In one of the most highly debated Fed decisions in recent history, the Federal Open Market Committee today decided to kick start its rate cutting cycle with an unusually large 50 basis point move, lowering the benchmark policy rate to 4.75%-5.00%. Today’s move appears designed to pre-empt any significant economic weakness and should secure the U.S. economy’s soft landing.

A heavily debated decision

Rarely has Wall Street been so torn, so close to a Fed decision. Most Fed watchers were of the belief that the ongoing strength of the economy only justified a 25 basis point cut—according to Bloomberg, only 10% of economists they surveyed had got the 50bps call correct. By contrast, the market was pricing in a 50bps cut, taking its cue from the stream of articles in recent days that were suggesting a 50bps decision was in deep consideration. In fact, this played out quite clearly in the voting. For the first time since 2005, there was a dissent within the committee.

Powell’s assessment

In the end, the Fed’s decision to cut rates by 50bps was not a reflection of a weak U.S. economy. In fact, Fed Chair Jerome Powell’s assessment of the U.S. economy was fairly positive. He described it as “basically fine,” considers the labor market to be in “solid shape” and the unemployment rate as “very healthy.” He was even, dare I say it, more positive than consensus.

Rather, the 50bps cut appears to have been driven by a combination of growing confidence around the inflation outlook, a desire to prevent job layoffs from materializing, and a signal of the Fed’s “commitment to not fall behind the curve.” In other words, the fall in inflation has permitted the Fed to shift from being data dependent and reactive to now pre-emptive and forward-looking.

Even so, Powell tried to convey their nimbleness around future decisions, emphasizing that if the economy remains robust and/or inflation proves sticky, they will lower policy rates more slowly. Equally, if the labor market deteriorates more quickly than expected, the Fed “is prepared to respond.” So, perhaps still a little data dependent and reactive…

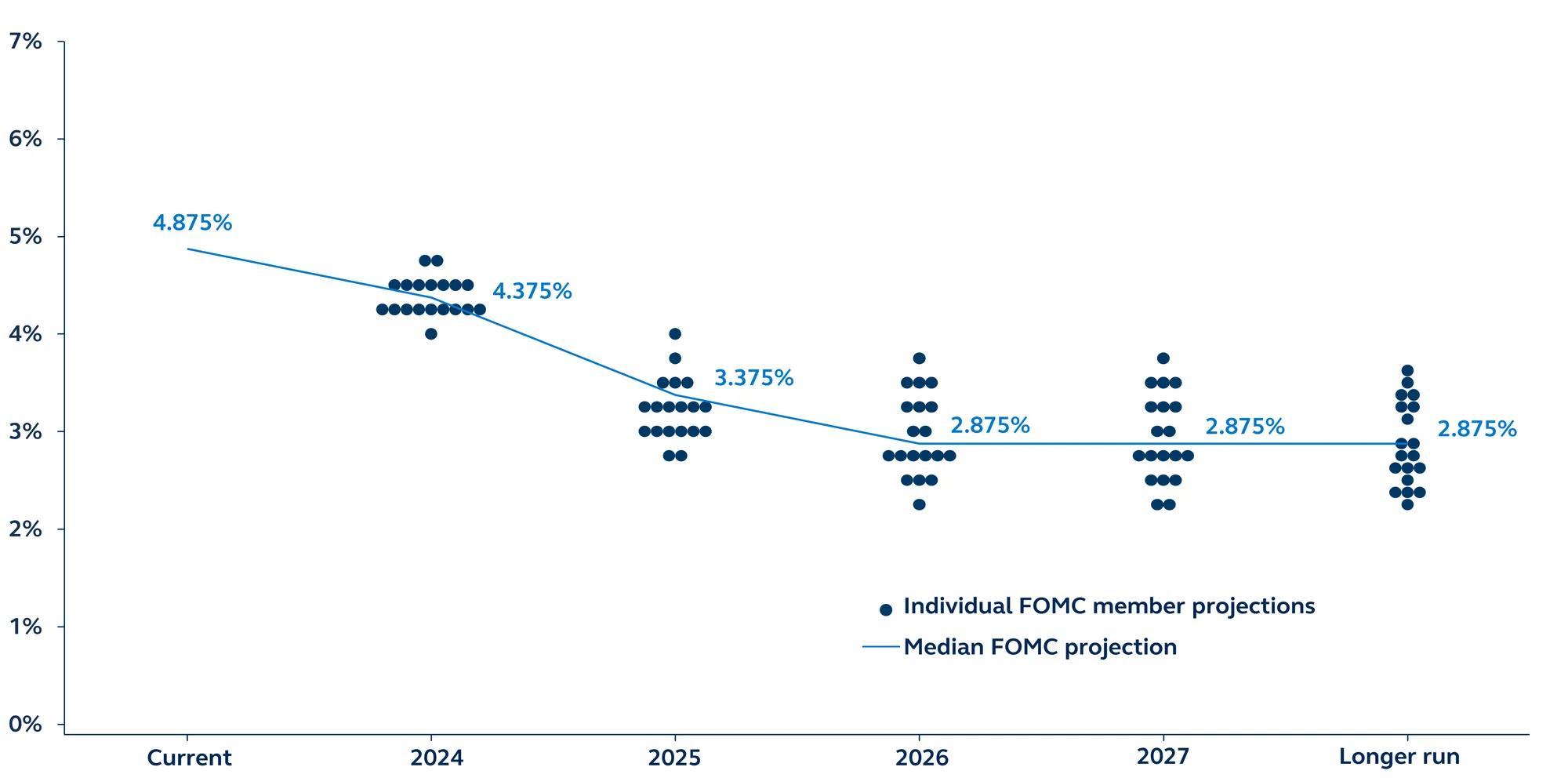

Updates to the Summary of Economic Projections

The new Summary of Economic Projections (SEP) saw some intriguing revisions.

- The GDP growth forecasts for 2024 was revised down marginally from 2.1% to 2%. Growth for 2025 and 2026 was left unchanged at 2% for both years—a soft landing if ever there was one.

- The unemployment rate forecast was upwardly revised from 4% to 4.4% this year—an acknowledge of the greater than expected deterioration in the labor market in recent months—from 4.2% to 4.4% in 2025, and 4.1% to 4.3% in 2026.

- The interesting take away from this was that they expect unemployment to hit its peak this year. That would be unusual—historically, once the unemployment rate has risen 0.5% in a 12 month period, it goes on to rise an additional 1.5% at a minimum. It also raises the question—if the unemployment has only a further 0.2% to increase, what was the need for a 50bps cut?

- The core PCE inflation was lowered from 2.8% to 2.6% for this year, 2.3% to 2.2% in 2025, and unchanged to 2% in 2026. This is a clearly improved inflation picture for the next two years, but it still takes the same amount of time to hit the target as was projected in the June SEP.