Policy outlook

While there’s acknowledgement by economists and policymakers that labor demand has been incrementally slowing, concerns have been tempered by a low-firing environment. Last month, however, the two dissents amongst FOMC members revealed increasing worries about labor demand within the committee. The Fed kept the policy rate steady, nevertheless, as Chairman Powell noted that a shrinking labor supply was keeping the labor market in balance.

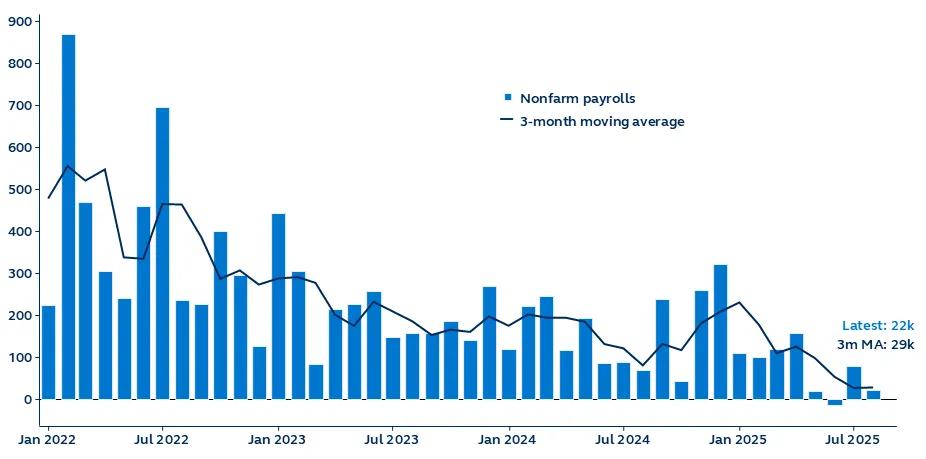

After today’s weak payroll print, a June contraction, and four consecutive months of sub-100,000 gains, a September rate cut is virtually guaranteed. The focus will now likely shift to the magnitude of the cut and the potential for additional reductions. While markets might see a September rate cut as a proactive measure, any further deterioration in the labor market could swiftly change the narrative from viewing rate cuts as stimulative to seeing them as a response to a faltering economy.

Investors should be cautious about interpreting weaker payroll figures as immediate indicators of recession. The deceleration in labor force growth due to tighter immigration policies may obscure increasing slack and help maintain equilibrium in the labor market. As long as layoffs remain limited, even with a potential slowdown in labor demand, the market may continue to perceive rate cuts as strategic efforts to foster growth, rather than reactive measures to economic distress.