After a tumultuous 2022 for global equity markets, many regions are now offering more attractive valuations. The U.S. and India, however, are the notable exceptions, highlighting the importance of global portfolio diversification during the year ahead.

Global equity returns and valuations

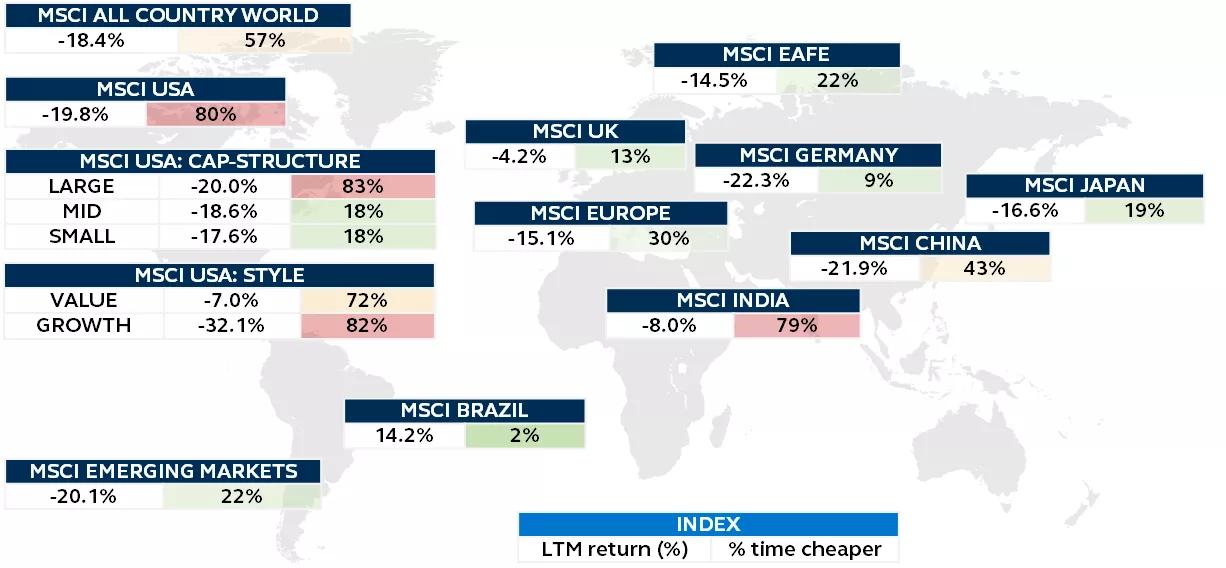

Last twelve months returns and % time cheaper, MSCI indices

FactSet, Bloomberg, MSCI, Principal Asset Allocation. LTM (last twelve months) returns are total return and in USD terms. % Time Cheaper is relative to PAA Equity Composite Valuation history. PAA Equity Composite Valuation is a calculated measure, comprised of 60% price-to-earnings, 20% price-to-book and 20% to dividend yield. Composite started in 2003. EAFE is Europe, Australasia, Far East. Data as of December 31, 2022.

At the start of 2022, global equity valuations were significantly stretched. Following an extremely challenging year which saw some indices drop by 20%, equity valuations have become more attractive, with some global markets even considered “cheap.”

Today, for example, Germany has only been cheaper 9% of the time, and the UK just 13% of the time. In emerging markets, China has been cheaper around 40% of the time, while Brazil has rarely been more attractive.

In the opposite direction, however, two major markets stand out. In India, its relatively small 8% decline last year didn’t pull down valuations as significantly as other global markets. In the U.S., despite a 20% and 32% decline in MSCI large-cap and growth indices respectively, markets have still been more attractive over 80% of the time.

While expensive valuations over the past decade did not present any obstacles on the way up, cheap valuations do not necessarily present any obstacles on the way down—particularly if equity fundamentals remain weak. Watch for region- specific growth outlooks to potentially improve, driven by China’s reopening or falling European gas prices, which, combined with the valuation picture, could prove instructive as to where the best opportunities may lie.

In the year ahead, the looming U.S. recession will weigh on the broad equity market outlook. For investors, however, the relatively attractive valuations outside the U.S. suggest opportunities exist.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2704120