The collapse of Silicon Valley Bank (SVB) over the weekend, the biggest bank failure in U.S. history after Washington Mutual in 2008, seemingly caught both regulators and markets off guard, and triggered fears of contagion across the global banking sector. In response, on Sunday night (March 12), U.S. policymakers (the Treasury Department, the Federal Reserve, and the Federal Deposit Insurance Corporation) announced emergency measures to shore up the U.S. banking system.

The solvency crisis at SVB

U.S. commercial banks’ profits have been under pressure from deteriorating asset quality, slowing loan growth, and rising deposit rates. As the Federal Reserve hiked rates, SVB’s situation became particularly precarious. Not only was its deposit base predominantly from the struggling technology sector, the nature of many of the clients SVB served (start-up technology and venture capital funds) meant that a high proportion of its clients’ deposits were in excess of the $250,000 threshold guaranteed by the Federal Deposit Insurance Corporation (FDIC).

Remember, banks don’t typically hold all customer deposits in cash. They utilize deposits to make loans or purchase historically stable securities, like Treasurys and mortgage-backed securities, with customer deposits. In that respect, SVB had been behaving no different than any other bank. However, given SVB’s impressive deposit growth during the ultra-low rate environment of the past few years, they had been forced to hold an unusually large proportion of fixed income securities. When the Federal Reserve started pushing rates higher to combat inflation, those securities lost significant value, and as challenged tech companies withdrew their deposits, it forced SVB to mark to market these now underwater fixed income positions. Essentially SVB became obligated to realize losses, and in doing so, triggered a solvency crisis.

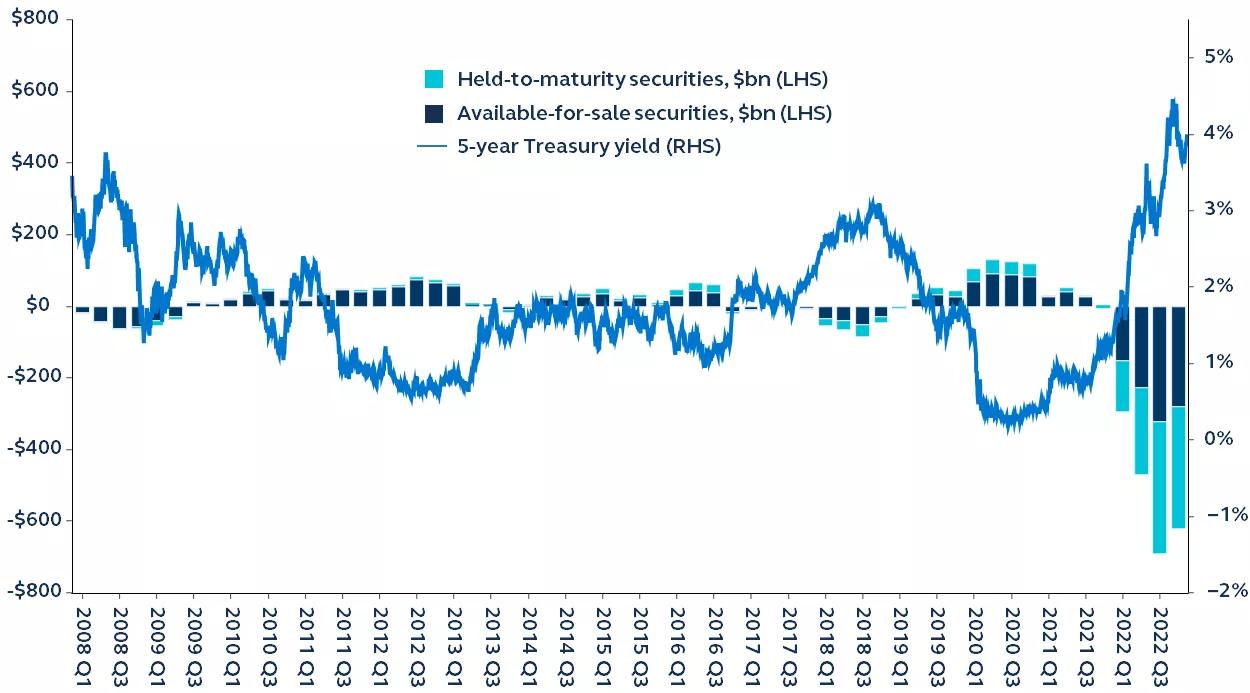

Bank unrealized investment gains/losses

FDIC banks’ unrealized gains/losses on investment securities and the 5-year U.S. Treasury yield, 2008–2022

Source: Clearnomics, FDIC, Federal Reserve, Principal Asset Management. Data as of March 13, 2023.

