The Fed’s aggressive 50 basis point rate cut, while unconventional, reflects a proactive approach to stave off any potential economic weakness. Despite associations of such large cuts with crises, today's economic backdrop remains resilient. With recession risks receding and a favorable historical pattern during non-recessionary rate cutting periods, investors have reasons to remain cautiously optimistic about the market’s near-term outlook.

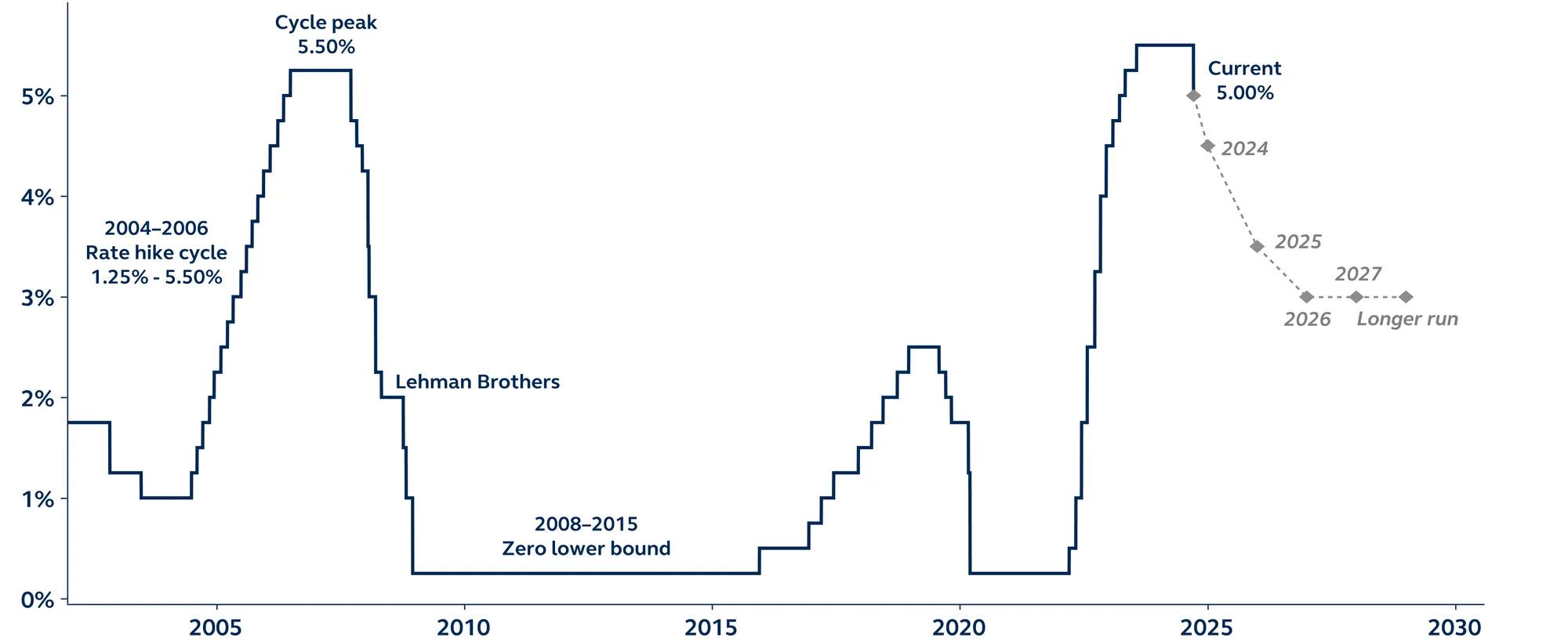

Federal funds rate

Target range upper limit and FOMC forecasts

The Federal Reserve’s (Fed) decision to kick start its rate cutting cycle with an unusually large 50 basis points reduction of the benchmark policy rate appears designed to pre-empt any significant economic weakness and signals that this Fed will go to historic lengths to secure a soft landing.

Since the late 1980s, when Fed policy shifted away from large swings in policy rates and became more stable and credible, 50bps cuts have become associated with crises and recession. As a result, moves of this size typically prompt major market angst as investors begin to price in economic and financial disaster.

Today, however, there are no financial strains, and no asset price bubbles bursting, while economic growth, although slowing, remains supported by robust household and corporate balance sheets. Rather, the 50bps cut appears to have been driven by a combination of growing confidence around the inflation outlook, a desire to prevent job layoffs from materializing, and is an indication of the Fed’s commitment to not fall behind the curve. With a sequence of rate cuts on the way, recession risk has receded, and markets are responding positively.

Since 1985, five of the best 10 years for the S&P 500 came when the Fed was cutting interest rates without recession. Stretched valuations may temper U.S. equity gains this time, but the historical perspective suggests investors have good reason to be cautiously optimistic.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3875795