At today’s Federal Open Market Committee (FOMC) meeting, despite choosing to keep the benchmark policy rate on hold at 5.25%-5.50%, the Federal Reserve (Fed) still managed to deliver a hawkish message. The updated Summary of Economic Projections maintained an additional rate hike this year and removed two rate cuts next year, ramming home the message of higher for longer.

Economic assessment

Fed Chair Jerome Powell opened the press conference with a couple of victory laps, noting that inflation has moderated, inflation expectations are well-anchored, the labor market is rebalancing, participation is up, nominal wage growth is showing signs of easing, and, as a result, the Fed is now “in a position to proceed carefully” on its rate path. It’s undoubtedly true—economic growth has consistently surprised to the upside, and inflation has decelerated significantly, so the Fed should pat themselves on the back.

Yet, despite the success, the Fed believes it needs to be cautious about the next steps. That also rings true—as long as economic growth is above trend, there is a risk of inflation resurgence. As such, the Fed remains prepared to hike again if appropriate, and data dependency remains their approach to policy decisions.

Updates to the Summary of Economic Projections

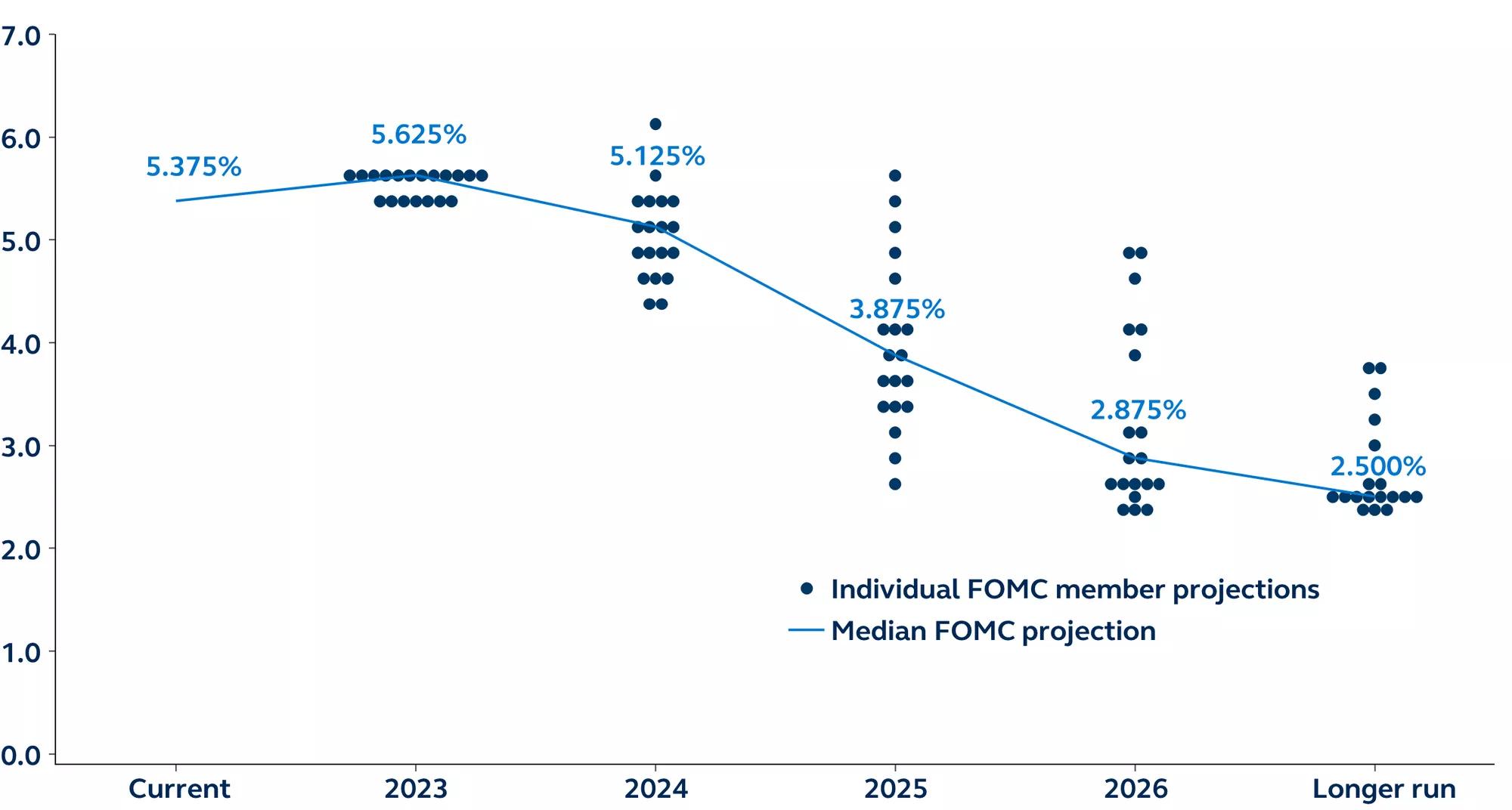

The new dot plot and Summary of Economic Projections indicate that the FOMC possesses a fairly high degree of confidence in a soft landing, as well as the need to maintain policy rates higher for longer:

- The median projection still has rates ending this year at 5.6%. This equates to one more 25 basis points (bps) hike this year.

- 12 of the 19 participants believe that policy rates need to rise again this year; the remaining 7 project no further hikes in 2023.

- In 2024, the median dot plot sees rates falling to 5.1%, equivalent to 50 bps of cuts next year. This is 50 bps fewer cuts than shown in the June dot plot and 25 bps fewer cuts than in the broad market consensus.

- The median projection then falls to 3.9% in 2025, equivalent to a further 125 bps of cuts. Overall, the new dot plot sees a total 175 bps of cuts in 2024 and 2025 combined, 50 bps less than in the June projections.

- The median dot falls further to 2.875% in 2026—still above the median longer-run dot, which remains unchanged at 2.5%. Following ample discussion in recent months about a higher neutral rate, there had been some expectation of an upward revision to the longer-run dot, so this was a slight surprise.