The U.S. dollar has been surging in 2022, with higher interest rates, a more hawkish central bank, stronger economic prospects, and global safe-haven flows all fuelling its ascent. A weaker dollar would loosen financial conditions and enable a global risk rally. However, it would likely take both an improvement in the global growth outlook, especially relative to the U.S., and a period of Federal Reserve rate cuts, for this to occur. It is reasonable to suggest that this bull will likely continue into 2023.

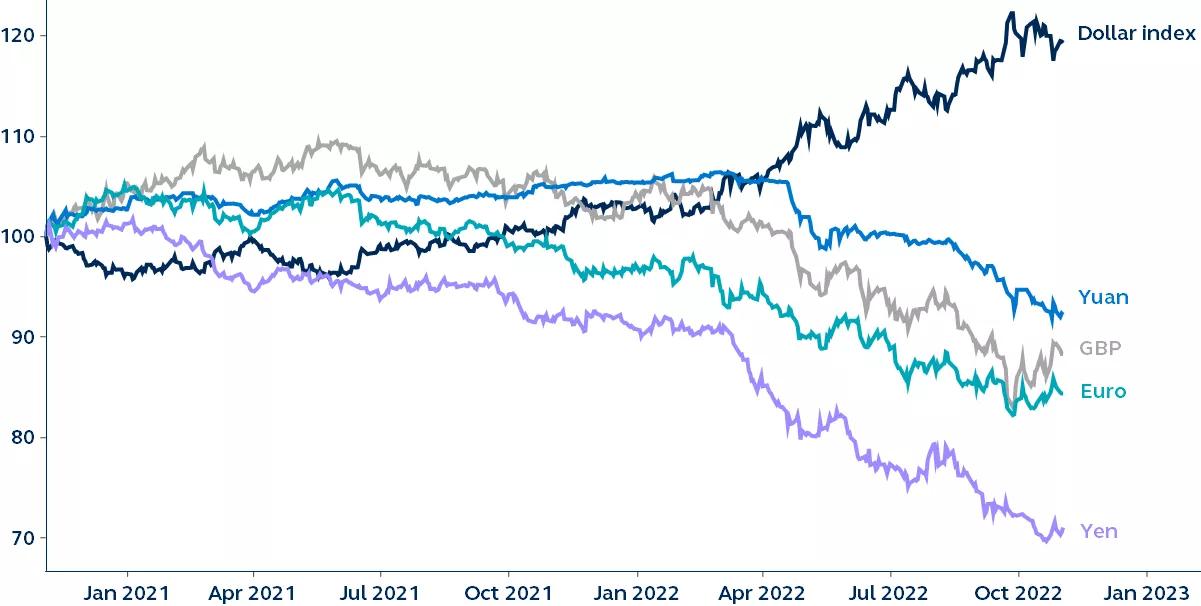

Major currencies vs. the U.S. dollar index

Relative change over last 24-months. Rebased to 100 at November 1, 2020

Bloomberg, Principal Asset Management. Data as of November 2, 2022.

Amid current economic and geopolitical uncertainty, the U.S. dollar has enjoyed strong returns in 2022, sending the U.S. dollar index (DXY) to levels unseen in over 20 years. Year-to-date, it’s up 13% vs. the euro, 17% vs. pound Sterling, and 22% vs. the yen. This has important implications for international portfolios and, being the world’s reserve currency, also for global financial conditions.

So, what’s driving the dollar higher? In recognition of domestic vulnerabilities, some central banks have recently slowed their pace of rate hikes—in contrast to the solely inflation-focused Federal Reserve (Fed), which is now widely expected to raise rates above 5%. Consequently, higher interest rates in the U.S. have continued to attract global capital flows seeking higher returns. As global economic risks further emerge, the dollar will likely continue to be considered the best safe haven to withstand growth setbacks in both Europe and Asia.

Although a dollar peak may arrive when the Fed does eventually slow its monetary tightening path, this alone may not be enough to trigger substantial dollar depreciation. In the past, it has also required an improvement in the global growth outlook to drive a dollar reversal. Therefore, while the dollar’s valuation remains stretched—the drivers of its strength are not yet exhausted. Investors can expect the dollar surge to likely continue well into 2023.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2575282