Policy outlook

It was well anticipated that the FOMC would cut rates by 25 bps during today’s meeting. Labor market activity has slowed since the last Fed meeting, indicating a clear need for the Fed to resume their easing cycle. Yet, at the same time, the broader economic picture is not filling them with so much concern that an aggressive easing cycle is required.

In addition, as Powell noted during the press conference, while labor market downside risks have increased, the inflation uncertainty remains very heightened. The passthrough of tariffs remains very difficult to predict, implying that the Fed needs to tread carefully. Throw in labor supply shifts, data measurement concerns, and government policy upheaval and uncertainty, and it becomes fairly apparent that a cautious approach to rate cuts is required for now.

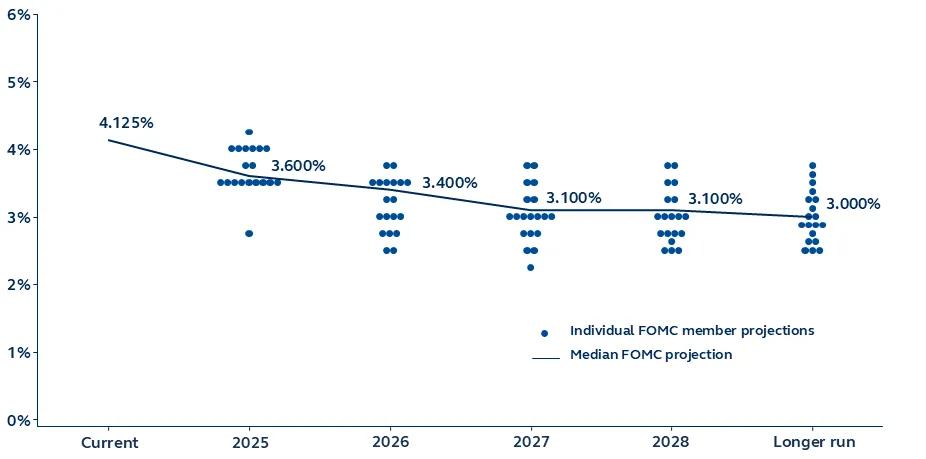

Looking forward, we expect two more 25bps rate cuts this year followed by further easing next year. In all, this should be a gentle easing cycle, providing enough stimulus to arrest a further significant deterioration in the labor market and give some relief to the more vulnerable areas of the economy.