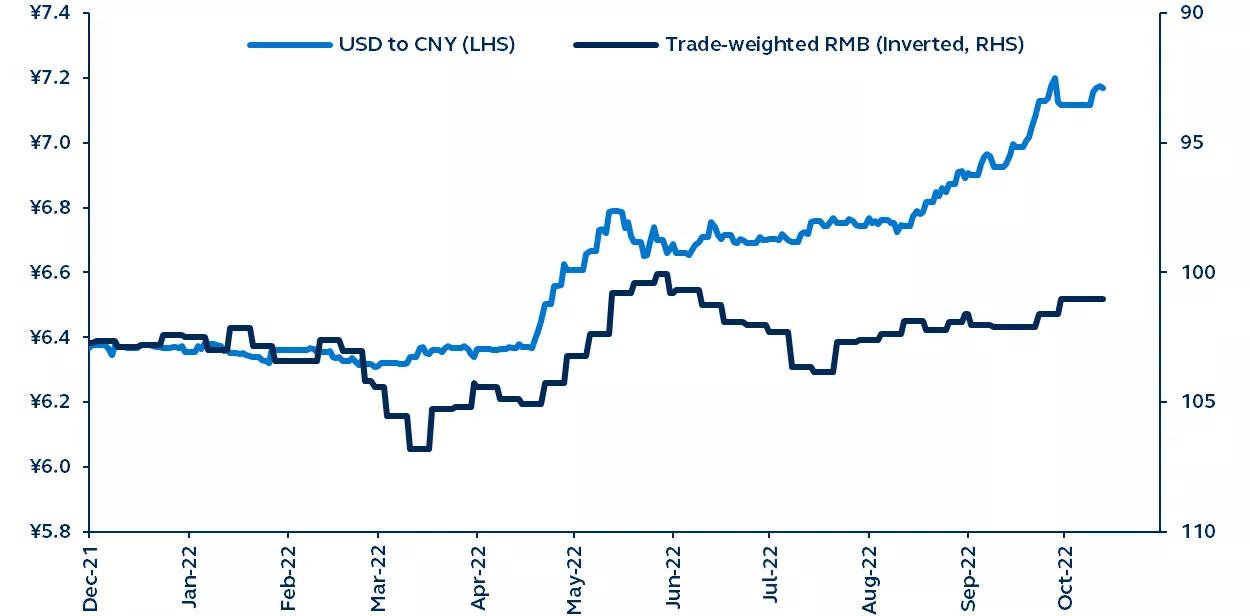

The U.S. dollar’s relentless rally has brought fresh concerns to Chinese policymakers as disorderly currency movements could derail the economic recovery and fuel capital flight. Nonetheless, the renminbi’s resilience against key trading partners, strong trade flows and the Chinese central bank’s robust FX toolkit should help China withstand the present currency weakness until the dollar peaks.

U.S. dollar vs. Renminbi

December 2021–present

Bloomberg, Principal Asset Management. Data as of October 13, 2022. Note: Trade-weighted RMB is the CFETS RMB index, the official trade weighted RMB index against a basket of foreign currencies authorized by PBoC.

The hawkish Federal Reserve (Fed) is supercharging the U.S. dollar, pushing it to a 20-year high and curtailing the ability of other global central banks to effectively stabilize their economies.

China is no exception. With the People’s Bank of China (PBoC) trying to keep monetary policy loose, the yield differential between the U.S. and China has turned firmly in favor of the greenback. China’s continued restrictive COVID policy has also significantly hurt confidence, further reducing the relative attractiveness of the renminbi—contributing to a 6% depreciation against the U.S. dollar in just the last three months, and also prompting capital outflows.

While concerning, the situation is not as dire as it may appear. The renminbi has held steady against the currencies of China’s major export rivals, and trade flows have remained strong, partially offsetting capital outflows. Policymakers are also deploying measures aimed at limiting further RMB depreciation. Increasing onshore foreign currency liquidity, and curbing currency speculation via increases to the risk reserve ratio, jointly suggest a disorderly depreciation of the RMB is unlikely. As such, the PBoC should be able to ride out the present currency weakness until the U.S. dollar peaks, potentially when Fed policy rates peak early next year.

Nonetheless, challenges could still emerge next year if shrinking global demand results in slowing export growth, renewing downward pressure on the renminbi. A storm cloud be forming on the horizon.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2525382