Most commercial real estate construction in the U.S. is showing signs of slowing as elevated interest rates continue to put the clamps on available capital. However, manufacturing facilities construction is a notable exception—with spending levels in the property sector more than double what they were a year ago. The surge in onshore manufacturing construction gives investors an important look into the state of globalization and highlights the most appealing potential opportunities within real estate today.

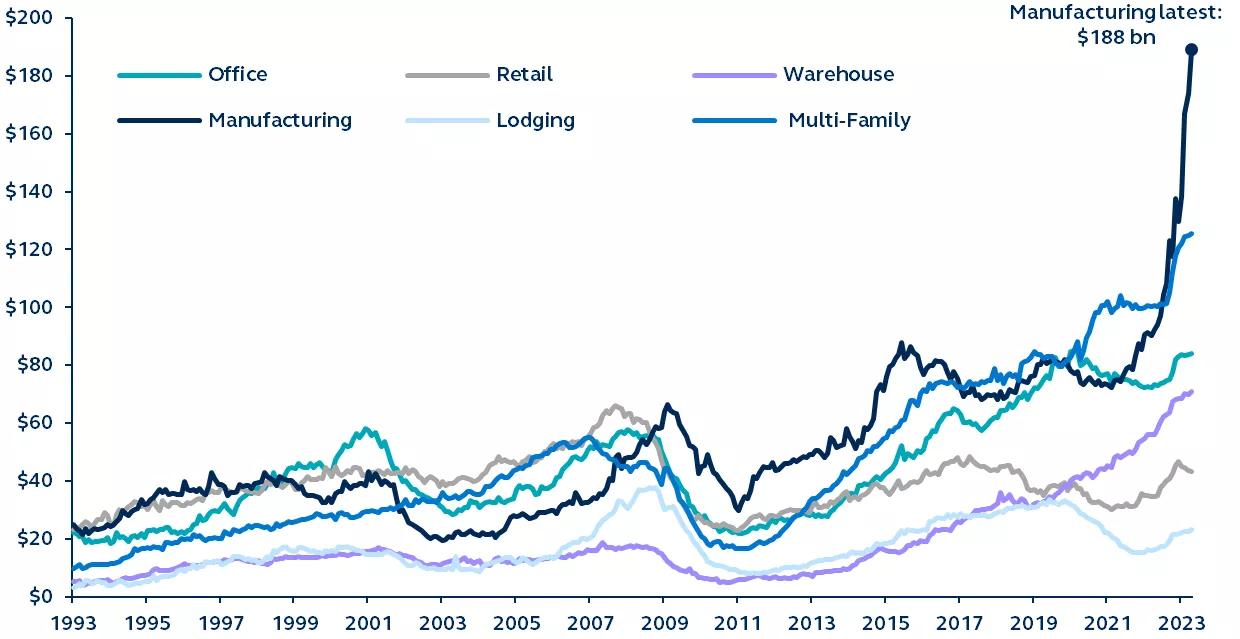

Construction spending on commercial real estate in the U.S.

Construction Put in Place (c30), billions, SAAR, 1993–present

Source: U.S. Census Bureau, Construction Spending, Principal Real Estate. Data as of June 1, 2023.

Despite a U.S. economic landscape that includes higher interest rates, regional bank failures, and constrained capital available for real estate transactions, private spending on manufacturing facilities is surging. In April, construction put in place for manufacturing facilities increased by 8.7% over its March figure, and is up 104.6% in the last year. At the same time, construction spending across other property sectors rose just 0.7% last month (23.5% year-over-year) and appears to be slowing.1 Although the lead time associated with planning and development means that construction is a lagging commercial real estate indicator, the surge in current construction spending on manufacturing provides an important read on the state of globalization.

- While globalization isn’t dead, there seems to be a shift in the mindset of U.S. companies that now intend to increase the domestic production of goods that had previously been produced offshore.

- Additionally, the emerging trend in capital flows toward constructing new manufacturing plants is a crucial step in modernizing the domestic supply chain.

For investors, the growth in onshore spending creates investment opportunities across equity and debt within the real estate sector. In particular, investments in industrial manufacturing facilities and warehouses, that enable the flow of newly produced domestic goods, will hold increased appeal. A renaissance in U.S. manufacturing may be on the horizon.

1 Other property sectors include office, retail, warehouse, lodging, and multi-family.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Potential investors should be aware of the risks inherent to owning and investing in real estate, including: value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2978689