The headwinds that plagued emerging market debt (EMD) for most of 2021 and 2022 have broadly become tailwinds— thanks primarily to swift central bank action that has allowed emerging markets to reach peak inflation and begin leveling off rates faster than their developed market counterparts. With risks to the asset class well exposed and fully priced in, today's EMD offers investors the potential for high income with limited downside and favorable diversification.

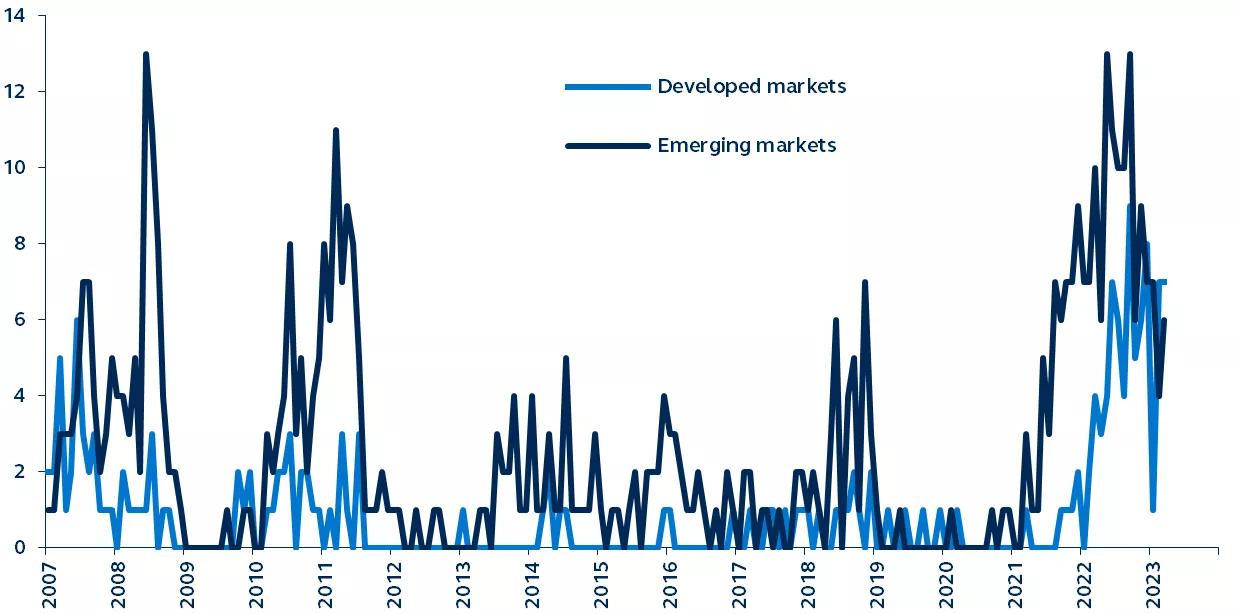

Global central bank policy rate hikes

Count, 2007–present

Source: Bank for International Settlements, Bloomberg, Principal Asset Management. Data as of March 31, 2023.

Emerging market debt (EMD) faced many stubborn challenges in 2022. The post-COVID surge in global inflation, and developed market (DM) central banks’ subsequent scramble to “catch-up”, sent global fixed income assets into a tailspin and strengthened the USD. Furthermore, China’s zero-COVID policy, and its property sector’s serial defaults, hampered economic activity. However, these challenges have largely abated today, and EMD is now reemerging as an attractive option for investors.

- Central banks in most EMs—who began hiking rates in 2021, well before their DM counterparts—are now considering rate cuts from very high levels, potentially providing attractive yields and enhanced returns on local currency bonds. Additionally, in a steadier USD environment, EM currencies will likely begin to regain ground.

- Today, most EM sovereign defaults have already happened and should remain confined to select frontier countries with low systemic importance.

- EM’s growth premium versus DMs will likely be at a 10-year high in 2023 and may increase further in 2024.

- EMD has already seen unprecedented outflows in 2022, leaving the asset class attractively valued and vastly under- owned—likely making EMD one of the most asymmetric trades in global fixed income.

With its risks well exposed and fully priced in, EMD offers investors the potential for high income with limited downside and favorable diversification.

For a deeper dive into the opportunities emerging market debt currently presents, read The case for emerging market debt.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2924431