2022, characterized by soaring inflation and frantic Federal Reserve activity, saw both U.S. equities and bonds record double-digit yearly declines for the first time since the 19th century. 2023, however, is sizing up to potentially be a better year for some segments of the market.

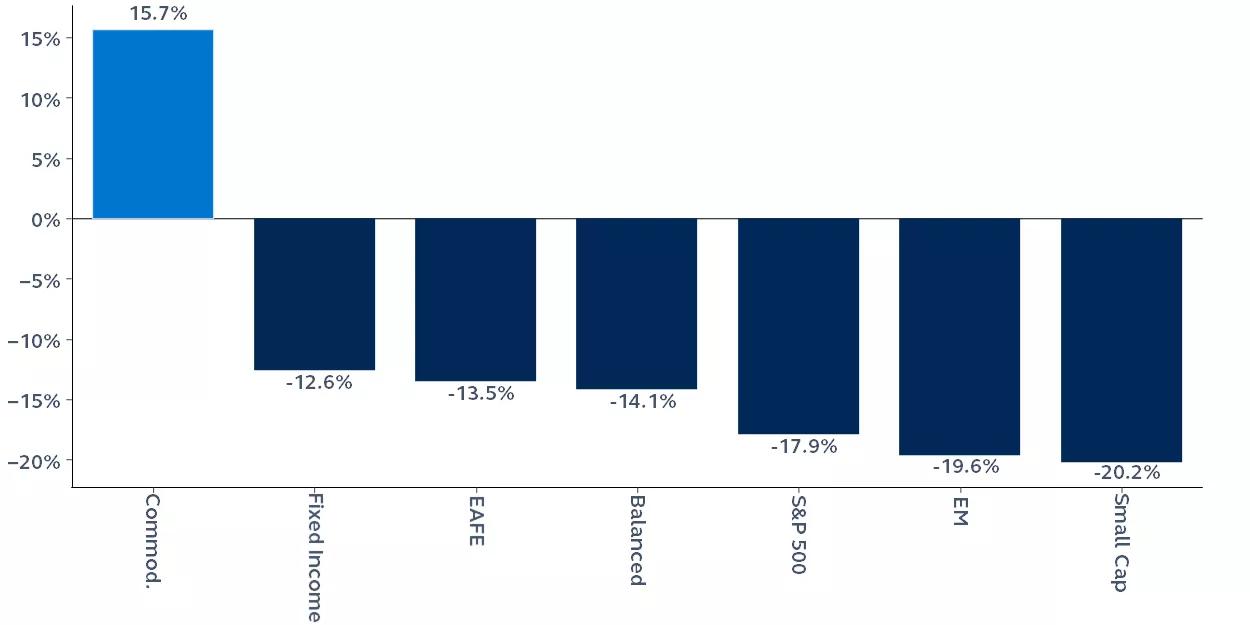

Asset class performance

Total return, year to date

Source: Clearnomics, Standard & Poor’s, MSCI, FTSE Russell, Bloomberg, Principal Asset Management. Data as of December 29, 2022. Commodities = Bloomberg Commodity Index, Fixed Income = iShares Core U.S. Bond Aggregate Index, EAFE = MSCI EAFE Index, Balanced = Hypothetical 60/40 portfolio consisting of 40% U.S. Large-Cap, 5% Small-Cap, 10% International Developed Equities, 5% Emerging Market Equities, 35% U.S. Bonds, and 5% Commodities, EM = MSCI EM Index, Small Cap = Russell 2000 Index. Indices are unmanaged and do not take into account fees, expenses, and transaction costs and it is not possible to invest in an index.

2022 was a difficult year for markets as nearly all asset classes struggled against historic inflation. As of December 29, the S&P 500, Dow and Nasdaq are down 17.9%, 6.7% and 32.4% year-to-date on a total return basis, respectively. The 10-year U.S. Treasury yield began the year at 1.51% and now sits at 3.82%, while the U.S. Dollar, which had surged all the way to 128, has settled back around 104.

One year ago, U.S. equities were at all-time-highs, interest rates were near historic lows, and central banks were only just preparing to hike rates. Mere months later, the 40-year trend of both falling inflation and interest rates had been broken, as the U.S. Federal Reserve began its rate hiking cycle, plunging equities to bear market levels. Unfortunately, 2023 may present similar challenges as persistently restrictive monetary policy and the likely resulting recession will weigh on the broad equity market outlook.

There may be some silver linings in the year ahead, however. Inflation is already starting to decelerate due to improved supply chains and lower energy prices. Global equity valuations are considerably more attractive, and there may also be greater opportunities in core fixed income and real assets as interest rates stabilize. In 2023, diversification across asset classes is recommended; inflation mitigation continues to be necessary; and taking advantage of attractively valued global opportunities will likely be rewarded.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2657763