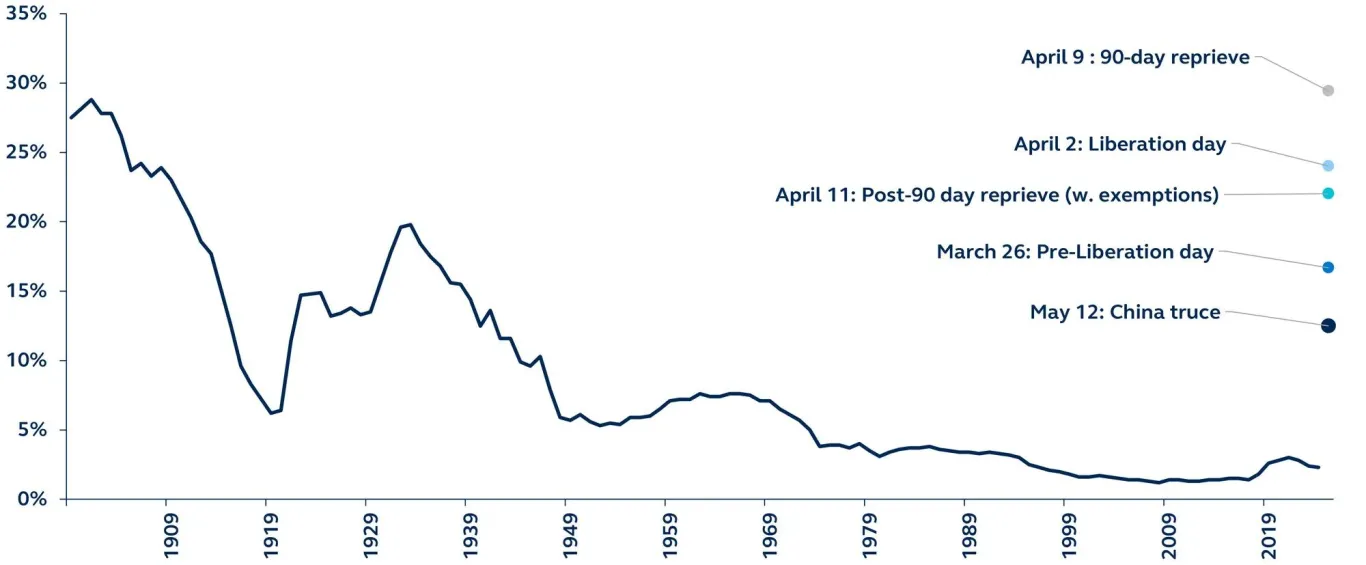

The U.S.-China tariff truce marks a significant, albeit temporary, de-escalation in trade tensions—one that meaningfully reduces recession risks and helps stabilize near-term investor sentiment. Still, the policy path ahead remains highly uncertain. While the worst-case scenario may be off the table, the long-term implications for global trade and portfolio positioning are far from settled, especially considering tariffs are still higher compared to where they were at the start of the year.

U.S. average effective tariff rate and projections

Source: Bloomberg, Principal Asset Management. Data as of May 12, 2025.

The 90-day tariff truce between the U.S. and China marks a significant, if temporary, easing of tensions that have weighed heavily on global markets since the start of the year. As both countries scale back punitive tariffs—U.S. rates dropping from 145% to 30%, and China’s from 125% to 10%—investors have responded with relief, sending risk assets higher this week as recession fears subside.

By averting a scenario that could have slashed U.S. GDP growth by over 2%, the rollback lowers the effective U.S. tariff rate to around 12%, reducing the drag on the U.S. economy to just over 1%. Importantly, it also mitigates the risk of widespread supply shortages. China, too, benefits—its projected GDP impact narrows to under 1%, offering breathing room to policymakers and exporters alike.

But this reprieve is not a resolution. While peak trade policy pessimism has likely passed, the direction of travel implies more, rather than less, trade barriers compared to a year ago. The path beyond the 90-day window also remains unclear. Business investment and hiring decisions may remain cautious amid lingering uncertainty, while elevated tariff levels continue to pressure margins and consumer prices.

For now, the worst-case scenario appears to have been avoided. But markets—and investors—should stay nimble. The truce buys relief, not resolution, and policy uncertainty will likely remain a source of volatility.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4510457