Policymaker intervention

While SVB and Signature Bank (a second bank with deep ties to crypto and tech start-ups which was taken over by regulators this weekend) appear to be relatively unique cases given their very concentrated deposit base, both failures threatened a loss of confidence in the financial system. In response, U.S. policymakers stepped in late Sunday to mitigate contagion concerns:

- The FDIC, Federal Reserve, and Treasury Department announced that all SVB and Signature depositors, including uninsured depositors, will have full access to their money. In doing so, they have signalled that they will guarantee all deposits, which should prop up confidence among depositors across all U.S. banks.

- The Fed also introduced a new Bank Term Funding Program—a lending facility which will provide additional funding to banks that run into liquidity problems. Essentially, the program offers banks loans of up to one year, taking government-backed bonds as collateral, and valuing those bonds at face value rather than marking them to market.

The big picture

While the specific nature of SVB’s failure has come as a surprise to much of the market, it should not be surprising that the banking system and broader economy are under pressure from the Fed’s rapid withdrawal of liquidity. Every Fed tightening cycle in history has introduced financial strains and, notably, the current Fed hiking cycle has been the most aggressive in 40 years and one of the most aggressive in history. Indeed, with the U.S. Treasury yield curve inverted by over 100 basis points late last week (an incredibly strong recessionary signal), the writing was very much on the wall that problems may be looming.

Until this past weekend, markets had broadly ignored these threats, not reacting to slowing earnings forecasts or growing recession concerns. SVB and Signature Bank’s failures have reminded investors that risk assets simply cannot escape the wrath of monetary tightening. The risk of a banking crisis has finally underscored the tensions between the Fed’s efforts to tame inflation and growing concerns that the policy tightening to date will spark a recession.

A Federal Reserve re-focused

Just under a week ago, a materially more hawkish narrative from Fed Chair Jerome Powell at his Congressional Testimony, had convinced financial markets that the Fed could revert to a 50 basis point hike in March, with many investors beginning to suggest that a 6% Fed funds rate was possible. In light of the SVB crisis, the policy arithmetic for the Federal Reserve may have changed.

While the inflation problem is still very present, the Fed will likely need to put extra focus on the financial stability side of its mandate, taking consideration of the additional pressures a rate hike could put on the financial system. While a rate hike pause could result in a loosening of financial conditions, it would likely be offset by the inevitable tightening in bank lending standards, greater risk aversion, and (now that there is a greater appreciation of the financial stability risks of higher rates) higher rate sensitivity of risk assets. As a result, pausing in March may actually not set the Fed back in its inflation fight.

Once the immediate financial stability concerns have passed, it will be important for the Fed to restart rate hikes. As such, investors should prepare for only a temporary pause in rate hikes, with a peak Fed funds rate of 5.25%-5.5% likely. The risks to this forecast are unusually elevated and further deterioration in the health of the financial system will inevitably reduce the peak rate forecasts.

Asset allocation views

Given the sudden realization of risks, investors ought to ensure their exposures minimize vulnerability to the macro-driven threats. High-quality, defensive assets should be sought out, while diversification will be increasingly important.

Broad U.S. equity markets will likely remain challenged as the twin concerns of risk aversion and economic weakness come to the fore.

- Maintaining exposure to segments which have lower exposure to cyclical sectors and have less stretched valuations will be important, as will focusing on corporates that are able to preserve margins and top line growth via pricing-power.

- Non-U.S. equity markets, particularly ones with greater exposure to the more positive outlook for China’s economy, stand to potentially outperform in this environment.

Within fixed income, U.S. Treasurys and high-quality credit merit portfolio allocation.

- As is already unfolding, bonds are positioned to provide risk mitigation during periods of volatility and risk.

- The negative correlation between stocks and bonds has reasserted itself, and the diversification benefit of fixed income has been restored.

- By contrast, riskier credit segments will likely see fairly significant spread widening over the coming months.

Ultimately, as investors experienced during the COVID crisis, policymaker intervention can be powerful and can completely change the market landscape. Staying invested and waiting for the situation to stabilize, rather than attempting to time an extremely volatile market, remains the best option for reaching portfolio goals.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Asset allocation and diversification do not ensure a profit or protect against a loss. Equity investments involve greater risk, including higher volatility, than fixed-income investments. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority ,or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority ("FCA").

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS License No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800 547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA50392.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2789649