Many investors are likely keeping a close eye on the upcoming mid-term elections and what the potential outcomes might mean for their portfolios. Historically, however, both midterm elections, as well as the political makeup of the subsequent U.S. government, have very little impact on market performance.

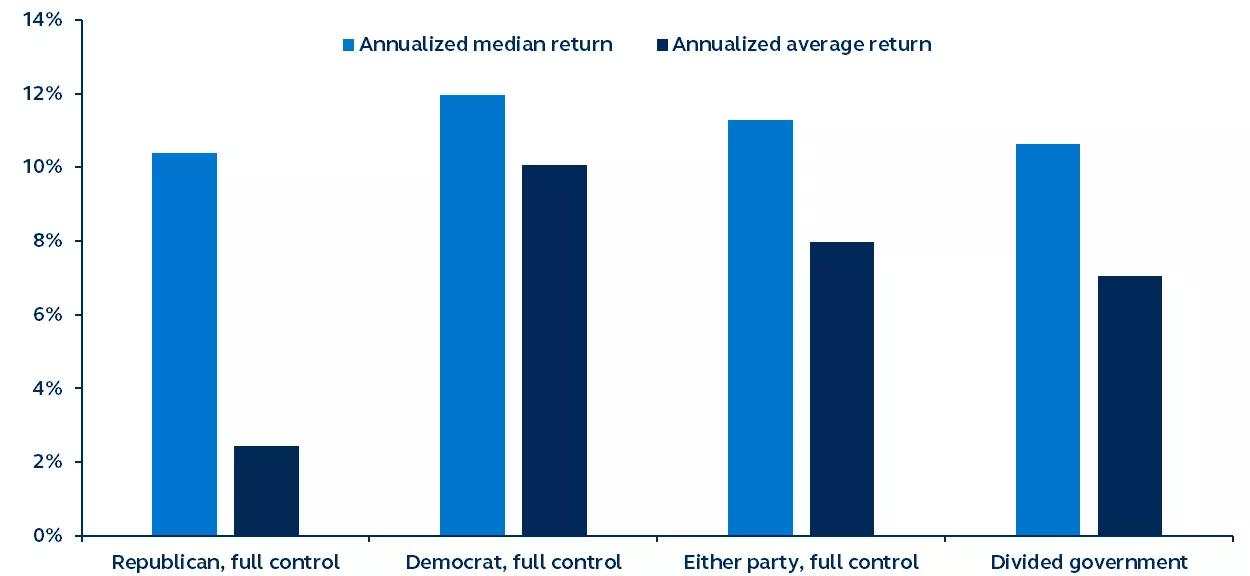

Equity market performance by government control

S&P 500 price returns, 1928-July 2022.

Bloomberg, Principal Asset Management. Assumes being wholly in or out of the market based on political control. Data as of October 13, 2022. Note: A Republican controlled government had a lower average return over the analysis period, but this was skewed significantly lower by the Great Depression period. The median return, on the other hand, was meaningfully higher.

The U.S. mid-term elections are less than a month away. According to polling data analysis website FiveThirtyEight, as of October 13, Republicans have a 70% chance of gaining control of the House, while Democrats have a 67% chance of controlling the Senate. Although a divided government is still the most likely outcome, it is certainly not assured.

While the three months and six months after an election tend to be marked with strong equity market performance (up on average 6% and 11%, respectively)1, this positive market reaction is most often attributable to the resolution of uncertainty, rather than a response to any specific policy agenda or election outcome. Indeed, the make-up of the government—be it divided or unified, Democrat or Republican controlled, a shift in power or reinforcement of the status quo—does not have a statistically significant impact on market returns.

Therefore, rather than allowing political uncertainty to dictate investment decisions, investors should be focused on the economics that will be responsible for market returns in the periods ahead. Today, it is inflation, the Fed’s response to elevated inflation, and resulting risk of recession, that will be what determines the market’s direction over the coming quarters.

Tune out the political noise: It’s the economics that will be the key long-term driver of market performance.

1Analysis is over the time period 1928 through July 2022.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2475568