In the coming quarters, many equity analysts expect robust corporate earnings recoveries; an optimistic outlook that has been supportive of strong year-to-date stock performance. However, the current economic backdrop is fraught with uncertainty, and investors may not be appropriately pricing in the strong likelihood of recession in the next 6-12 months.

Today, global central banks remain broadly hawkish, and many leading economic indicators are already in contraction. Europe is teetering on a stagflationary recession, while the world’s growth engine, China, is experiencing deflation. Although U.S. growth appears buoyant for now, its future, and the current global picture, leave earnings resilience far from assured.

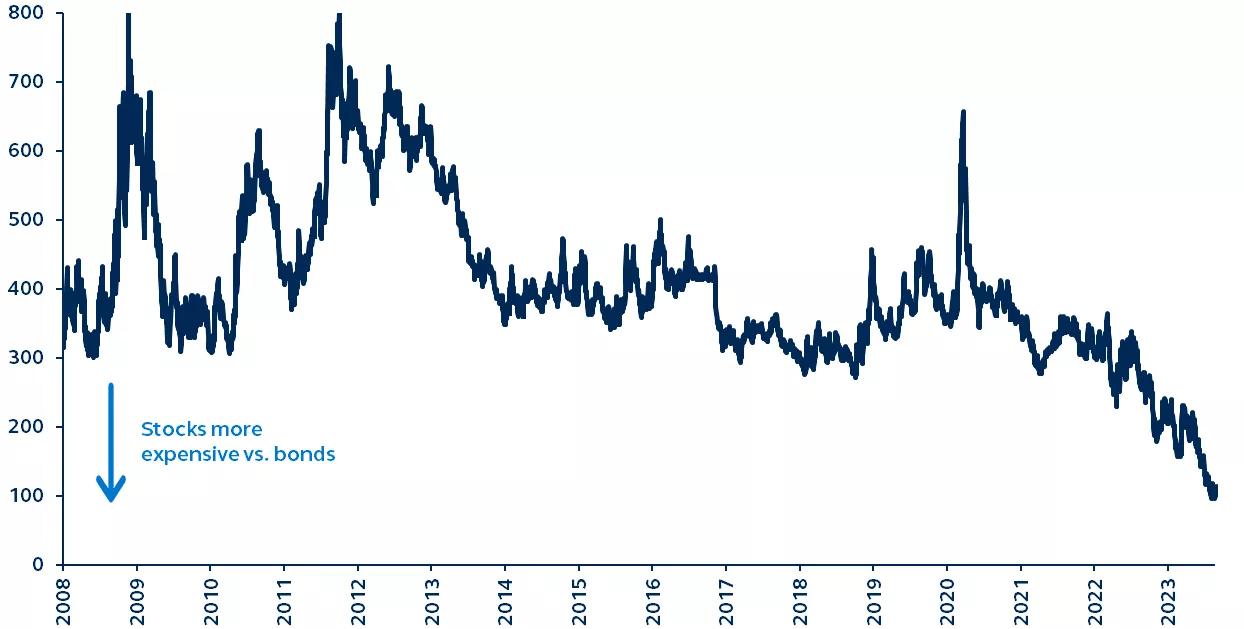

Therefore, given the economic uncertainties, and with the S&P 500 risk premium at its lowest level in nearly two decades, investors are rarely getting adequate compensation in the equity market. In fact, future earnings disappointments seem to be so underappreciated that price-to-earnings multiples remain close to their pre-Fed hiking highs in early 2022—hardly reflective of the current environment and associated risks.

Despite recent U.S. economic resilience, investors should remain alert to an upcoming recession. Increasing allocations to high-quality credit may be appropriate, as bonds now provide an even more valuable portfolio hedge, offering income, capital stability, and diversification, as well as potentially sizeable capital gains once recessionary markers become more conspicuous.