U.S. multifamily starts (5+ units) per 1000 households

Annualized monthly data

In the second part of our Living Sector Series, we focus our attention on apartments, which we believe to be among the most dynamic of all commercial real estate sectors today (See Part 1: Growth and diversity in the living sector). Although apartments and multifamily rentals were once the primary form of investing in the institutional housing sector, the residential market has become larger and more diverse over the past decade. That said, apartments still represent a key subsector of the broader rental market and offer investors several interesting tactical and strategic opportunities.

In this paper, we will focus on the apartment sector in the U.S. and Europe, with an emphasis on the moderately priced, or affordable segment of the market, which we believe offers the most broad-based exposure to renter demand due to shifting demographics and income distribution.

Over the past 12 months, demand for apartments has remained near record levels across key strategic markets and vacancy rates are well within their equilibrium ranges. Strong rent growth since the start of the pandemic has continued to fuel impressive NOI growth as leases have continued to roll up to market asking rents. Since 2020, U.S. apartment rent growth has averaged 5.6% on an annualized basis, and in Europe that figure is 3.7%. The impact of mark-to-market rents with more frequent rollovers than other property sectors and low vacancy rates have translated into annual NOI growth in the low double digits.

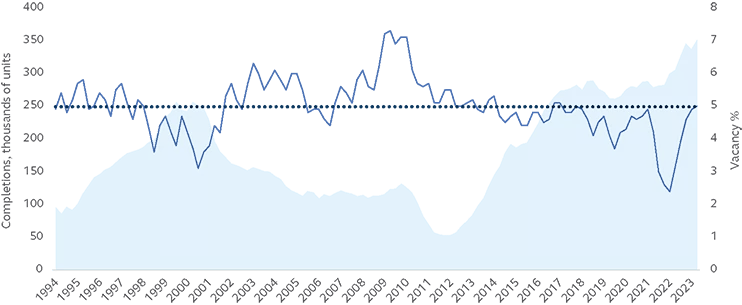

If there has been a question mark regarding the apartment sector in both regions, it has been the high levels of development. In the U.S., the pace of new deliveries has pushed vacancy rates up toward their long-term historical averages for institutionally managed properties (Exhibit 1).

EXHIBIT 1: High levels of development have pushed vacancy rates higher in the U.S.

U.S. multifamily construction and vacancy

Source: CBRE EA, Principal Real Estate, Q2 2023.

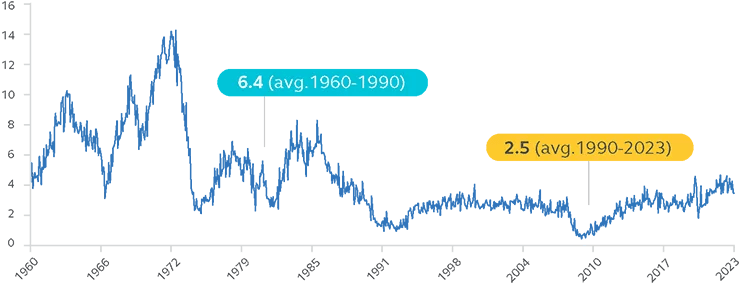

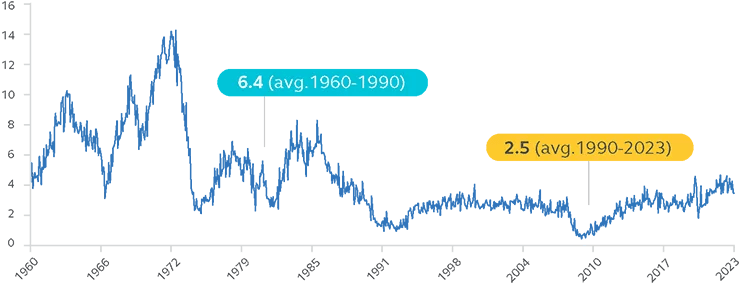

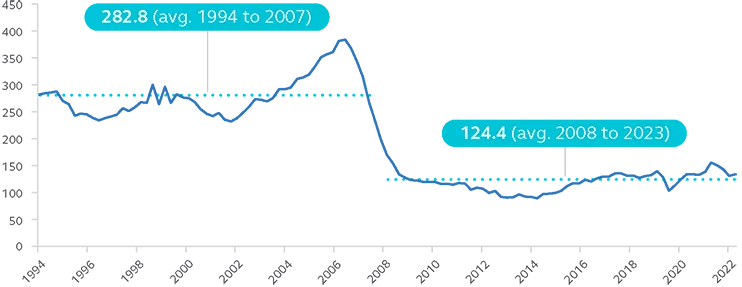

Recent supply and demand trends may be somewhat misleading, however. Despite an increasing number of projects that are under construction, apartment units have been under-delivered over the past decade. Consequently, there has been a shortage of housing which has resulted in an affordability crisis in many major cities for both the rental and for-sale markets. In the U.S. for example, Exhibit 2 (left chart) shows that since 1990 only 2.5 new multifamily units have been built for every thousand households—well below the average of 6.4 between 1960 and 1990. In Europe as well (right chart), construction permits issued for residential dwellings have yet to recover to their pre- Global Financial Crisis (GFC) levels.

EXHIBIT 2: We have not been building enough apartment units

U.S. multifamily starts (5+ units) per 1000 households

Annualized monthly data

Construction permits issued for residential buildings in the Euro Area

Index 2015=110, Seasonally adjusted

Most major markets in the U.S. and Europe are now facing a housing deficit with many needing more units to accommodate population growth than are currently being supplied. In fact, a research report from Freddie Mac—a U.S. government sponsored entity founded to provide liquidity to the residential sector— recently stated the U.S. needs an additional 3.8 million housing units to meet current demand growth.1 In Europe, the construction of new residential buildings is also unable to keep up with demand. The German Property Federation for example has reported that the deficit of housing in the country has reached its highest level in 20 years and that by 2025 the shortage may increase to 700,000 flats.2 As a result, across both sides of the Atlantic, the outlook for current landlords and developers remains positive and suggests that secular demand through demographics will provide a steady flow of new renters looking for space.

To get our full perspective on demographics driving apartment demand, affordability trends and middle-income investment strategies, download The Apartment Sector: Increasing demand for affordable living (PDF).

1 Freddie Mac, May 2021

2 Reuters, February 2023

For Public Distribution in the United States. For Institutional, Professional, Qualified, and/or Wholesale Investor Use Only in other Permitted

Jurisdictions as defined by local laws and regulations.

Risk Considerations

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Therefore, the value of the investment and the income from it will vary and the initial investment amount cannot be guaranteed. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. All these risks can lead to a decline in the value of the real estate, a decline in the income produced by the real estate and declines in the value or total loss in value of securities derived from investments in real estate.

Index descriptions: The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account.

Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided. All figures shown in this document are in U.S. dollars unless otherwise noted. This material may contain ‘forward looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is issued in:

• Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/ qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Principal Funds are distributed by Principal Funds Distributor, Inc.

© 2023 Principal Financial Services, Inc. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal Real Estate is a trade name of Principal Real Estate Investors, LLC, an affiliate of Principal Global Investors.

MM13676 | 09/2023 | 3127725-122024