After a turbulent and unexpected 2023, there is widespread concern that commercial real estate will face additional challenges in 2024. While the office sector may remain vulnerable, other sectors remain well-funded and will be supported by a constructive economic backdrop, setting the stage for a transformative year in commercial real estate.

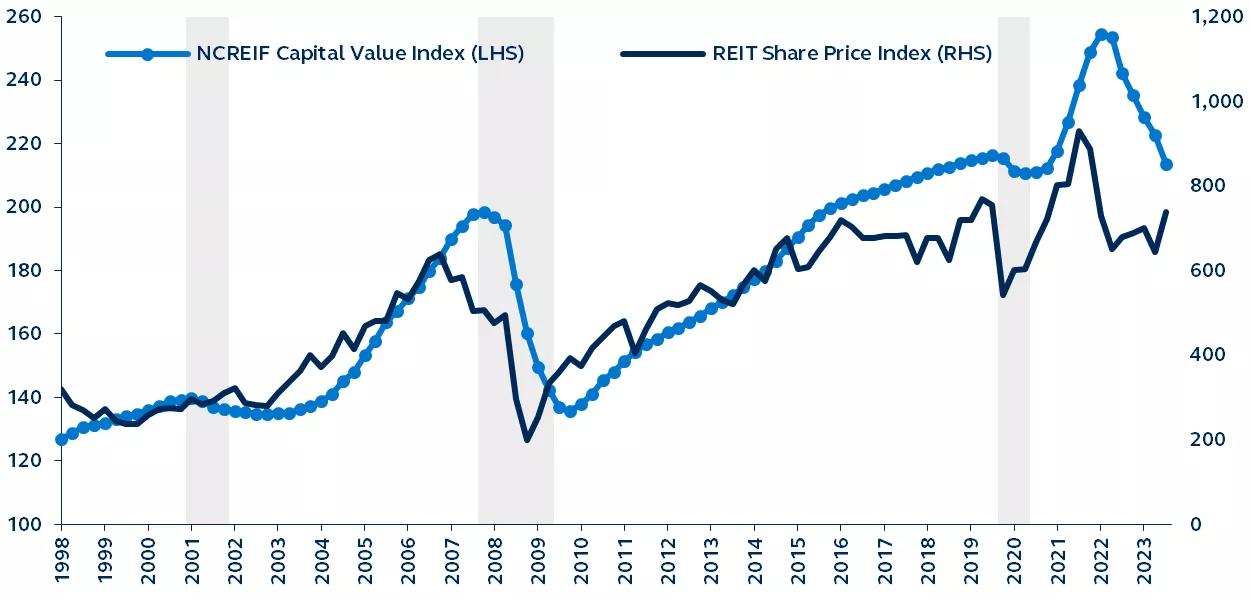

U.S. equity REIT share price and NCREIF (NPI) capital value indices

Rebased to 100 at 1977Q4, recessions are shaded

Last year, commercial real estate (CRE) faced its most challenging year since 2009, impacted by the Fed's policy tightening and the regional banking crisis. Consequently, a significant withdrawal of debt capital led to a sharp drop in property sales. The CRE market now faces heightened refinancing risks, with $1.2 trillion of debt maturing by 2025 amidst tough lending conditions and higher interest rates.

While the maturity wall is undoubtedly significant, the overall refinancing risk to the CRE market should be relatively well contained for three reasons:

- Given the potential contagion impact in CRE, policymakers are keen to avoid additional stress on the financial system, and would be quick to head off any periods of illiquidity and distress in both CRE and banks.

- A resilient U.S. economy is supporting tenant demand across CRE.

- Although nearly 20% of the CRE debt scheduled to mature in 2024 is in the challenged office sector, others, such as apartment (more than 30% of the outstanding debt), enjoy stronger fundaments and more secure liquidity.

Given the sector-specific nature of CRE, and the extremely attractive valuations compared to prior years, the main determinant of CRE performance in 2024 will likely be the durability of the economic expansion, rather than refinancing risk. If the Fed can pivot to an easing cycle against the backdrop of ample liquidity and positive economic growth, 2024 could provide a transition point for the CRE market.

Read more about what lies ahead for commercial real estate in our latest market bulletin, Commercial real estate: Debt maturities and investment opportunities.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3382067