The details

The Mortgage Bankers Association released its 2Q25 Commercial/Multifamily Mortgage Debt Outstanding Report on September 23, 2025.

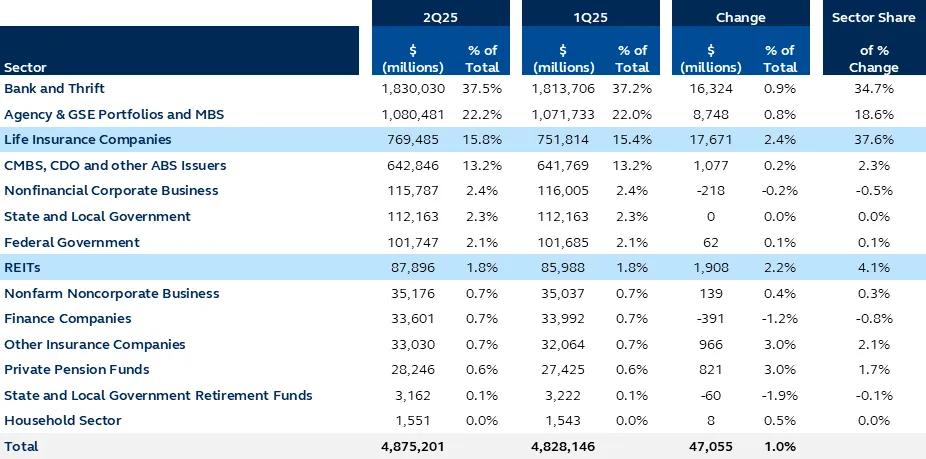

The level of commercial/multifamily mortgage debt outstanding increased by $47.1 billion (1%) in the second quarter of 2025, bringing the total debt outstanding to about $4.88 trillion. Within that, multifamily mortgage debt alone rose by $27.7 billion (1.3%) to $2.19 trillion from the first quarter of 2025. This implies that core commercial mortgage debt increased by $19.4 billion (0.7%) to approximately $2.69 trillion compared to the prior quarter. This is consistent with the Mortgage Bankers Association’s 2Q25 Survey of Commercial / Multifamily Mortgage Banker Originations, which previously showed that originations rose 48% quarter-over-quarter and 66% year-over-year.

Among the largest lenders, life insurance companies and REITs experienced the greatest quarter-over-quarter increases in total commercial/multifamily mortgage debt outstanding—up 2.4% and 2.2%, respectively. REITs had the largest increase in the prior quarter, underscoring the growing importance of debt funds in commercial real estate lending markets.

Only three lender types saw quarter-over-quarter declines:

- Nonfinancial Corporate Business (-0.2%)

- Finance companies (-1.2%)

- State and Local Government Retirement Funds (-1.9%)

However, it’s important to note that these lender categories represent relatively small portions of the total mortgage debt outstanding—just 2.4%, 0.7% and 0.1%, respectively.

Notably, banks and thrifts continue to increase their total outstanding mortgage debt holdings by 0.9%, now accounting for 37.5% of the total market. This trend is likely driven by large banks, as the Federal Reserve’s Senior Loan Officer Opinion Survey indicated that large banks reported stronger loan demand in the second quarter, while smaller banks experienced weaker demand.