We had the opportunity to participate in the 2024 Milken Institute Global Conference recently, and among the key takeaways for capital markets was that despite revised expectations for rate cuts, investor sentiment remains buoyant, largely driven by optimistic interpretations of Federal Reserve language. Strong economic fundamentals and earnings growth figures provide a solid foundation, which will likely allow markets to thrive further even as rate cuts are still months away.

The stock market and earnings

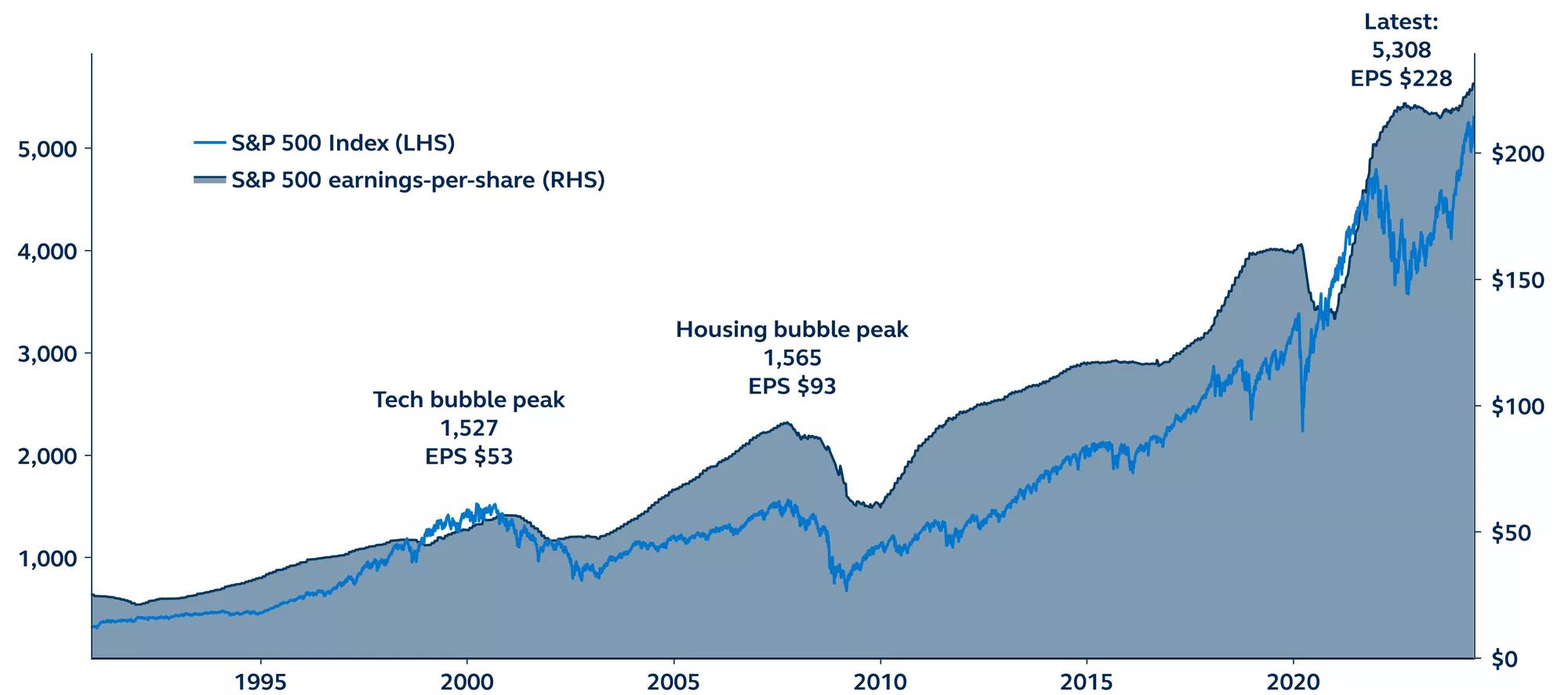

S&P 500 Index price and trailing earnings-per-share, 1990–present

Recently, I had the opportunity to attend the 2024 Milken Institute Global Conference in Beverly Hills and speak on a panel with a few of my esteemed peers about future financial conditions and the overall health of the U.S. economy. One of the hottest discussion topics was how, despite downwardly revised rate cut expectations, U.S. markets remain exuberant.

Interestingly, Federal Reserve (Fed) language is playing a large part in fluctuating market sentiment. Last October, markets embraced Chairman Jerome Powell’s (premature) inflation victory dance, which inevitably loosened financial conditions, and is likely one of the reasons we saw sustained economic strength and associated upside inflation surprises in Q1. Again, during the April FOMC meeting, Chair Powell was clearly quite dovish and pushed back against fears of rate hikes, which re-incensed a bit of happiness into the market. Investors are clearly eager to cling on to even the smallest sign that rate cuts are coming.

Additionally, investors who are looking across the markets and the U.S. economy are seeing fundamentals— growth and earnings numbers— that are quite strong at the moment. This makes it easier to digest Fed language indicating that they might not get the additional tailwind of rate cuts as soon as anticipated this year. Ultimately, with such a strong U.S. economy, it makes sense that markets are doing well despite delayed rate cuts, and investors should be able to eke out further positive gains from here.

Click here to read my full recap from Milken and for more takeaways for the rest of 2024.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3583751