Markets climbed in the first quarter despite the unexpected banking crisis, with the S&P 500 gaining 7.5% with dividends in the first three months of the year. However, markets are yet to appreciate downside earnings risks and as macro conditions deteriorate, investors should be prepared for the S&P 500 to potentially re-test its September 2022 lows.

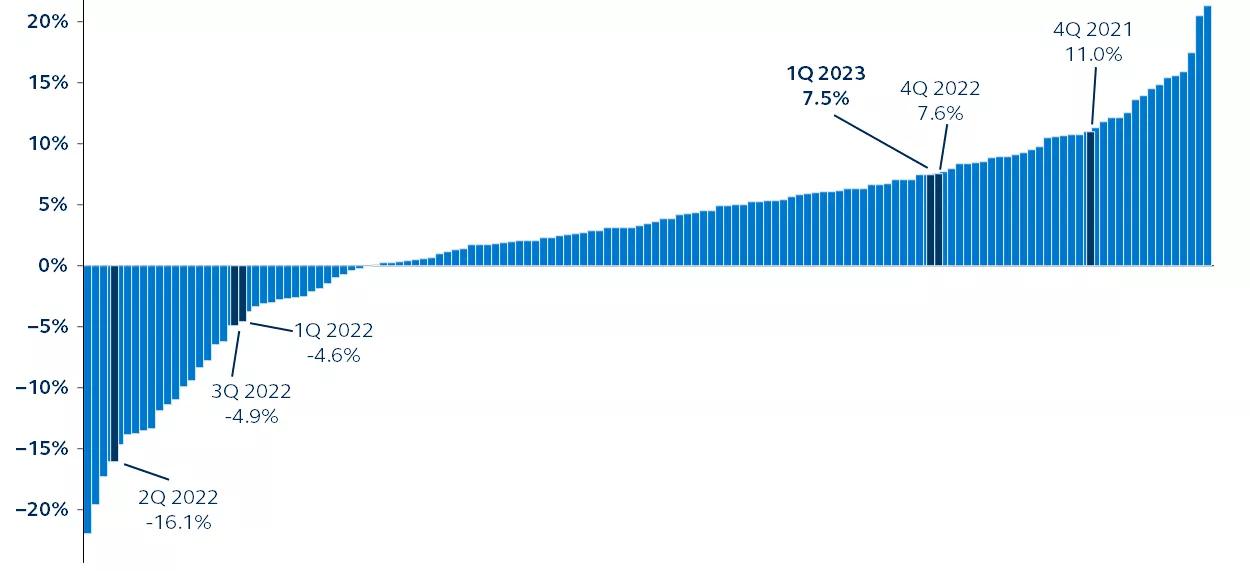

S&P 500 ranked quarterly performance

Price return, 1988–present

Source: Clearnomics, Standard & Poor’s, Principal Asset Management. Data as of March 31, 2023.

The first quarter will be remembered for a banking crisis that unexpectedly presented the Federal Reserve (Fed) with a new dilemma: Cut rates to alleviate market angst and risk spurring inflation higher, or persist with the rate hiking path, but risk spreading the crisis within the broader financial system. Ultimately, the decision to hike rates by 25 basis points at the Fed’s March meeting enabled them to maintain their focus on inflation while also acknowledging the financial stability risks.

Despite the ongoing uncertainty, the S&P 500 gained 7.5% with dividends during 1Q 2023, while the 10-year U.S. Treasury yield fell from a peak of 4.1% in early March to 3.5% at the end of the quarter.

Fed tightening has put significant stress on the economy and, with yield curves inverted, bank profitability has come under pressure. In response, banks are raising credit standards and starting to limit credit flow, weighing on both consumer spending and labor markets. Although U.S. equities have proven resilient, it is reasonable to expect risk assets to be challenged from here, with the remainder of 2023 dominated by earnings and economic growth scares.

Financial conditions will likely tighten further from here as the Fed continues to use its policy rate to target inflation, while using its balance sheet liquidity to target financial stability. High-quality, defensive assets should help minimize vulnerability to these macro-driven threats in the period ahead.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2832250