2024 began with a burst of optimism. The U.S. economy seemed poised for further robust growth, inflation appeared on a clear downward path, and the Federal Reserve (Fed) was set to complement the picture with rapid and aggressive policy rate cuts. Risk assets, unsurprisingly, saw one of their strongest first quarters since the pandemic.

But since the first quarter, the economic landscape has deteriorated. U.S. economic growth halved in 1Q from the previous quarter, inflation has shown renewed strength, and market expectations for Fed rate cuts have plummeted from seven to barely two rate cuts by the end of 2024. So, while risk assets have continued to deliver positive gains, their upward trajectory has been interspersed with occasional pullbacks.

With markets losing some of their gleam and unrestrained optimism fading, a pressing question looms: can risk assets sustain their rally?

A cooling U.S. economy…

After an impressive acceleration in 2023, U.S. economic activity is now cooling. Pockets of weakness in the consumer are beginning to materialize and recent labor market surveys suggest some underlying softness is starting to develop. Interestingly, growth is only slowing very modestly—by and large, the resilience narrative remains intact.

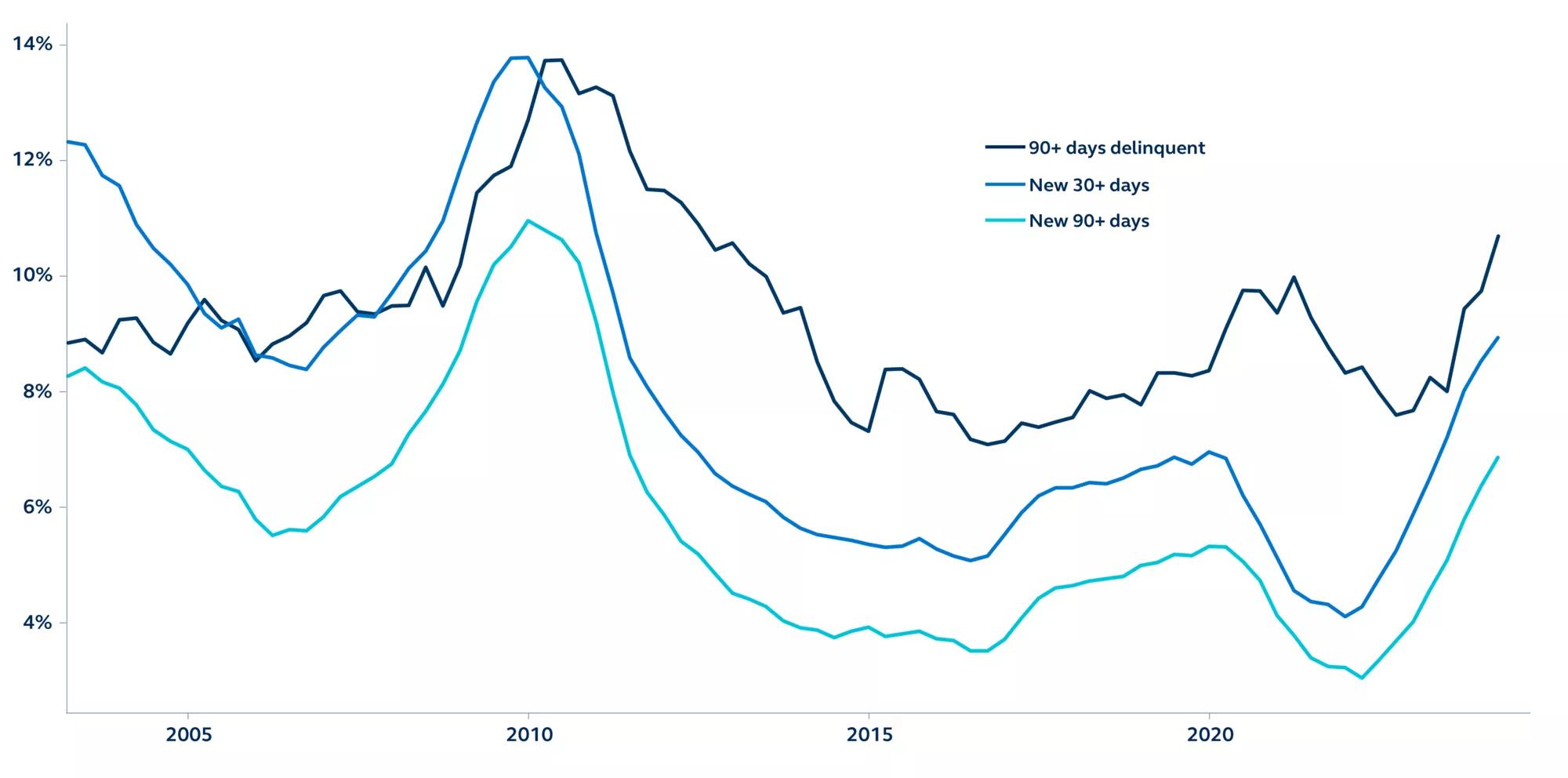

The downshift in growth is not unexpected—tighter Fed policy was always going to inevitably weigh on various segments of the economy. In particular, lower income households have been the most vulnerable. Not only have they borne the brunt of elevated prices, but many have missed out on the significant wealth gains stemming from higher stock prices and higher home prices, as well as the rise in passive income that higher interest rates on savings and deposit accounts bring. As a result, many lower-income households have almost exhausted their excess savings, increasingly forcing them to borrow to fund their purchases. And with interest rates soaring on credit cards and auto loans, delinquency rates are now rising. Recent corporate earnings guidance has provided evidence of strains, with U.S. consumers extending their shift toward more deliberate value-focused spending and lower cost point retailers.

Credit card delinquency rates

Percent of current outstanding balance, quarterly, January 2003–present