are included with equity; REIT securities are excluded), as of 30 June 2022. “The Largest Real Estate Investment Managers,” Pensions & Investments, 3 October 2022.

6 Based on gross asset value as of 31 December 2022.

7 Past performance is not indicative of future results and should not be relied upon to make an investment decision.

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted. Investing involves risk, including possible loss of principal.

This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorised and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act (2001). This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM13209 | 01/2023 | 2639218-122024