While there may be elevated volatility around the midterm elections, the yet-to-be determined outcome and resulting makeup of congress is unlikely to have a meaningful bearing on investment portfolios over the long term. Investors should instead focus on the economics—rising interest rates, elevated inflation, and the looming potential of recession—that will be responsible for market returns in the periods ahead.

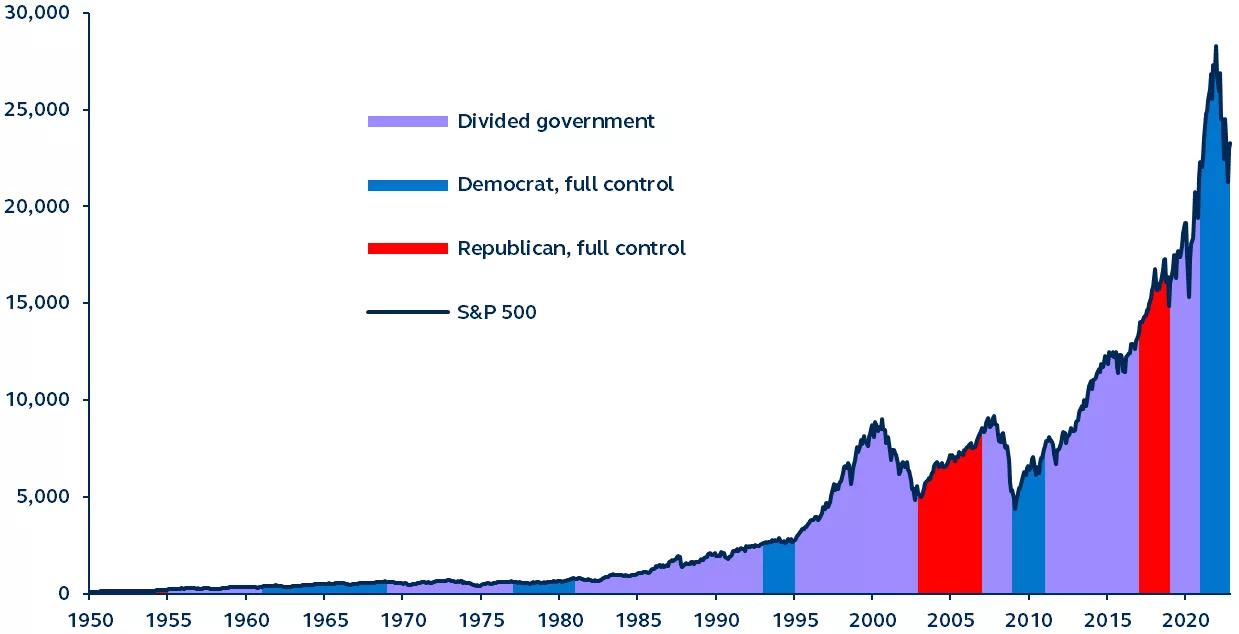

Market performance by U.S. government party control

S&P 500 Index, rebased to 100 at January 1, 1950

Bloomberg, S&P Dow Jones Global Indices, Principal Asset Management. Data as of November 11, 2022.

The results of the U.S. midterm elections are still unclear. The tallied votes so far suggest Republicans are likely to achieve a majority in the House of Representatives, but the Senate is still too close to call. While the wait may be frustrating, whether the Democrats or Republicans win the Senate should be largely irrelevant to the broad market outlook. Instead, key macro dynamics and policy decisions are much more likely to shape portfolios in the period ahead:

- The issue of needing to raise the debt limit by Q3 2023 has garnered some attention. However, regardless of whether Republicans win back control of one or both congressional chambers, a vote to raise the debt ceiling will likely be leveraged to extract spending cuts during negotiations with the White House.

- Continued inflation caution (despite the October inflation surprise) and the prospect of further Fed hikes is laying the groundwork for U.S. recession. Without countercyclical fiscal policy action, risk assets will have to confront this challenging economic backdrop in 2023.

Ultimately, aside from the increased visibility on the political outlook, the outcome of the midterm elections is unlikely to have a meaningful and sustained impact on markets. Instead, it is historically elevated inflation, the Fed’s inflation response, and the resulting risk of recession, coupled with key structural policy decisions, that will determine the market’s direction.

Want more on this topic? Read The U.S. 2022 midterms elections: Implications for investors.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2589280